Given the international implementation of Pillar Two globally, the GloBE rules will be an additional consideration for cross-border deals.

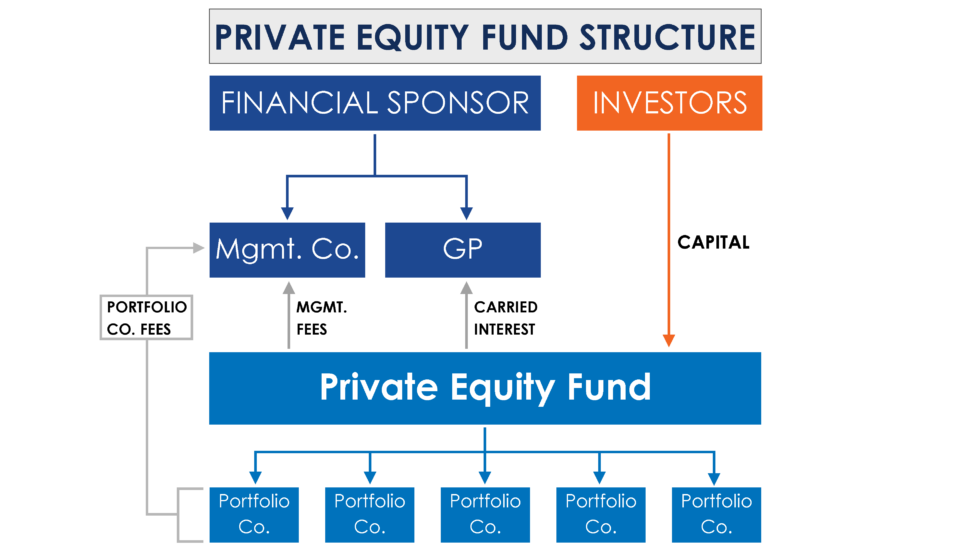

In this article we look at some of the most significant issues to consider including the determination of when and how deals can bring groups within the scope of Pillar Two, specific considerations for private equity funds, differences in GloBE and domestic tax treatment and potential restrictions on post-acquisition transfers.

Where two separate MNE groups merge to form a single group, Article 6.1.1(a) of the

• Under IFRS 10 investment entities do not consolidate their subsidiaries. Instead, they are measured at fair value through the profit or loss account.

There are a couple of exceptions to this including:

(1) if the subsidiary provided investment advisory services to the investment entity, and;

(2) if the investment entity is owned by another company (a non-investment entity) then it consolidates all subsidiaries including the investment entities and any entities it controls. Non-controlling interests though wouldn’t be consolidated even by the UPE.

• Under ASC 820 investment companies use the fair value accounting method for non-controlling interests in other investment companies.

Generally, most investment funds hold minority (ie non-controlling) interests in their investments and they would not need to consolidate. As such, they would not be included in the MNE group for GloBE purposes.

Even if an investment entity held controlling interests in other entities and therefore was required to consolidate, if those entities met the requirements to be treated as excluded entities then the group would be outside the scope of the GloBE rules.

Even if funds are structured as flow-through entities for tax purposes (eg as an English or Delaware limited partnership), they are still subject to the general requirement to consolidate for controlling interests.

In the case of a tax transparent private equity fund that was within the scope of Pillar Two, the general rule is that the GloBE income is allocated to the owners of the tax transparent entity in proportion to their ownership interests unless the tax transparent entity is the Ultimate Parent Entity (UPE) of the group (in which case the GloBE income is allocated to the UPE unless it is an excluded entity and subject to a number of reductions).

As with most aspects of the GloBE Rules, Article 6.3.1 of the OECD Model Rules provides that the GloBE treatment of intra-group transfers of assets follows the accounting treatment.

The accounting treatment generally values the transfer of assets at fair value (eg FRS 102 requires the total fair value of any consideration as well as the assets, liabilities and contingent liabilities of the acquirer to be determined).

Therefore any gain or loss recognised for accounting purposes would also flow through into the GloBE income calculation.

Many domestic jurisdictions provide for gains and losses to be deferred on intra-group transfers, Article 6.3.2 of the OECD Model Rules includes a similar rule which applies where there is a ‘GloBE Reorganisation’.

A GloBE Reorganisation occurs where there is a transfer of assets and:

(a) the consideration for the transfer is, in whole or in significant part, equity interests

(b) the transferors gain or loss on the assets is not wholly or partly subject to tax; and

(c) the tax law applicable to the transferee entity requires them to use the transferor’s tax base as the carrying value of the assets (the so-called ‘stand in the shoes’ principle).

This means that the transferor jurisdiction must provide for the tax-free deferral of the gain and the base cost is not uplifted in the transferee jurisdiction.

Where there is an intra-group transfer of assets that doesn’t meet these requirements, it is treated as a ‘non-qualifying gain or loss’ and needs to be recognised in GloBE income (or loss).

It will therefore be important to ensure that the requirement for a GloBE reorganisation are met on any intra-group transfer of assets. If not, the gain or loss would be recognised in GloBE income and if there was a tax free transfer under domestic law, the GloBE effective tax rate would be pushed down.

The Pillar Two rules should be considered at an early stage in any acquisition given the potential impact on post acquisition plans.

For instance, Article 9.1.3 of the OECD Model Rules provides that if an asset is transferred between group entities after November 30, 2021 and before the first year the GloBE rules apply to the group, the asset is recorded at its historic cost providing the entities would have been subject to the Pillar Two GloBE rules had they been in-scope.

The reason for this is to prevent an uplift in the base cost of assets (with potentially additional tax relief and reduced gains on a future disposal) when any original gain on the intra-group transfer was not taken into account for Pillar Two GloBE purposes as the group was not subject to the rules.

This would need to be considered at the outset as it potentially limits the ability of a group to move assets as part of a post-acquisition integration, given such transfers would then crystallise the inherent gains for Pillar Two purposes.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |