Italy Approves Model for the GloBE Tax Return

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

As Permanent Establishments are treated as separate constituent entities for the purpose of the Pillar Two GloBE rules, there needs to be some way of allocating adjusted covered taxes to the PE for the purpose of calculating the jurisdictional ETR. For more information on PEs, see Pillar Two and Permanent Establishments.

In some cases, the main entity may not have separate financial statements for the PE, and the taxes paid by the PE may be included in the taxes incurred by the main entity.

Covered taxes are allocated to a PE under Article 4.3.2 of the OECD Model Rules by the following mechanism:

1. Identify the PE’s share of the main entity’s domestic taxable income. This should be able to be identified from the corporate income tax return process.

2. Identify the main entity’s tax liability arising from the PE’s taxable income. This is straightforward if the PE is subject to a separate tax rate. In other cases, the main entity’s tax liability (before any foreign tax credit) needs to be allocated to the PE.

3. Determine the amount of any tax credit allowed in the main entity in respect of the PE’s taxable income.

The tax determined using these steps is deducted from the covered tax for the main entity and allocated to the PE.

If there is a loss under the Pillar Two GloBE rules for a PE, Article 3.4.5 of the OECD Model Rules provides that this will be treated as an expense of the main entity to the extent that the loss of the PE is treated as an expense for domestic tax purposes.

Pillar Two GloBE income that is subsequently earned by the PE is treated as income of the main entity up to the amount treated as an expense by the main entity.

As the loss is allocated to the main entity, Article 4.3.4 of the OECD Model Rules provides that any adjusted covered taxes associated with the income are also allocated to the main entity up to the maximum corporate income tax on the income in the jurisdiction.

Note in this case, any deferred tax asset created and subsequently unwound in the main entity isn’t taken into account in adjusted covered taxes by either the PE or the main entity. This does not affect the treatment of the domestic law tax loss, which is subject to the general deferred tax regime.

In the case of a tax transparent entity, the tax of the partner or member as determined above is allocated to the PE under Article 4.3.2(b) of the OECD Model Rules.

Any covered taxes that aren’t allocated to a PE are allocated to the entity owners (eg partners or members). If there is a reverse hybrid entity, just as for the allocation of Pillar Two GloBE income, covered taxes remain with the entity (aside from any amounts attributable to a PE).

The same approach taken to allocating covered tax to PEs can also be used to allocate covered taxes to CFCs under Article 4.3.2(c) of the OECD Model Rules, given this is essentially a similar scenario. Note, however, the below push-down limitation rule for passive income.

A hybrid entity is an entity that is treated as opaque for tax purposes where it is located but tax transparent in the jurisdiction of its owners.

If the owner of a hybrid entity is a constituent entity that suffers tax on its share of the income of the hybrid entity (including withholding taxes), the covered taxes are allocated to the hybrid entity under Article 4.3.2(d) of the OECD Model Rules. The same three-step approach used to allocate covered taxes to a PE can also be used to calculate the covered taxes allocated to the hybrid entity.

Note, however, the below push-down limitation rule for passive income.

Withholding tax and other taxes (including net basis taxes) incurred on dividends received from another constituent entity are allocated to the distributing company under Article 4.3.2(e) of the OECD Model Rules.

This is notwithstanding the fact that the financial accounts of the receiving company will have accounted for any withholding tax in its current tax expense. Therefore, there would be a reduction in covered taxes for the receiving company and an increase in covered taxes for the distributing company.

Article 2.6 of the OECD Administrative Guidance confirms that this also includes deemed distributions.

Covered tax that relates to passive income allocated to hybrid entities or CFCs is restricted to the lower of:

This is provided by Article 4.3.3 of the OECD Model Rules.

Any remaining covered tax is allocated to the owners (eg the company with the CFC regime in place).

This ensures that the tax allocated to a CFC or hybrid entity in relation to passive income is sufficient to reach the 15% global minimum rate and does not artificially increase the covered tax of the CFC or hybrid entity (which would increase its ETR and reduce any potential top-up tax liability).

Passive income is defined as:

– dividends or similar payments;

– interest or similar payments;

– rent;

– royalty;

– annuity; or

– net gains from property that produces income listed above.

See our interactive tool to simulate the impact of the CFC pushdown limitation

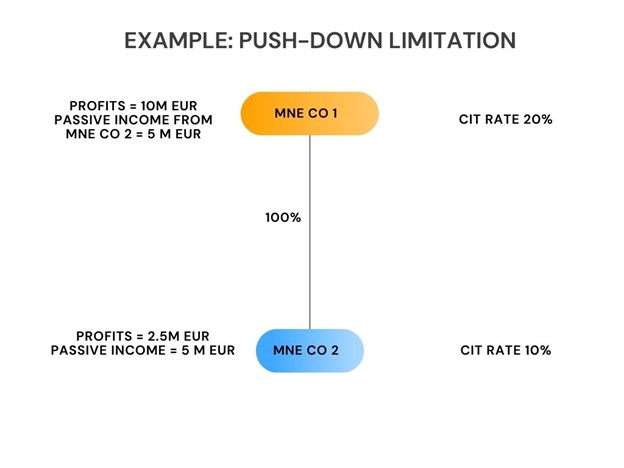

MNECo1 is part of an MNE group subject to the Pillar Two GloBE rules. It is resident in a Country A that has a domestic corporate income tax rate of 20%.

MNECo2 is a wholly-owned subsidiary of MNECo1 and is resident in Country B, which has a corporate income tax rate of 10%.

Country A has a CFC regime which taxes the foreign passive income of MNECo2.

MNECo1 has profits of 10,000,000 euros and is additionally taxed on foreign passive income of MNECo2 of 5,000,000 euros.

MNECo2 has trading profits of 2,500,000 euros and taxable passive income of 5,000,000 euros.

The tax in MNECo1 is 15,000,000 * 20% = 3,000,000 euros. In addition, it can claim a foreign tax credit on the CFC income of 500,000 euros. Therefore, the final tax liability of MNECo1 is 2,500,000 euros.

The Pillar Two GloBE rules allocate CFC tax incurred by MNCo1 to MNECo2. This will increase its adjusted covered taxes, increase its Pillar Two GloBE ETR and reduce any top-up tax payable for MNECo2.

This is beneficial given the lower rate of corporate income tax in Country B. However, given the CFC income relates to foreign passive income the push-down limitation needs to be considered.

The tax allocated to MNECo2 is restricted to the lower of the actual amount of covered tax that relates to the passive income in the parent jurisdiction and the top-up tax percentage in the subsidiary jurisdiction multiplied by the subsidiary’s passive income taxed under the CFC/hybrid regime.

The actual amount of covered tax in MNECo1 is (5,000,000 * 20%)- 500,000 = 500,000 euros.

The top-up tax percentage in Country B is 5% (15%-10%).

Applying this to the 5,000,000 euros passive income taxed in MNECo1 results in tax of 250,000 euros.

As such although the actual amount of CFC tax in MNECo1 is 500,000 euros, only 250,000 euros can be allocated to MNECo2 for its adjusted covered tax calculation.

The remaining 250,000 euros remain with MNECo1.

The final Pillar Two GloBE ETR calculation for MNECo1 would be:

Income = 10,000,000 (as the Pillar Two GloBE Income is reduced by the CFC income)

Covered tax = 2,000,000 + remaining CFC tax of 250,000 = 2,250,000

ETR = 22.5%

The final Pillar Two GloBE ETR calculation for MNECo2 would be:

Income = 7,500,000

Covered tax = 750,000 + allocated CFC tax of 250,000 = 1,000,000 euros

ETR = 13.3%

If there was no CFC pushdown limitation, the MNECo1 Pillar Two GloBE ETR would be 20% and MNECo2’s Pillar Two GloBE ETR would be 10%.

This would have had the effect of reducing top-up tax in Country B with no Pillar Two impact in Country A as its ETR is above the 15% global minimum rate.

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

On December 31, 2025, Israel enacted Law No. Law 5776-2025 on the Minimum Corporate Tax for Multinational Groups. The enacted law contains some significant changes from the previous draft law.

On December 29, 2025, Uruguay’s President issued Decree No. 325/025, to provide for exemptions from the QDMTT for entities covered by a tax stability agreement. Note that Law N° 20446 to enact the QDMTT was published in the Official Gazette on January 8, 2026.

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |