Interaction Between Bonus Depreciation and the Substance-Based Income Exclusion

In this article we look at the interaction between deferred tax on bonus depreciation and the substance-based income exclusion on investments in tangible assets.

In this article we look at the interaction between deferred tax on bonus depreciation and the substance-based income exclusion on investments in tangible assets.

Foreign tax credits interact with the Pillar Two GloBE Rules in a number of ways. In this article we assess the key impact.

In this article we look at some of the key drivers that can result in Pillar 2 ETR’s being significantly different to the headline domestic tax rate.

A number of the adjustments to the deferred tax expense under Pillar 2 will mean significant changes to ERP systems. See our list of all required adjustments.

Today, the Accounting Standards Board of Japan (ASBJ) issued the Practical Response Report on the ‘Treatment of Deferred Tax in Relation to the Revision of the Corporation Tax Act Corresponding to Global Minimum Taxation’.

The Practical Response Report is applicable from today and until it is repealed by the ASBJ.

Yesterday the Financial Accounting Standards Board (FASB) issued a Tentative Decision on the treatment under US GAAP of deferred taxes for the GloBE minimum tax.

Today, the International Accounting Standards Board (IASB) issued an Exposure Draft for proposed amendments to IAS 12 to take account of the Pillar Two Model Rules.

The International Accounting Standards Board (IASB) will be discussing the approach to Pillar Two in its November 22, 2022 meeting. As preparation for this, a staff paper has been issued to outline a proposed approach to Pillar Two including a temporary exception and disclosure requirements.

IAS 1, IAS 10 and IAS 12 all have provisions that can impact on the required disclosures in financial statements for Pillar Two, however, the key determinant will be whether the domestic tax law to implement the Pillar Two GloBE Rules has been announced, substantively enacted, or enacted before the financial statements are issued.

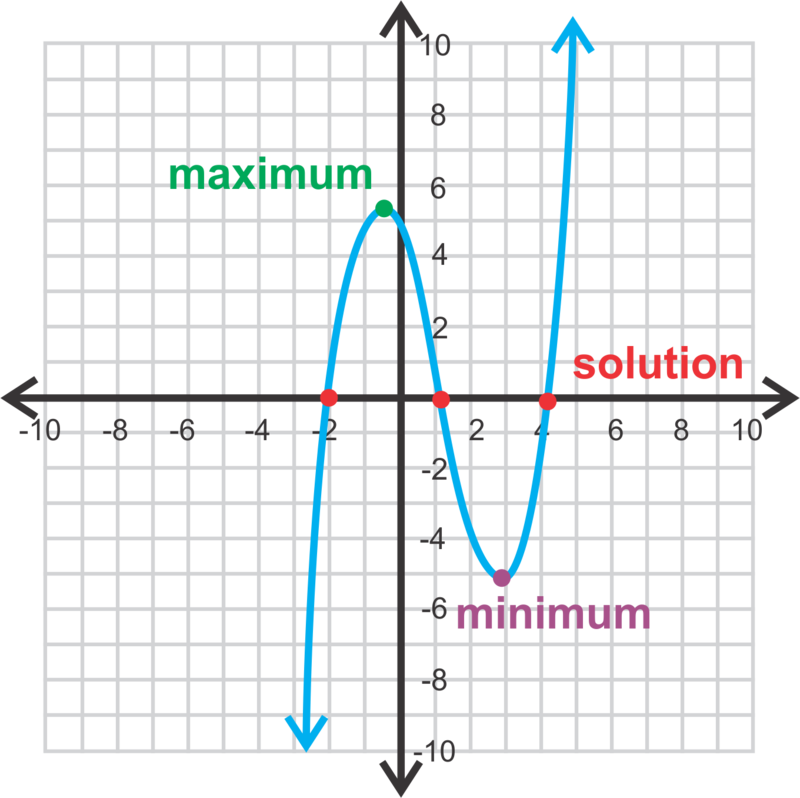

The Total Deferred Tax Adjustment Amount is a key element of the Pillar Two effective tax rate calculation. See our members flowchart which guides you though the calculation.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |