Italy Approves Model for the GloBE Tax Return

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

An investment entity is generally an investment fund or real estate investment fund and includes certain subsidiaries that hold assets or investments funds on the investment fund’s behalf or where substantially all of the income is dividends or losses from fair value interests or arising under the equity method of accounting. For more information, on the equity method of accounting, see excluded equity gains or losses at Pillar Two GloBE Specific Adjustments.

An investment fund is defined in Article 10 of the OECD Model Rules as an entity that:

• is designed to pool assets from a number of investors (some of which are unrelated);

• invests in accordance with a defined investment policy;

• allows investors to reduce transaction, research, and analytical costs, or to spread risk collectively;

• is primarily designed to generate investment income or gains, or protection against a particular or general event or outcome;

• investors have a right to return from the assets of the fund or income earned on those assets, based on the contributions made by those investors;

• it or its management is subject to a regulatory regime in the jurisdiction in which it is established or managed;

• it is managed by investment fund management professionals on behalf of the investors.

A key issue is that the GloBe ETR of investment entities is not subject to the general jurisdictional blending calculation, and they are treated separately. For more information on jurisdictional blending, see ETR Calculation and Top-Up Tax.

Article 7.4.2 of the OECD Model Rules provides that multiple investment entities in a jurisdiction effectively form a separate investment entity group which is subject to a separate jurisdictional ETR calculation.

The GloBE ETR calculation is similar to the standard ETR calculation, but with a twist. It is calculated as:

Adjusted Covered Taxes/MNE’s Allocable share of the GloBE Income

The allocable share of the GloBE income is based on the inclusion ratio used for the purposes of the IIR:

GloBE income of the Investment entity less amounts attributable to other owners/total GloBE income of the investment entity

The adjusted covered taxes of the investment entity are the covered taxes accrued to the investment entity based on the above inclusion ratio plus any other covered taxes that accrue to its constituent entities owners and that are pushed down to the investment entity. For more information on taxes pushed down, see Allocation of Covered Taxes.

The investment entity top-up tax calculation is then calculated in a similar way to the standard GloBE top-up tax calculation:

1. The top-up tax percentage is determined by deducting the investment entity ETR from the 15% global minimum rate

2. The MNE groups allocable share of the investment entities GloBE income is reduced by the substance-based income exclusion (‘excess profits’)

3. The top-up tax percentage is applied to the excess profits

As noted above, multiple investment entities in a jurisdiction effectively form a separate investment entity group which is subject to a separate jurisdictional ETR calculation.

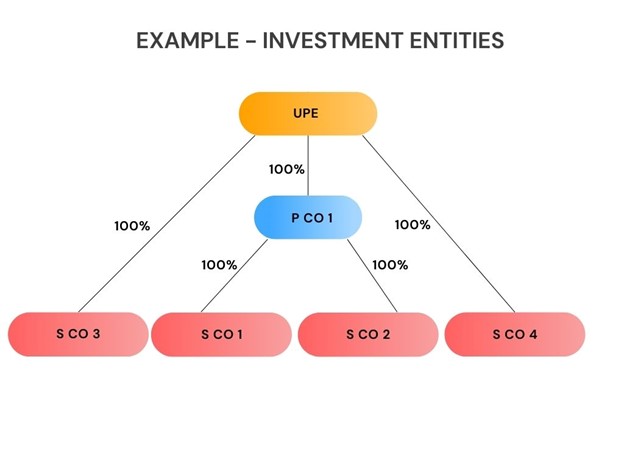

The UPE is located in Country X. It owns 100% of P Co, located in Country Y. P Co owns 100% of S Co 1 and S Co 2, which are both investment entities located in Country A.

The UPE also fully owns two other constituent entities in Country A, S Co 3 and S Co 4 which aren’t investment entities.

For this example, we will keep it simple and assume there are no covered taxes pushed down to the investment entities given there are no third-party shareholders.

Let’s assume GloBE income and adjusted covered taxes are:

S Co 1 = GloBE income of 15,000,000 euros and adjusted covered taxes of 3,000,000 euros

S Co 2 = GloBE income of 20,000,000 euros and adjusted covered taxes of 2,000,000 euros

S Co 3 = GloBE income of 10,000,000 euros and adjusted covered taxes of 2,000,000 euros

S Co 4 = GloBE income of 20,000,000 euros and adjusted covered taxes of 3,000,000 euros

S Co 1 and S Co 2 are investment entities and would calculate their GloBE ETR separately from the other entities in Country A.

In this case, they would have a GloBE ETR of 14.2857% (5,000,000/35,000,000).

The other entities in the jurisdiction would have a jurisdictional ETR of 16.7%.

Therefore, top-up tax may be due for the jurisdiction.

If the investment entities were not treated as a separate MNE group for jurisdictional blending purposes, the jurisdictional ETR would be 15.3% and no top-up tax would have been levied.

The reason for having a separate jurisdictional blending calculation for investment entities is that they may well suffer very low rates of tax in domestic jurisdictions.

If this was blended with other entities in the jurisdiction, more highly taxed entities would see the overall jurisdictional GloBE ETR reduced by the low-tax investment entities.

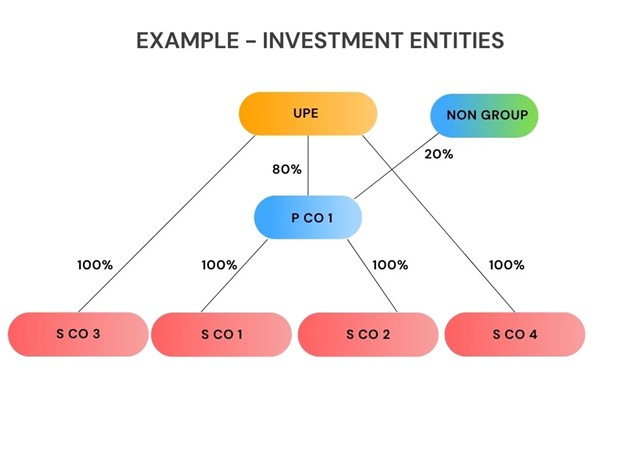

Let’s change the group structure so that the UPE owns 80% of the shareholding in P Co (which entitles it to 80% of the profits). The remaining 20% is owned by non-group members.

In this case, the GloBE ETR of S Co 1 and S Co 2 is calculated based on its allocable share of the GloBE income and top-up tax. In this case, that would be 80%.

The GloBE income would be 80% * 35,000,000 = 28,000,000 euros

The top-up tax would be 80% * 5,000,000 euros = 4,000,000 euros

The ETR would therefore still be 14.2857%. The top up-tax percentage is 0.7143%.

This is applied to 80% of the GloBE income = 28,000,000 * 0.7143% = 200,004 euros

As mentioned above, the substance-based income exclusion applies to the calculation of excess profits for the purposes of calculating the top-up tax. For more information on the substance-based income exclusion generally, see Substance-Based Income Exclusion.

Again, this is reduced under Article 7.4.6 of the OECD Model Rules to only take account of the MNE group’s allocable share of the investment entity’s GloBE income (or loss).

For instance, what if in the above example, S Co 1 had local tangible asses of 10,000,000 euros in Country A. If we assume the standard 5% carve-out rate applies (ie we ignore the transitional rules), the substance-based carve-out would be 500,000 euros. The MNE group’s allocable share of GloBE income is 80%, therefore the substance-based carve-out allocated to the investment entity is 400,000 euros.

This would reduce excess profits to 27,600,000 euros and the top-tax would be 27,600,000 * 0.7143% = 197,147 euros.

An investment entity is generally an investment fund or real estate investment fund and includes certain subsidiaries that hold assets or investments funds on the investment fund’s behalf or where substantially all of the income is dividends or losses from fair value interests or arising under the equity method of accounting.

Article 7.4.2 of the OECD Model Rules provides that multiple investment entities in a jurisdiction effectively form a separate investment entity group which is subject to a separate jurisdictional ETR calculation.

The GloBE ETR calculation is similar to the standard ETR calculation, but with a twist. It is calculated as:

Adjusted Covered Taxes/MNE’s Allocable share of the GloBE Income

The allocable share of the GloBE income is based on the inclusion ratio used for the purposes of the IIR:

GloBE income of the Investment entity less amounts attributable to other owners/total GloBE income of the investment entity

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

On December 31, 2025, Israel enacted Law No. Law 5776-2025 on the Minimum Corporate Tax for Multinational Groups. The enacted law contains some significant changes from the previous draft law.

On December 29, 2025, Uruguay’s President issued Decree No. 325/025, to provide for exemptions from the QDMTT for entities covered by a tax stability agreement. Note that Law N° 20446 to enact the QDMTT was published in the Official Gazette on January 8, 2026.

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |