| Status | Enacted Law |

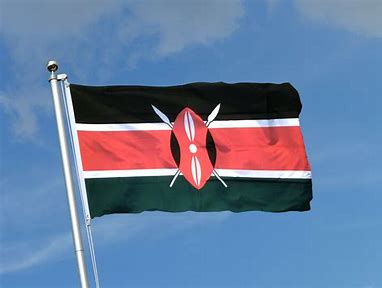

| Law | Tax Laws (Amendment) Act, 2024 Draft Income Tax (Minimum Top Up Tax) Regulations, 2025 |

| Effective Date | Financial years beginning on or after January 1, 2025 |

| IIR | No |

| UTPR | No |

| QDMTT | Yes |

| Filing Deadlines | Standard for GIR, Non standard TuT Return |

| Safe Harbours | Transitional CbCR Safe Harbour and the Simplified calculations for Non-Material Constituent Entities Safe Harbour |

If you haven’t got a subscription you can sign up below

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |