Japan Issues Guidance on its UTPR and QDMTT Application

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

Once the top-up tax for the jurisdiction has been calculated, it is then allocated to the constituent entities in the jurisdiction that have net Pillar Two GloBE income (ie not entities that have Pillar Two GloBE losses) so that the charging provisions (ie the income inclusion rule or under-taxed payments rule) can correctly apply.

Note, that if all of the constituent entities in the jurisdiction are wholly owned and the UPE is applying an income inclusion rule, the allocation amongst constituent entities wouldn’t be required given the UPE would simply account for the top-up tax.

Article 5.2.4 of the OECD Model Rules provide that the allocation is based on each relevant constituent entity’s share of the total net Pillar Two GloBE income of the jurisdiction.

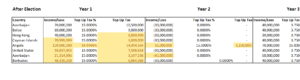

Example

In jurisdiction X:

Company A has net Pillar Two GloBE income of 5 million

Company B has net Pillar Two GloBE income of 10 million

Company C has net Pillar Two GloBE income of 20 million

Company D has a net Pillar Two GloBE loss of 5 million

Total jurisdictional top-up tax is 5 million. This is allocated as follows:

Company A = 5 million * 5/35 = 714,286

Company B = 5 million * 10/35 =1,428,571

Company C = 5 million * 20/35 =2,857,143

Company D = 0

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

On December 31, 2025, Israel enacted Law No. Law 5776-2025 on the Minimum Corporate Tax for Multinational Groups. The enacted law contains some significant changes from the previous draft law.

On December 29, 2025, Uruguay’s President issued Decree No. 325/025, to provide for exemptions from the QDMTT for entities covered by a tax stability agreement. Note that Law N° 20446 to enact the QDMTT was published in the Official Gazette on January 8, 2026.

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Simplified ETR Safe Harbour from December 31, 2026 (December 31, 2025 in certain cases). We provide an excel overview and a sample calculator for the key elements of the Safe Harbour calculation.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Substance-based Tax Incentive Safe Harbour. This online tool shows how the new safe harbour operates.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |