The UTPR operates after any qualifying IIR has been taken into account. The actual top-up tax to be allocated uses the same calculations for both the IIR and the UTPR. For more information on the IIR, see Income Inclusion Rule).

The charging provisions simply determine which jurisdiction or entity is liable to account for the top-up tax and the amount of the payment.

Article 2.5.1 of the OECD Model Rules provides that the UTPR adjustment begins with the calculation of the total UTPR top-up tax amount. This is the total top-up tax amount for all low-tax jurisdictions and low-taxed entities.

The UTPR amount is then reduced to zero if the UPE owns the low-taxed entity through parent entities that apply an IIR, under Article 2.5.2 of the OECD Model Rules.

As the IIR follows a top-down approach you could have a situation where there is no IIR in the UPE’s jurisdiction, but there is an IIR in one of the intermediate parent company jurisdictions.

In this case, they would apply an IIR and there would be no UTPR in the low-taxed entity providing the UPE indirectly owned all the ownership interest in the low-taxed entity. This treatment also applies if there are a number of intermediate parent entities.

So the general approach is:

• If all of the direct and indirect ownership interest of a UPE in a low-tax entity is held via subsidiary parent entities (ie intermediary parent entities and POPEs) that apply an IIR then the UTPR wouldn’t apply as the UTPR top-up amount is reduced to zero.

• If not, the UTPR will apply.

However, there could be cases where a parent entity applies an IIR but this doesn’t cover all of the top-up tax allocated to it.

For instance, if an intermediate parent owned a 60% controlling interest but the UPE owned 80% and wasn’t located in a jurisdiction that levied a qualifying IIR. In this case, the top-down treatment would apply so the intermediate parent entity had to account for top-up tax, but this would be insufficient as not all of the UPE’s ownership interest would be held by a parent entity that applies an IIR.

Where this applies, the amount accounted for under the IIR is simply deducted from the total top-up tax amount to be accounted for under the UTPR. No account is taken here of the UPEs allocable share of any top-up tax.

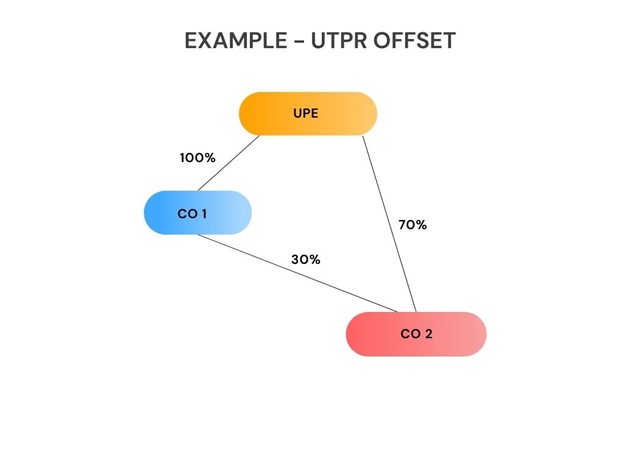

Under-Taxed Payments Rules – Example

A UPE owns 100% of Company 1, an intermediate holding company, and 70% of Company 2 which is a low-tax entity. The remaining 30% of Company 2 is owned 25% by Company 1 and 5% by non-group entities.

The UPE jurisdiction and the low tax entity jurisdiction do not apply an IIR. Only the Company 1 jurisdiction applies an IIR.

The UPE isn’t required to apply an IIR.

Company 1 applies an IIR on its 25% allocable share of Company 2.

However, the UPE ownership is 70% direct ownership and 25% indirect ownership. As not all of the UPE’s ownership interest are held by a parent entity that applies an IIR, there is an offset of the IIR tax in Company 1 paid against the UTPR top-up tax amount.

For instance, if the top-up tax in Company 2 was 10,000,000 euros, Company 1 would account for tax under the IIR of 2,500,000 euros. This would reduce the UTPR top up tax amount to 7,500,000 euros.

The general approach is:

• If all of the direct and indirect ownership interest of a UPE in a low-tax entity is held via subsidiary parent entities (ie intermediary parent entities and POPEs) that apply an IIR then the UTPR wouldn’t apply as the UTPR top-up amount is reduced to zero.

• If not, the UTPR will apply.

No, like all aspects of the Pillar Two GloBE Rules, they are not mandatory. However, a jurisdiction that did not apply the under-taxed payments rule would sacrifice tax revenue from low taxed subsidiaries in its jurisdiction.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |