Denmark GloBE Country Guide: Updated for June 2024 Amending Law

On June 11, 2024, Law No. 684 was published in the Danish Official Gazette. This implements additional aspects of the OECD Administrative Guidance.

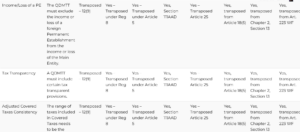

Article 2.10 of the February 2023 OECD Administrative Guidance provides more information on the treatment of the US Global Intangible Low-Taxed Income (GILTI) regime.

This is to be treated as a blended CFC Regime for GloBE purposes. Under the GloBE Rules CFC taxes are allocated to the foreign CFC (subject to the push down restriction). The GloBE Commentary doesn’t go into detail on the allocation and just provides that the CFC tax should be allocated to each CFC based on the owner’s share of the underlying income.

However, determining the allocation can be tricky when there is a blended CFC regime.

The December 2023 OECD Administrative Guidance provides additional information on the application of the Blended CFC rules, including:

– where an MNE Group calculates multiple GloBE Jurisdictional ETRs for different types of Entities located in the same jurisdiction (eg a separate GloBE ETR for investment entities or JVs),

– where an MNE Group is not required to calculate an ETR as they claim the Transitional CbCR Safe Harbour or the QDMTT Safe Harbour, or if the De Minimis exclusion applies

– where a Constituent Entity is subject to a Blended CFC Tax Regime on the income of non-GloBE Entities.

If you haven’t got a subscription you can join up below.

On June 11, 2024, Law No. 684 was published in the Danish Official Gazette. This implements additional aspects of the OECD Administrative Guidance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Turkey for accounting periods beginning on or after January 1, 2024. Updated for the draft legislation submitted to the Turkish Parliament on July 16, 2024.

Updates to our QDMTT Legislative Tracker to include domestic QDMTT legislation released up to July 19, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Portugal for accounting periods beginning on or after January 1, 2024. Updated for the draft law issued on July 10, 2024.

Permanent Establishments (PEs) are subject to a number of specific rules under Pillar Two in order to apply the general provisions to them. Key issues are what is a PE under Pillar Two? where is it located? and how are income and taxes allocated to it?

On July 10, 2024, the OECD released the draft XML schema for the GloBE Information Return (GIR). This provides a method of structuring the data reporting for the GIR.

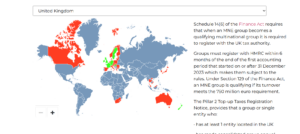

Many jurisdictions will require GloBE registration for administrative purposes, however, the law issued to date has been inconsistent. We outline the GloBE registration obligations from the domestic legislation (enacted and draft) issued to date, with citations and links to relevant laws.

On July 3, 2024, the Italian Ministry of Economy & Finance issued a Decree which contains the procedures for the implementation of the Qualified Domestic Minimum Top-up Tax (QDMTT).

In the 2024 Budget address, the Gibraltar government confirmed that draft legislation for the introduction of a QDMTT is expected in September 2024.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |