Menu

Trending Now

A key aspect of the Pillar Two GloBE rules is the effective tax rate (ETR) calculation that needs to be compared for each jurisdiction against the 15% global minimum tax.

However, the Pillar Two GloBE ETR cannot be calculated unless we know what the Pillar Two GloBE income is (and Pillar Two GloBE taxes, for which see Adjusted Covered Taxes).

In this section, we take a look at the Pillar Two GloBE income which is an essential building block of the Pillar Two rules.

Summary

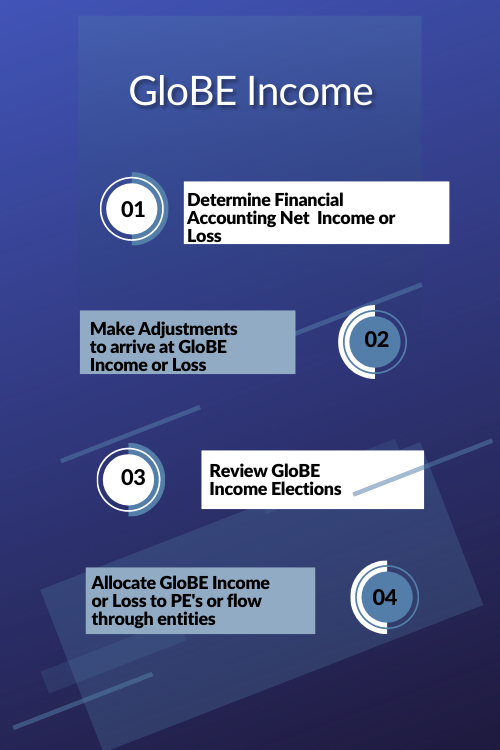

In essence, the Pillar Two GloBE income calculation is relatively straightforward. Put simply you:

• Determine the financial accounting net income or loss of the Constituent entity;

• Then adjust this to arrive at the Pillar Two GloBE income or loss via specific adjustments and income requirements.

However, as always, the devil is in the detail. Whilst the Pillar Two GloBE income calculation is based on the financial accounts of the relevant group entity, it attempts to provide a standardized measure of taxable income reflecting key principles in the domestic tax legislation of a number of jurisdictions.

Therefore, the financial accounting net income or loss figure needs to be adjusted to provide a measure of taxable income.

Many of these adjustments are amended versions of adjustments that are commonly applied in domestic tax regimes eg participation exemptions, arms-length requirements for intra-group transactions, excluded dividends and accrued pension costs.

There are also a number of elections available to MNEs when determining Pillar Two GloBE Income.

They generally apply either to minimize compliance costs, reduce volatility in the effective tax rate (ETR) calculation or provide for tax treatment similar to domestic tax regimes.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |