Italy Approves Model for the GloBE Tax Return

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

A low-taxed constituent entity is an entity which is located in a jurisdiction that has a Pillar Two GloBE ETR below the 15% global minimum rate, and that has Pillar Two GloBE income taxed below that rate.

The requirement to hold an ownership interest at any time during the fiscal year means that even if a constituent entity is sold, the IIR still applies.

The Ultimate Parent Entity (UPE) pays an amount equal to its allocable share of the top-up tax. For more information, see Allocated Top-Up Tax.

Note that whilst the Pillar Two GloBE ETR calculation is carried out on a jurisdictional basis, the charging provisions apply on an entity basis. This is why for instance, after the top-up tax has been calculated, there are rules to then allocate this top-up tax back to the constituent entities (based on each relevant constituent entity’s share of the total net Pillar Two GloBE income of the jurisdiction).

Under Article 10 of the OECD Model Rules, an intermediate parent entity is a constituent entity that isn’t a UPE and that owns an ownership interest in another constituent entity in the MNE group.

Certain other entities also can’t be an intermediate parent entity. This includes investment entities, partially owned parent entities (‘POPEs’) and permanent establishments (‘PE’s). If a constituent entity is held via a PE, ownership is deemed to be with the main entity. Article 3.2 of the OECD Administrative Guidance also confirmed that Insurance Investment Entities can’t be intermediate parent entities.

Just as for a UPE, an intermediate parent entity that owns (directly or indirectly) an ownership interest in a low-taxed constituent entity applies the IIR (assuming it is located in a jurisdiction that applies an IIR) and pays top-up tax based on its allocable share of the top-up tax of the low-tax entity. Again, just as with a UPE, a controlling interest in the low-taxed constituent entity isn’t required.

You may be thinking, well, if there is a UPE and an intermediate parent entity that has an ownership interest in a low-taxed entity, who pays the tax?

Article 2.1 of the OECD Model Rules applies a top-down approach. This means that the IIR falls to the entity at the top of the ownership chain. If there is no IIR in force in the jurisdiction of the UPE, the liability to account for top-up tax under an IIR then flows down the ownership chain.

If there are two or more intermediate parent entities that own an interest in a low-taxed entity, again this top-down approach applies, so the entity that is highest in the chain that applies an IIR would be liable.

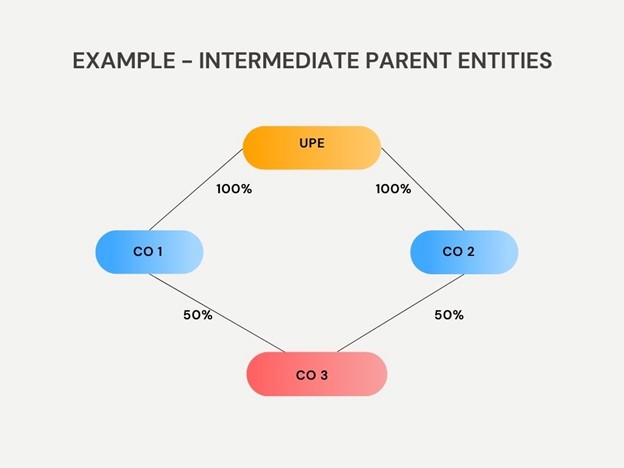

A UPE is resident in country A. Country A does not apply an IIR.

The UPE owns 100% of Company 1 and Company 2. Both companies are resident in Country B, which does apply an IIR.

Companies 1 and 2 each own 50% of Company 3, which is tax resident in Country C. Country C does not apply an IIR. Company 3 is a low-taxed entity and top-up tax of 10,000,000 euros is calculated under the Pillar Two GloBE rules.

The UPE would not apply an IIR, as Country A has not implemented an IIR. As such, the top-down approach applies and the intermediate parent entities (Company 1 and Company 2) would apply the IIR given Country B has implemented an IIR.

Their allocable share of the top-up tax is 50% and they would each pay top-up tax of 5,000,000 euros.

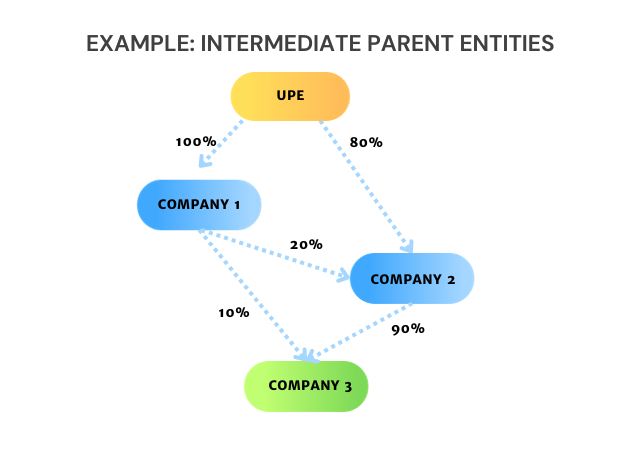

Let’s change the group structure slightly. The UPE now owns 100% of Company 1 and 80% of Company 2, with the remaining 20% owned by Company 1. Both Company 1 and 2 are in different jurisdictions but both apply an IIR.

If the UPE jurisdiction applies an IIR, the situation would be straightforward, and all of the top-up tax would be allocated to the UPE under the IIR.

However, as the UPE jurisdiction does not apply an IIR, Company 2 is required to apply an IIR as it is classed as an intermediate parent entity given it owns an ownership interest in a low-taxed entity (Company 3).

Company 1 is also required to apply the IIR as that is also an intermediate parent entity given its ownership interest in Company 3. However, Company 1’s allocable share of the top-up tax is reduced by the amount levied in Company 2 in respect of its indirect ownership.

Therefore, Company 2 would be allocated 90% of the top-up tax (given it has a 90% direct shareholding). Company 1 would be allocated 28% of the top-up tax (10% direct ownership and 18% indirect ownership). However, Company 1 would then reduce the top-up tax attributable to its indirect ownership in Company 3 by the amount taxed in Company 2.

Note that if Company 1 held a controlling interest in Company 2, the position would again be different. In this case, an intermediate parent entity would own a controlling interest in another intermediate parent entity.

Providing the intermediate parent entity highest up in the chain applies an IIR, it is that entity that applies the IIR. Therefore, in this example that would be Company 1.

A POPE is defined in Article 10 of the OECD Model Rules as a constituent entity, other than a UPE, a Permanent Establishment or an Investment Entity that owns (directly or indirectly) an ownership interest in another constituent entity in the same group, and the right to more than 20% of its profits are held by persons that aren’t part of the MNE group. Article 3.2 of the OECD Administrative Guidance also confirmed that Insurance Investment Entities can’t be POPEs.

There’s a departure here from the standard top-down rule for POPEs as under Article 2.1.4 of the OECD Model Rules, even if a UPE applies an IIR, if there is a POPE that owns an interest in a low-taxed entity it will also need to apply the IIR. If there are two or more POPE’s in the ownership chain that hold an interest, then the top-down approach applies providing the subsidiary POPE is wholly owned by the parent POPE.

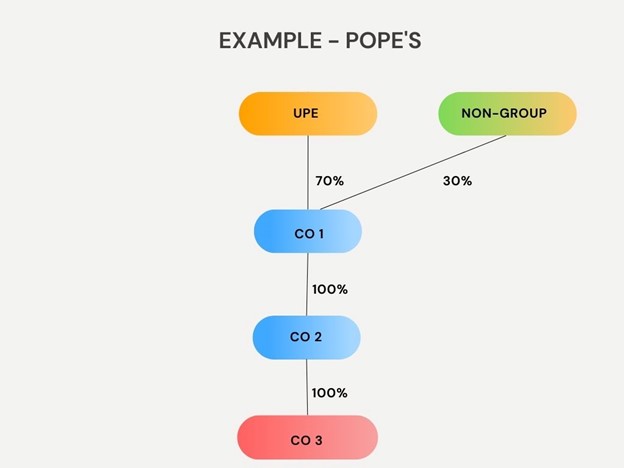

A UPE is resident in country A.

The UPE owns 70% of Company 1 which is resident in Country B. The other 30% ownership interest is owned by non-group members.

Company 1 owns 100% of Company 2, which is resident in Country C.

Company 2 owns 100% of Company 3, which is resident in Country D.

Company 3 is a low tax entity and top-up tax of 10,000,000 euros is calculated under the Pillar Two GloBE rules.

All jurisdictions apply an IIR except for Country D.

In this case, both Company 1 and Company 2 are POPE’s as they own an ownership interest in another constituent entity and more than 20% of their ownership interests are directly or indirectly owned by non-group members.

For company 1, 30% of its ownership interest is directly held by non-group members and for Company 2 30% of its ownership interest is indirectly held by non-group members.

A POPE is required to apply the IIR irrespective of whether the UPE applies an IIR providing the POPE jurisdiction applies an IIR.

Therefore, both Company 1 and Company 2 would be required to apply an IIR. However, if one POPE is wholly owned by another, the IIR applies to the POPE highest in the ownership chain. In this case, Company 1 would apply the IIR. Its allocable share would be 100% and it would pay top-up tax of 10,000,000 euros.

The UPE would also apply an IIR, however, the IIR offset applies so that the UPE would reduce its top-up tax by the top-up tax allocated to the POPE. Therefore, the UPE’s top-up tax would be nil.

This example illustrates that whilst there is a general top-down approach, the existence of a POPE can effectively switch this off so that the entity lower in the chain applies the IIR.

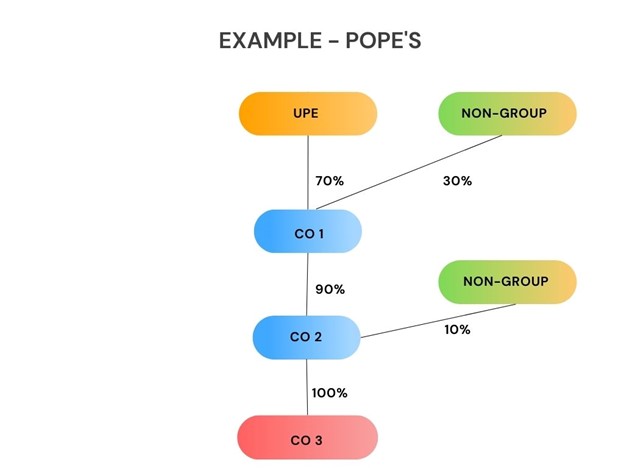

If Company 1 owned 90% of Company 2, with the remaining 10% owned by third parties, the result would be different.

They would still both be POPEs as Company 1 still has 30% of its ownership interest held by non-group members, and Company 2 would have 10% of its direct ownership held by non-group members and 27% indirect ownership by non-group members.

However, as Company 1 does not wholly own Company 2, there is no switch-off mechanism to allocate the IIR just to Company 1.

Therefore Company 2 would apply the IIR based on an allocable share of 100% (ie 10,000,000 euros top-up tax). Both the UPE and Company 1 would also apply the IIR but the IIR offset would reduce any top-up tax payable to zero.

The IIR generally applies to foreign low-taxed entities. However, the Pillar Two GloBE rules permit jurisdictions to amend their domestic legislation to tax domestic low-taxed entities.

The Income Inclusion Rule is the primary method of accounting for top-up tax under Pillar Two. The general rule is that a UPE is required to apply the Income Inclusion Rule (IIR) where it owns an ownership interest in a low-taxed constituent entity at any time during a fiscal year.

Under Article 10 of the OECD Model Rules, an intermediate parent entity is a constituent entity that isn’t a UPE and that owns an ownership interest in another constituent entity in the MNE group.

A POPE is defined in Article 10 of the OECD Model Rules as a constituent entity, other than a UPE, that owns (directly or indirectly) an ownership interest in another constituent entity in the same group, and the right to more than 20% of its profits are held by persons that aren’t part of the MNE group.

There’s a departure here from the standard top-down rule for POPEs as under Article 2.1.4 of the OECD Model Rules, even if a UPE applies an IIR, if there is a POPE that owns an interest in a low-taxed entity it will also need to apply the IIR.

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

On December 31, 2025, Israel enacted Law No. Law 5776-2025 on the Minimum Corporate Tax for Multinational Groups. The enacted law contains some significant changes from the previous draft law.

On December 29, 2025, Uruguay’s President issued Decree No. 325/025, to provide for exemptions from the QDMTT for entities covered by a tax stability agreement. Note that Law N° 20446 to enact the QDMTT was published in the Official Gazette on January 8, 2026.

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |