Article 1.1 of the OECD Model Rules provides that the Pillar Two GloBE Rules apply to Constituent Entities in an MNE Group that have annual revenue of 750 million euros or more in the Consolidated Financial Statements of the UPE in at least two of the four Fiscal Years preceding the relevant Fiscal Year.

This rule, therefore, restricts the scope of the Pillar Two GloBE rules in two main ways:

Firstly, the rules only apply to Constituent Entities of an MNE Group: and

Secondly, the MNE group itself must exceed the 750 million euros revenue threshold.

This threshold is set at the same level as the Country-by-Country reporting threshold to try and simply administration costs.

• The threshold does not include the current year and is based on the previous four years. This ensures that an MNE group will know if it will be within the scope of the Pillar Two GloBE rules at the start of any fiscal year;

• In the case of newly created entities, the revenue threshold is met if the revenue of the group exceeds 750 million euros in the previous two years, irrespective of whether there are consolidated financial accounts for the previous four years.

• The revenue threshold applies to the consolidated revenue in the consolidated accounts of the MNE Group, not simply the total revenues of each company in the MNE group.

As intra-group transactions are eliminated as part of the process of preparing consolidated accounts, this means that any revenue that derives from intra-group transactions would also be eliminated.

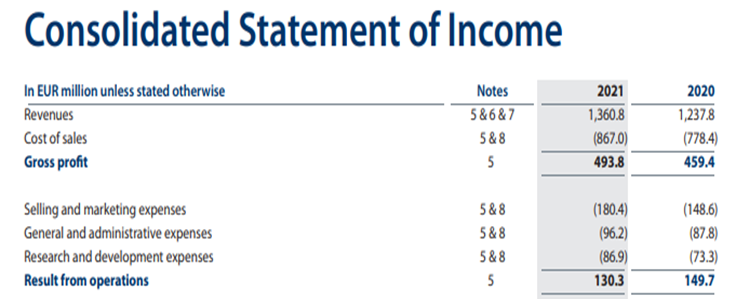

For example, in this case:

The revenue used for the purposes of the revenue threshold would be 1.360.8 billion euros.

• Where a company is consolidated in the MNE group, all of the revenue that is consolidated is taken into account for the purposes of the 750 million euros threshold ie there is no reduction for any amounts due to minority shareholders.

• Article 1.1.2 of the OECD Model Rules provides that the 750 million euro threshold is adjusted if a fiscal year is less than or exceeds 12 months. For example, if the fiscal year was 6 months, and the consolidated revenue was 300 million euros, the revenue for the purposes of the 750 million euro threshold would be 12/6* 300 million = 600 million euros.

• Although Excluded Entities are not subject to the Pillar Two GloBE ETR and top up tax mechanisms, under Article 1.1.3 of the OECD Model Rules, their revenue is taken into account for the purposes of the 750 Million Revenue Threshold.

The 750 million threshold is based on euros. When implementing domestic legislation to give effect to the Pillar Two GloBE rules, it is recommended that countries use euros to determine the threshold.

However, this will undoubtedly not always be the case. If a country uses its domestic currency to determine the revenue threshold it is also recommended that it rebases its currency each year (as provided in Paragraph 18 of the Introduction to the Commentary to the OECD Model Rules).

In this case an MNE would use the revenue threshold that applies at the start of its fiscal year.

For instance, if an MNE group has a fiscal year that ends on 31 March 2023, and the revenue threshold of the country is rebased on 31 December each year, the revenue threshold that applies as at 1 April 2022 is used.

MNEs also need to use a consistent basis to convert amounts in their consolidated financial accounts where they are in a different currency to the local currency in a jurisdiction.

This means that they need to apply the same method for all jurisdictions, and not adopt a ‘pick and mix’ approach.

The Pillar Two GloBE rules are heavily reliant on financial accounts and the treatment for financial accounting purposes.

This applies to pretty much all of the key principles of determining the amount of top-up tax liability.

The reliance on consolidated financial statements is also a key part of the Pillar Two rules.

The purpose behind consolidated financial statements is to show the assets, liabilities, income and expenses of a group as a single entity.

Under IFRS 10 for example, consolidated financial statements are required to be prepared when a parent entity controls one or more other entities (subject to a number of exceptions).

A parent entity controls another entity if it has

• power over the entity;

• exposure, or rights, to variable returns from its involvement with the entity

• the ability to use its power over the entity to affect the amount of the parent entity’s returns.

When preparing consolidated financial statements, assets, liabilities, income and expenses of the parent entity and other entities are combined. And all intragroup assets and liabilities are eliminated.

An exception for investment entities generally applies (eg under IFRS 10:31) such that they do not need to consolidate their subsidiaries.

For more information on the treatment of investment entities and investment funds, see Investment Funds and Pillar Two.

The GloBE revenue threshold is based on the revenue threshold used in the CbCR Rules. Whilst this will be the revenue taken from the P&L account in the MNE Group’s consolidated financial statements, different accounting standards can result in different definitions of ‘revenue’ for different MNE groups depending on the jurisdiction.

The December 2023 OECD Administrative Guidance confirms that for the purposes of Article 1.1 of the GloBE Rules, revenue includes the ‘…inflow of economic benefits arising from delivering or producing goods, rendering services, or other activities that constitute the MNE Group’s ordinary activities…’

Revenue is to be determined in line with the relevant accounting standard, which may allow for netting for discounts, returns and allowances, but before deducting cost of sales and other operating expenses. If different types of revenue are separately presented in the consolidated P&L account (eg extraordinary income), they must be aggregated to determine the total revenue.

Net gains from investments (whether realised or unrealised) reflected in the consolidated P&L account and income or gains separately presented as extraordinary or non-recurring items are specifically included in the definition of revenue.

If a financial accounting standard requires gains and losses to be presented separately in the consolidated P&L account, the MNE Group is required to reduce revenues by the amount of the gross losses netted off against gross gains.

A flexible approach is taken to financial entities, which may not record gross amounts from transactions in their financial statements. In such cases items considered similar to revenue under the UPEs financial accounting standards should be used.

The December 2023 OECD Administrative Guidance provides additional detail where an MNE Group has a UPE with a different fiscal year to some its subsidiaries (that are constituent entities).

Different accounting standards will apply different treatments in the preparation of the consolidated accounts. Some will simply include the Constituent Entity’s financial accounting results for its fiscal period into the Consolidated Financial Statements, irrespective of the different fiscal year end. Others will split out the income and expenses and only include the overlapping amounts.

In this situation, the Administrative Guidance provides that the method used in the relevant accounting standard also applies for GloBE purposes.

Note that where a Constituent Entity has a different fiscal year from the UPE and its financial accounts are not included in the preparation of the UPE’s Consolidated Financial Statements, the GloBE computations for the Constituent Entity’s Fiscal Year must be made based on UPE’s Fiscal Year end.

The December 2023 OECD Administrative Guidance provides information on how MNEs should determine the Adjusted Covered Taxes for a Fiscal Year if the taxable period of Constituent Entities in the jurisdiction is not the same as the Fiscal Year of the MNE Group?

In this case, different financial accounting standards could apply a different treatment in the preparation of the Consolidated Financial Accounts.

The OECD Administrative Guidance confirms that the method used in the Consolidated Financial Statements (or other financial statements used to determine the Financial Accounting Net Income or Loss of the Constituent Entity) should be used to determine its Adjusted Covered Taxes for the Fiscal Year.

A similar approach should be taken in determining the Adjusted Covered Taxes of a Joint Venture or JV Group that has a tax year different from its Fiscal Year.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |