Poland Issues a Draft Law to Implement OECD Administrative Guidance

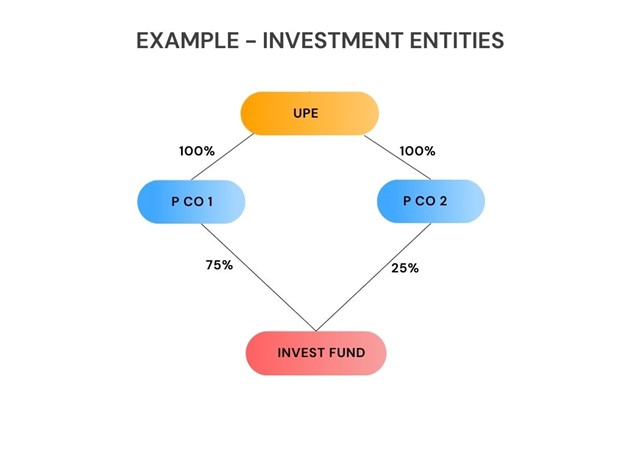

On February 13, 2026, Poland issued a draft law to amend its Global Minimum Tax Law for the December 2023, June 2024 and January 2025 OECD Administrative Guidance. This also includes QDMTT changes, including the introduction of a Local Financial Accounting Standard rule.