Investment companies are treated differently to other companies, for the purposes of the Pillar Two GloBE Rules.

Importantly, there are subject to separate jurisdictional blending requirements and only the allocable share of the groups ownership interest is taken into account when calculating the jurisdictional effective tax rate.

This can lead to multinationals with investment entities in a jurisdiction being subject to more than one effective tax rate calculation, and can impact on the amount of top-up tax payable.

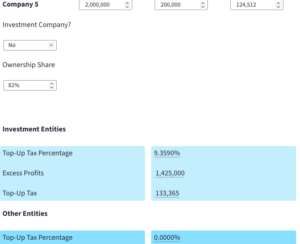

Our Pillar Two Investment Entities Calculator models the impact of a mix of investment and non-investment companies on both the effective tax rate and top-up tax payable.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |