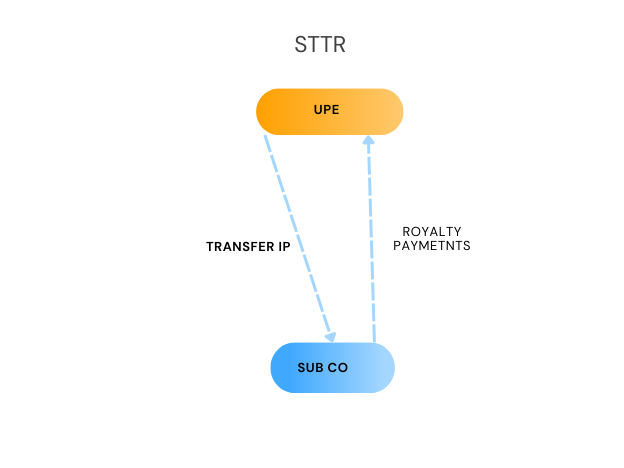

For example, if in this example the UPE was taxed on the royalty payments at 5%, Sub Co would have the right under the STTR to apply additional tax on the royalty payments at 4%. If the Sub Co was based in a regime that levied withholding tax at 15%, the STTR would not apply as it already applied tax at a rate above 9%.

The tax that can be levied by the source-state is the:

specified rate * gross amount of covered income

The specified rate is the difference between 9% and the tax rate applied to the covered income in the residence State.

For instance, if the tax rate on income of 1M was 5% in the residence state, the source state could levy tax of up to (9%-5%) 4% * 1M = 40,000.

Note, that the source state isn’t required to tax this full amount, but it cannot exceed it.

Other Treaty Provisions

Paragraph 3 of the Model STTR Article provides specific treatment where another provision of a double tax treaty (DTT) taxes the income.

Where another DTT provision taxes the income at the specified rate (so that the total tax rate is at least 9%), as you’d expect, the STTR does not apply (as it is unnecessary).

If another provision of a double tax treaty allows the source State to tax income at a rate below the specified rate, the taxing right under the other provision is preserved and the STTR simply tops up the rate to 9%.

Payments Subject to the STTR

Under Paragraph 4(a) of the Model STTR Article, payments subject to the STTR (referred to as ‘Covered Income’ in the STTR Article) are:

– interest

– royalties

– payments made in consideration for the use of, or the right to use, distribution rights in respect of a product or service;

– insurance and reinsurance premiums;

– fees to provide a financial guarantee, or other financing fees;

– rent or any other payment for the use of, or the right to use, industrial, commercial or scientific equipment; or

– any income received in consideration for the provision of services.

It should be borne in mind that these definitions are based on applicable treaty definitions. As such when considering the scope of interest or royalties for instance, jurisdictions may have different interpretations. The

OECD Model Tax Convention includes the observations and positions that jurisdiction have taken.

The following are not include in covered income under Paragraph 4(b) of the Model STTR Article:

– rent or other payment for the use of, or the right to use, a ship to be used for the transportation of passengers or cargo in international traffic on a bare boat charter basis; or

– items of income derived by a person whose domestic tax liability is determined by the tonnage of a ship.

The inclusion of services within the scope of the STTR list is likely to be of key interest to source jurisdictions, particularly as regards digital intermediation services.