Italy Approves Model for the GloBE Tax Return

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

The allocable share is defined in Article 2.2.1 of the OECD Model Rules as:

Top-Up Tax of the Low Taxed Entity x Parents Inclusion Ratio

The inclusion ratio is the:

Pillar Two GloBE Income of the Low Taxed Entity less any amount attributable to other ownership interests/Pillar Two GloBE Income of the Low Taxed Entity

This means that if the low-taxed entity is wholly owned by the parent entity, the inclusion ratio would be 100% and all of the low-taxed entity’s top-up tax would be levied on the parent under an Income Inclusion Rule (IIR).

A key component of the IIR calculation is ascertaining the amount of Pillar Two GloBE income attributable to other owners. This then feeds directly into a parent entity’s allocable share, and the amount of top-up tax they are liable to pay.

The way the Pillar Two GloBE rules do this is in Article 2.2.3 of the OECD Model Rules, by deeming consolidated financial accounts to be prepared. As part of the accounting consolidation, any income or assets attributable to other non-group owners would be eliminated so that the consolidated accounts reflect just the income, expenses, assets and liabilities of the group.

In order to do this, they make a number of assumptions so that the hypothetical consolidation actually achieves the correct allocation of Pillar Two GloBE income:

1. The accounting standard used for the deemed consolidation is the same as the UPE’s consolidated financial statements.

2. The parent entity owned a controlling interest in the low-taxed entity and there is a requirement to consolidate the results of the low-taxed entity in the deemed consolidated accounts.

This is an assumption to fit the Pillar Two GloBE rules to accounting rules (even if the accounting consolidation is only hypothetical). Just because the Ultimate Parent Entity (UPE) may have to prepare consolidated accounts doesn’t mean that a parent entity would.

The parent entity may for instance hold a minority interest in the low-taxed entity even though the UPE holds a controlling interest. This would then mean there may not be a requirement for the parent entity to prepare consolidated accounts. This assumption prevents that from happening.

3. Consolidated financial accounts eliminate intra-group transactions.

However, for the purposes of the Pillar Two GloBE rules intra-group transactions are usually included (unless of course an election is made for consolidated treatment for constituent entities in the same jurisdiction. For more information on this, see the Consolidation Election).

An assumption is therefore made that all transactions are with non-group companies. This prevents the hypothetical consolidation from eliminating intra-group transactions.

4. The final assumption removes all other owners from the deemed consolidation (by treating them as non-group companies) so that the deemed consolidation focuses on the interest held by the parent entity.

Where there are two or more parent entities in a chain required to apply an IIR, a backstop mechanism applies so that the parent entity higher in the chain can reduce its top-up tax by the amount of its top-up tax levied in the intermediate holding company or POPE.

This would not apply if for instance there was a POPE that wholly-owned another POPE which in turn owned an interest in a low-taxed entity, as in this case the POPE highest in the chain has priority. But if the subsidiary POPE was not wholly-owned, both POPEs would have to apply an IIR.

This rule prevents double taxation. It could also occur where an intermediate parent entity had a non-controlling interest in another intermediate parent entity that in turn holds the ownership interest in a low-taxed entity.

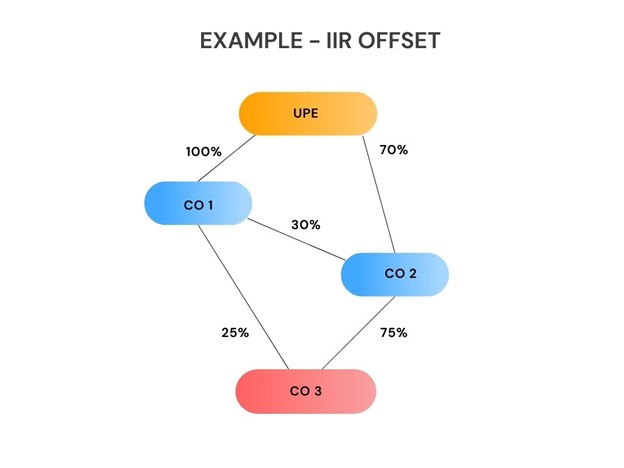

A UPE is resident in Country A. Country A does not apply an IIR.

The UPE owns 100% of Company 1 and 70% of Company 2. The remaining 30% of Company 2 is owned by Company 1. Both Companies are resident in Country B, which does apply an IIR.

Company 1 owns 25% of Company 3 and Company 2 owns 75% of Company 3. Company 3 is resident in Country C. Company 3 is a low tax entity and top-up tax of 10,000,000 euros is due under the Pillar Two GloBE rules.

The two intermediate parent entities are Company 1 and Company 2. If Company 1 owned a controlling interest in Company 2, Company 1 would just apply the IIR.

However, in this case, it does not. Therefore, both Company 1 and Company 2 apply the IIR on their allocable share of the top-up tax. Company 2’s allocable share would be 75%, equivalent to 7,500,000 euros. Company 1’s allocable share would be the 25% direct ownership and 22.5% indirect ownership ie 47.5%.

This would equate to top-up tax of 4,750,000. However, Company 1 can reduce its allocated top-up tax by the amount of top-up tax attributed to its indirect ownership (2,250,000 euros). This leaves Company 1 with allocated top-up tax of 2,500,000 euros.

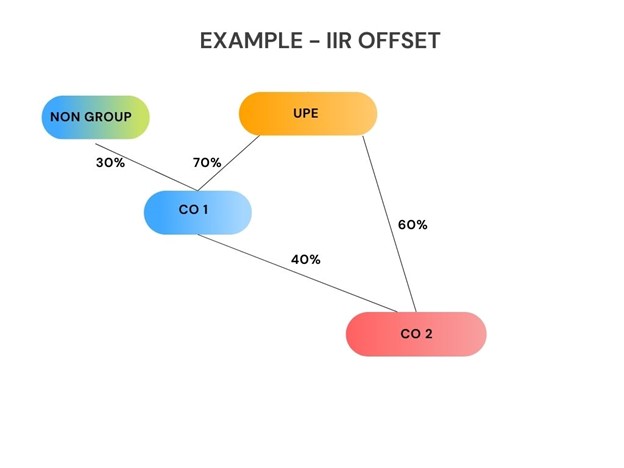

A UPE is resident in Country A. The UPE owns 60% of Company 2, resident in Country C.

The UPE owns 70% of Company 1 which is resident in Country B. The remaining 30% is owned by non-group members. Company 1 owns the remaining 40% of Company 2.

Company 2 is a low-taxed entity for Pillar Two GloBE purposes.

Both Country A and B apply an IIR.

In this case Company 1 is a POPE as it owns an interest in another constituent entity (Company 2) and more than 20% of its ownership interest is held by non-group members. As such Company 1 is required to apply an IIR.

The UPE is also required to apply an IIR. However, the top-up tax allocated to the UPE is reduced by the amount attributed to the POPE due to its indirect ownership.

For instance, if the top-up tax due in Company 2 was 50,000,000 euros, Company 1 would be allocated top-up tax of 20,000,000 euros (50,000,000 * 40%). The UPE has 60% direct ownership and 28% indirect ownership. Therefore, it would be initially allocated 88% of the top-up tax (44,000,000).

This would then be reduced by the top-up tax allocated to Company 1 due to its indirect ownership (28% * 50,000,000 = 14,000,000 euros).

The final allocation of top-up tax to the UPE would be 30,000,000 euros.

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

On December 31, 2025, Israel enacted Law No. Law 5776-2025 on the Minimum Corporate Tax for Multinational Groups. The enacted law contains some significant changes from the previous draft law.

On December 29, 2025, Uruguay’s President issued Decree No. 325/025, to provide for exemptions from the QDMTT for entities covered by a tax stability agreement. Note that Law N° 20446 to enact the QDMTT was published in the Official Gazette on January 8, 2026.

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |