When allocating taxes to group entities for the purpose of the Pillar Two rules, tax paid by a parent entity under a controlled foreign company (CFC) regime is usually allocated to the CFC entity.

However, this is subject to an important caveat. Article 4.3.3 of the OECD Model Rules provides for a restriction on the amount of tax incurred by the parent that is pushed down to the CFC where the CFC income is passive income.

This is to avoid a parent company in a high tax jurisdiction effectively transferring that higher tax to a low-tax CFC jurisdiction, given this would strike at the heart of the jurisdictional blending rules.

You can see more on the CFC pushdown limitation in our Allocation of Covered Taxes section, including a worked example of how it applies.

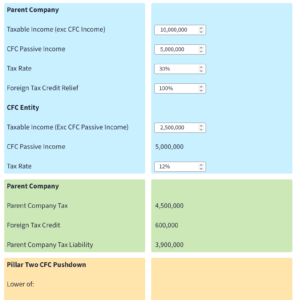

The interactive tool below is designed for our members to illustrate how the CFC pushdown limitation operates.

For more detailed Pillar Two modelling tools, including multiple years, unlimited companies and the impact of elections, see our Pillar Two Modelling Tools.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |