GILTI & Blended CFC Regimes

Article 2.10 of the Administrative Guidance provides more information on the treatment of the US Global Intangible Low-Taxed Income (GILTI) regime.

OECD Issues the Agreed Administrative Guidance for the GloBE Rules

Today the OECD has issued the Agreed Administrative Guidance for the Pillar Two GloBE Rules. This is the final part of the implementation framework for the GloBE Rules.

OECD Issues the Agreed Administrative Guidance for the GloBE Rules

Today the OECD has issued the Agreed Administrative Guidance for the Pillar Two GloBE Rules. This is the final part of the implementation framework for the GloBE Rules.

FASB Clarifies the Deferred Tax Treatment of the GloBE Rules

Yesterday the Financial Accounting Standards Board (FASB) issued a Tentative Decision on the treatment under US GAAP of deferred taxes for the GloBE minimum tax.

Infographic Showing IASB Pillar 2 Deferred Tax Proposals

See our infographic for the impact of the proposed IASB Pillar 2 amendments to IAS 12 for MNEs with a December 31 year end.

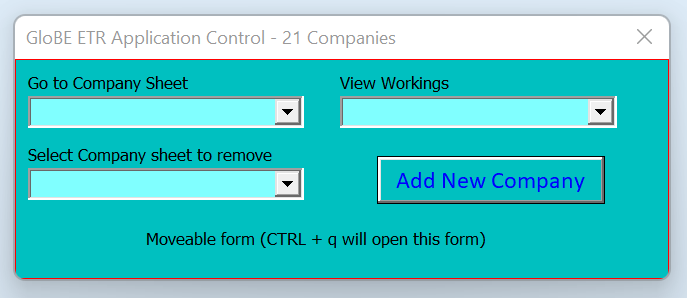

GloBE Top-Up Tax Modelling Tool – Unlimited Companies

Calculate estimated GloBE top-up tax. Add unlimited companies and jurisdictions via an easy to use control panel to view potential jurisdictional liabilities.

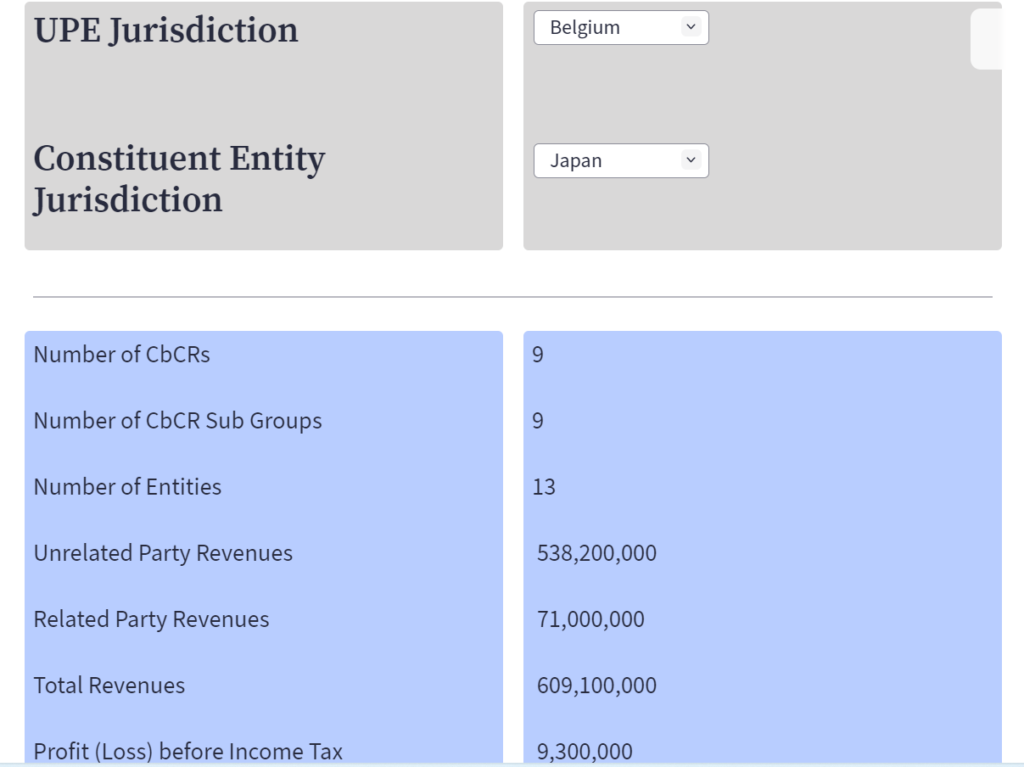

Updated Pillar 2 Modelling Tool – OECD CbC Data

Our Modelling Tool takes the underlying source data from the OECD aggregated CbC source data and subjects it to a data manipulation process to provide a drill down into some of the key metrics and data sources that are relevant for Pillar Two on a jurisdictional basis.

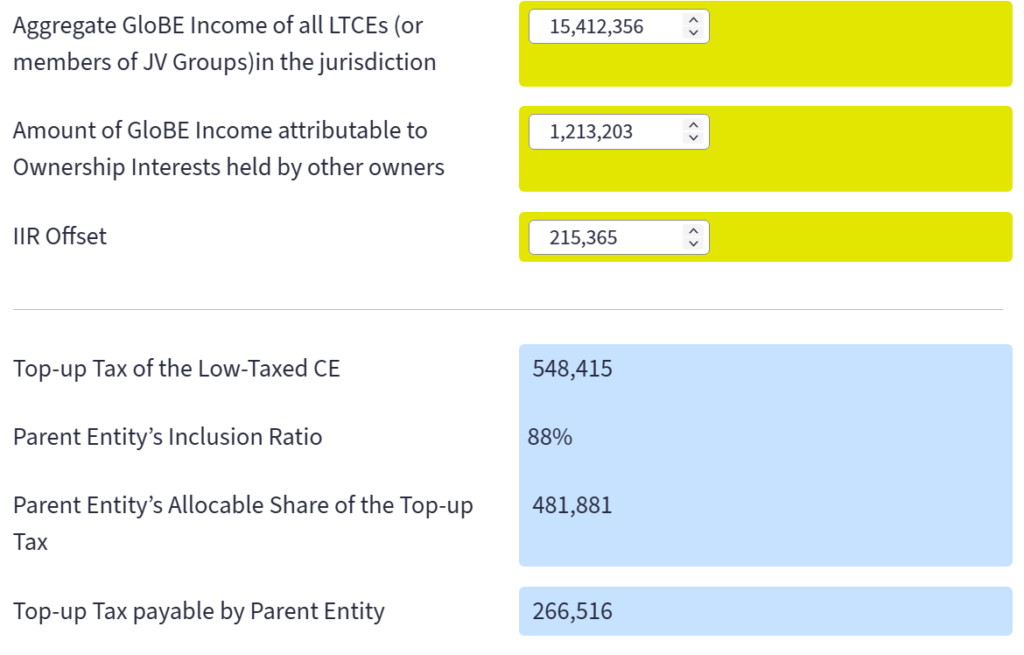

Income Inclusion Rule Calculator

Use our members Income Inclusion Rule Calculator to see how the IIR applies. Enter details of the low-taxed entity including jurisdictional GloBE income and other relevant information to determine top-up tax payable by the parent company.

Liechtenstein to Consult on Pillar Two Global Minimum Tax

Liechtenstein has announced it is to issue a consultation on a Pillar Two Global Minimum Tax in March 2023.

Comprehensive Data Points for the Substance-Based Income Exclusion

In this article we take a comprehensive look at how the substance-based income exclusion applies including the various adjustments for permanent establishments and flow-through entities and the data points required.