Australia Issues a Draft Law to Amend Global Minimum Tax Rules

On February 16, 2026, Australia issued the Taxation (Multinational—Global and Domestic Minimum Tax)

Amendment (2026 Measures No.1) Rules 2026, to amend its Global Minimum Tax Rules.

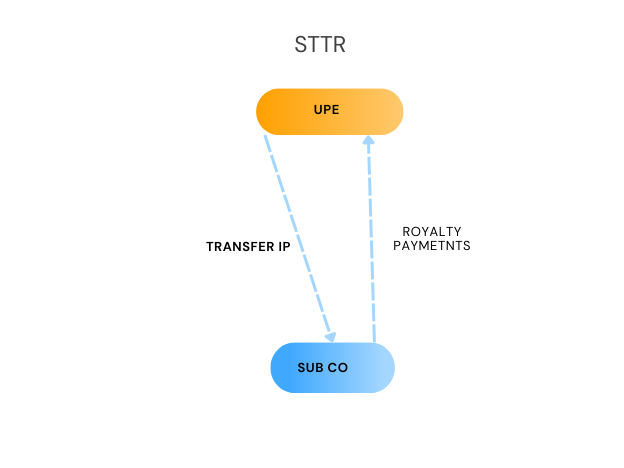

Pillar Two is comprised of two key rules, the GloBE Rules and the Subject-to-Tax Rule (STTR).

The STTR effectively claws back some of the taxing rights over certain forms of income that has been given to the residence jurisdiction under a double tax treaty. It only applies where the income is subject to a tax rate in the Country of residence below 9%.

Calculating the tax rate on covered income is a key aspect of the STTR, as only covered income with a tax rate of less than 9% is subject to the STTR.

The general rule is that the tax rate is the statutory rate of tax applicable in the residence state on the net income of the person receiving the income. This will, however, be adjusted for any specific beneficial tax treatment that reduces the tax charge (referred to as a preferential adjustment in the Model STTR Article).

Where the jurisdiction of the recipient does not levy tax on net income but on another alternative basis, the tax rate is not determined by the statutory rate of tax.

In this case, it is generally necessary for the two States to agree the tax rate or a method for determining the rate. This could, for instance, apply to a tax on a company’s assets or equity.

Where the recipient jurisdiction applies tax on gross income or as a capital tax the STTR Commentary suggests the inclusion of an additional provision in the treaty/a protocol to the treaty:

‘… the tax rate with respect to an item of covered income subject to the [insert the name of the tax] in [insert the name of the residence State], shall be the rate that results from dividing the total amount of such tax paid by the resident of [insert the name of the residence State] in the year in which the covered income is reflected in its financial statements by the total amount of its net income of that same year reflected in those financial statements…’

A similar approach could be taken where a jurisdiction applies a distribution tax.

The STTR guidance also addresses cases where a graduated rate applies in a jurisdiction. It notes that a simplified method could apply to determine the statutory tax rate eg by using the average rate of tax imposed on the net income of a company.

It does, however, caveat this by stating that an averaging approach is not always advised and should only be used where the graduated rate structure in the residence jurisdiction is expected to have a material impact on the statutory rate applying to the covered income.

In order to simply the process the authorities in both jurisdictions are required to notify each other of:

– the statutory rate (or any changes to those rates) applicable to residents of State with respect to items of covered income; and

– the provisions of their taxation law (or any changes to those provisions) that apply to items of covered income of residents of that State and that may result in a preferential adjustment.

A preferential adjustment is defined as a permanent reduction in the amount of the covered income subject to tax, or the tax payable on that income and which arises from one of three methods:

1) a full or partial exemption or exclusion from income.

2) a deduction from the tax base that is computed on the basis of the amount of income and without regard to any corresponding payment or obligation to make a payment.

This does not apply to deductions from the tax base that are not computed on the basis of the amount of income. Eg it doesn’t apply to ‘super deductions’ for tax purposes, accelerated depreciation or deductions of notional expenses such as notional interest deductions because they are not computed on the basis of the amount of taxable income.

3) a tax credit, (excluding a foreign tax credit) that is computed on the basis of the amount of income or tax on the income and that is directly linked to the item of covered income or that arises under a regime that provides a tax preference for income from geographically mobile activities.

Note that tax credits calculated by reference to investments or expenditure are not directly linked to covered income if they are granted regardless of the taxpayer’s income. For example, expenditure-based tax credits such as R&D tax credits are granted in respect of expenses incurred by the taxpayer, irrespective of whether the taxpayer derives any kind of income. In these cases, the tax credit is directly linked to the investment and does not depend on and cannot be traced to the income itself.

The permanent reduction needs to be “directly linked” to covered income. For example, an income exemption that applies to all or particular categories of royalty income, will be directly linked to an item of income. If that item of income also falls within the definition of covered income then the tax preference is one that is directly linked to an item of covered income.

This would not apply to a permanent reduction that applies to all taxpayers in a defined category or tax preferences attached to a specific type of expenditure. In that case, the permanent reduction is not directly linked to the character of the income derived by the taxpayer, but to the status of the taxpayer or the character of investment.

Foreign branch profit exemption regimes, for instance, are not “preferential adjustments” for the purposes of the STTR as the exemption arises from the attribution of income to a permanent establishment in a third State. That attribution will be undertaken following a functional and factual analysis and will involve the attribution of income wherever it arises, including income that arises in the State of the enterprise. The requirement that the exemption be “directly linked to the item of covered income” is therefore not met.

There are a number of exemptions from the STTR rules, including covered income paid by an individual or received by a person that is:

a) an individual;

b) not connected to the payer;

c) a recognised pension fund;

d) a non-profit organisation that is established and maintained exclusively for religious, charitable, scientific, artistic, cultural, sporting, educational, or other similar purposes;

e)

(i) that other State itself, or a political subdivision or local authority thereof;

(ii) the central bank;

(iii) an agency, mandatary or instrumentality of, or an entity or arrangement established or created by, a State, political subdivision or local authority; and

(iv) any other person wholly or almost wholly owned directly or indirectly by a State, its political subdivisions or local authorities, agencies, mandataries or instrumentalities, provided, above that their principal purpose is to fulfil a government function, and that they do not carry on a trade or business;

f) an international organisation;

g) a professionally managed entity or arrangement designed to invest funds obtained from unconnected persons primarily to generate investment income or to provide protection against an event, for the benefit of those persons provided that the entity or arrangement, or its managers, are regulated.

h) an entity or arrangement the taxation of which achieves a single level of taxation either in the hands of the entity or arrangement or its interest holders (with at most one year of deferral) provided that the entity or arrangement is widely held and either:

(i) holds predominantly immovable property; or

(ii) the entity or arrangement or its interest holders are subject to a tax rate of at least 9% in the State of which the entity or arrangement is a resident; or

(iii) an entity or arrangement that is wholly or almost wholly owned (directly or indirectly), or established or created, by one or more persons, entities, or arrangements referred to in subparagraphs c) to h):

Aside from interest and royalty income, the STTR will not apply to covered income if the gross amount of covered income does not exceed an amount equal to the costs incurred by the person deriving the income and that are directly or indirectly attributable to earning the income plus a mark-up of 8.5% on those costs.

The purpose of the mark-up threshold is to exclude from the STTR transactions that due to the low level of return present a more limited BEPS risk.

The mark-up threshold does not apply to interest or royalty income.

The return produced by an item of covered income is the difference between the gross amount of that income and the costs incurred by the person deriving the income that are directly or indirectly attributable to earning the income. The return produced by an item of covered income meets the mark-up threshold if it exceeds 8.5% of those costs.

The practical effect of this is that in most cases, where an agreed transfer pricing methodology has been used, the payment may satisfy the requirement to be a low-return payment.

Country A and B have a double tax treaty which includes the STTR and the 8.5% mark-up provision.

A Co, resident in Country A resident of State A makes a payment of 1 million for procurement services to B Co, resident in Country B. B Co incurs costs of 900,000 in generating the income. The return is therefore 100,000 and the mark-up is 11.1%. If costs were 950,000, the mark-up would be 5.26% and therefore the covered income would be excluded from the application of the STTR.

The mark-up percentage depends on the return produced by an item of covered income, which in turn depends on the costs incurred by the person deriving the oncome. The costs are based on both direct and indirect costs attributable to covered income.

Direct costs are generally relatively easy to calculate, however, indirect costs (such as general overheads) will also need to be calculated. One approach would be to multiply the total relevant cost by the amount of covered income divided by total income. For example, a person derives an intermediary fee of 50 and has total income of 500. Total overhead expenses incurred are 100. The total overheads attributable to that item of covered income would be 10.

The STTR Model Article includes rules to determine income for differing contractual arrangements.

1) It provides that all income derived by a person under the terms of a single contractual arrangement during a fiscal year for the same category of covered income and all costs incurred during the same fiscal year and that are directly or indirectly attributable to earning that covered income are aggregated for the purpose of determining the mark-up on costs.

As an example it states that in the case of quarterly payments of a single annual fee, each of the instalments paid in the fiscal year are aggregated to determine whether that income produces a mark-up below the threshold, as will the costs incurred in generating the income during that fiscal year.

Payments of the same item of covered income that are made under different contracts are not aggregated for the purpose of applying the STTR and a separate calculation is required.

2) Paragraph 9(b) of the STTR Model Article states that payments made under different contractual arrangements, or payments of different items of income, are aggregated if they are so interrelated that the amount of each separate item of covered income, and the direct and indirect costs incurred in earning that item of income, cannot be reliably identified if taken in isolation.

For this to apply there is no requirement that the income is paid under the same contractual arrangement.

3) Paragraph 9(c) of the STTR Model Article outlines specific rules to determine the mark-up percentage in various circumstances.

Firstly, this only applies to income received in consideration for the provision of services.

Secondly, the person deriving the income from the provision of services must have incurred costs, directly or indirectly from transactions with connected persons that are resident in a third jurisdiction and earn that income from the provision of services.

Thirdly, the connected person resident in a third jurisdiction must be subject to a tax rate below 9% on the income they derive from those transactions.

Finally, the services for which the consideration is received must be provided by the resident of the third jurisdiction to the person making the payment for the provision of services.

Eg A Co, a resident of Country A, derives income in consideration for the provision of services from B Co, a resident of Country B that is connected to A Co. A Co incurs costs from a transaction with C Co, a resident of a third jurisdiction that is connected to A Co, in earning the consideration for provision of services derived from B Co. This condition would be met if, under the arrangements, C Co provided some or all of the services directly to B Co.

If these conditions are met, the costs that result from transactions with the connected person that are included in the calculation of the mark-up on costs for the person deriving the income in consideration for the provision of services are limited to 80% of total costs. All costs incurred from transactions with connected persons are aggregated.

A Co, a resident of Country A, derives income in consideration for the provision of services of 1.6M from B Co, a resident of Country B.

In earning that income, A Co incurs total costs of 1.5M. Of those costs, 600,000 arise from transactions with C Co1 and 700,000 arise from transactions with C Co2.

C Co1 and C Co2 are residents of a third jurisdiction and are connected to A Co. The remaining 200,000 of costs arise from transactions with a third party.

Before the application of Paragraph 9(c) B Co has a mark-up on total costs of 6.67%.

C Co1 and C Co2 are subject to a tax rate below 9% on the income they derive from the transactions with A Co. C Co1 and C Co2 provide the services directly to B Co.

As a result, A Co’s connected party costs are capped at 80% of total costs, meaning that they are restricted to 1.2M.

As the costs incurred from the transactions with C Co1 and C Co2 are more than that amount (they are 1.3M), the mark-up must be calculated using 1.4M (1.2M connected party costs + 200,000 third party) of costs.

The mark-up is therefore 14%, which exceeds the 8.5% mark-up threshold.

The definition of a connected person is key for the application of the STTR, most notably as it doesn’t apply to payments to unconnected persons.

Paragraph 10 of the STTR Model Provision states that, a person shall be considered to be connected to another person if, based on all the relevant facts and circumstances, one has control of the other or both are under the control of the same person or persons.

In any case, a person is connected to another person if:

– one possesses directly or indirectly more than 50 per cent of the beneficial interest in the other (or, in the case of a company, more than 50 per cent of the aggregate vote and value of the company’s shares or of the beneficial equity interest in the company); or

– another person possesses directly or indirectly more than 50 per cent of the beneficial interest (or, in the case of a company, more than 50 per cent of the aggregate vote and value of the company’s shares or of the beneficial equity interest in the company) in each person

– whether the mark-up threshold is met;

– whether covered income qualifies for a preferential adjustment for the purposes of the tax rate test;

– whether the value of payments of covered income exceeds the materiality threshold; and

– whether the STTR applies to a payment of covered income where the alternative provisions catering for taxes imposed on an alternative basis or at the point of a profit distribution apply.

On February 16, 2026, Australia issued the Taxation (Multinational—Global and Domestic Minimum Tax)

Amendment (2026 Measures No.1) Rules 2026, to amend its Global Minimum Tax Rules.

On February 13, 2026, Poland issued a draft law to amend its Global Minimum Tax Law for the December 2023, June 2024 and January 2025 OECD Administrative Guidance. This also includes QDMTT changes, including the introduction of a Local Financial Accounting Standard rule.

On February 12, 2026, Cabinet Resolution No. (2) of 2026, was published in the Official Gazette to provide for the detailed implementation of the IIR and QDMTT in Qatar.

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |