Menu

Trending Now

In order to calculate the jurisdictional effective tax rate (ETR) for Pillar Two GloBE purposes (and therefore to determine if any top-up tax is due), it is necessary to identify the taxes suffered by the constituent entities in the jurisdiction.

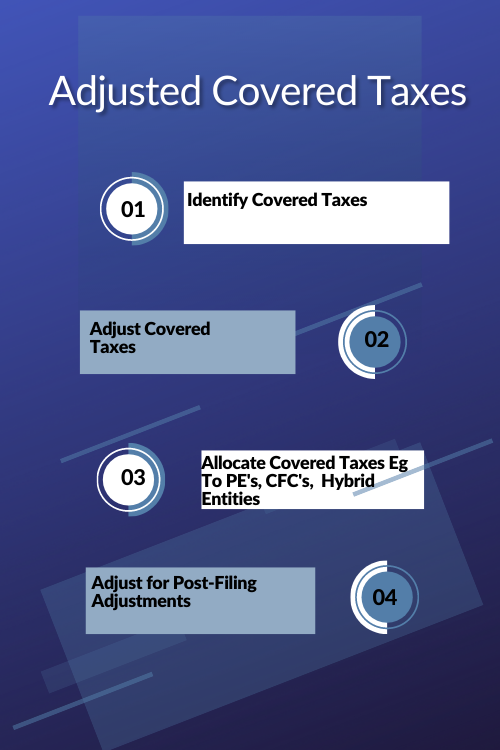

The Pillar Two GloBE rules identify relevant taxes as ‘covered taxes’. These are then adjusted to arrive at ‘adjusted covered taxes’ which is the figure used in the ETR calculation.

Note that, as with Pillar Two GloBE income, the calculation of adjusted covered taxes is based on an entity approach (ie the adjusted covered taxes for each entity in the jurisdiction is calculated). When the actual Pillar Two ETR is calculated this is (generally, but not always) calculated on a jurisdictional basis.

As with most aspects of the Pillar Two GloBE rules, the approach to calculating adjusted covered taxes begins with the financial accounts. The current tax expense accrued in the Financial Accounting Net Income or Loss of the constituent entity is used as the starting point and then adjusted.

The general approach is:

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |