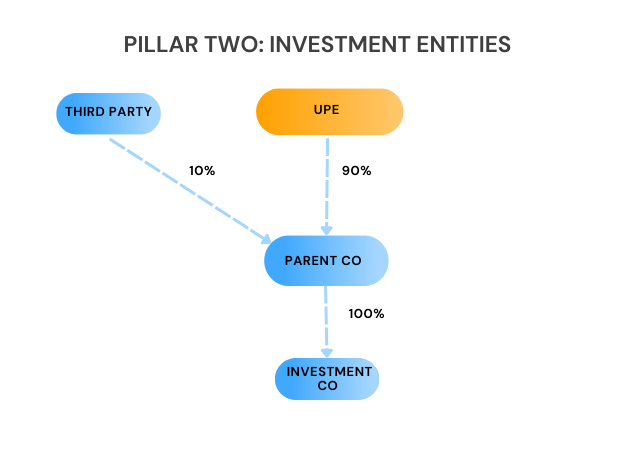

The Pillar Two effective tax rate (ETR) calculation for investment entities is similar to the standard ETR calculation, however, there is an important twist.

The investment entity has GloBE income of 10 million euros and incurs tax of 500,000 euros.

It has local tangible assets of 1 million euros.

The intermediate parent company incurs tax of 500,000 euros under a CFC regime in respect of the investment entity (note we assume the CFC pushdown limitation is not relevant).

The top-up tax is calculated as:

Adjusted Covered Tax=

Tax incurred by investment entity =500,000* 90% = 450,000 euros

CFC tax pushed down = 500,000* 90% = 450,000 euros

GloBE income = 10 million * 90% = 9 million euros

The ETR is therefore 10%.

The top-up tax percentage is 5% (15%-10%).

The substance-based income exclusion is (1 million * 5%* 90% ) = 45,000 euros.

Top-Up tax is therefore (9 million – 45,000) * 5% = 447,750 euros.

If we assume the UPE is in a jurisdiction that applies an income inclusion rule, the UPE would account for the top-up tax of 447,500 euros.

There is no reduction for the minority interest as it has already been taken into account.

In this case, there would be no effective difference between the position of an investment entity and any other entity. The method of calculating the top-up tax would be different but the eventual outcome would be the same (ie if the entity was not an investment entity, the top-up tax would be 497,500 and the UPE would be allocated 90% of the tax (447,750)).

However, this will not always be the case.

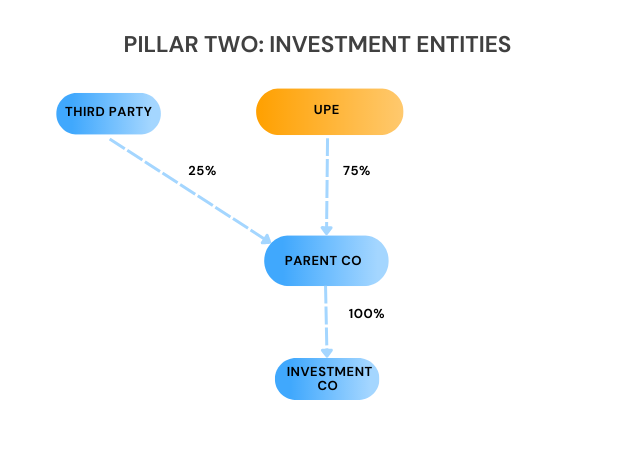

For instance, what if the UPE held the investment company via a partially owned parent entity (POPE)?

A POPE is a constituent entity, other than a UPE, that owns (directly or indirectly) an ownership interest in another constituent entity in the same group, and the right to more than 20% of its profits are held by persons that aren’t part of the MNE group.

There’s a departure here from the standard top-down rule for POPEs as even if a UPE applies an IIR, if there is a POPE that owns an interest in a low-taxed entity it will also need to apply the IIR.

If we adjust the example above so that the UPE owns 75% of Parent Co and the remaining 25% is held by non-group members, the structure would be:

Parent Co would be a POPE and would apply an IIR (assuming it is located in a jurisdiction that applies an IIR).

It would be allocated tax based on its allocable share, which in this case would 100%.

Therefore, 447,750 would be allocated to the POPE. The UPE would also apply an IIR but the IIR offset mechanism would reduce any top-up tax allocated to it by the amount paid by the POPE.

If the low-taxed entity wasn’t an investment entity the top-up tax allocated to the POPE would be 497,500.

For information on the jurisdictional blending implications of investment companies, see Non-Tax Transparent Investment Funds

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |