Italy Approves Model for the GloBE Tax Return

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

Article 3.2.3 of the OECD Model Rules applies an arms-length requirement for transactions between constituent entities in different jurisdictions. This should generally apply in any case due to transfer pricing policies under domestic tax laws.

Although these transactions may be eliminated in the consolidated financial accounts, given the Pillar Two GloBE income or loss is based on the entity’s financial accounts they would need to be considered.

If the financial accounts agree to an arms-length basis no adjustment would need to be made unless for tax purposes a different value is used to apply the arms-length basis.

Note that this only applies to the value of intra-group transactions, not the timing of intra-group transactions. Therefore, no adjustment is required to adjust the timing of an item in the financial accounts to the timing under domestic tax law.

The arms-length basis doesn’t generally apply to transactions between group entities in the same jurisdiction, as the jurisdictional blending rules will generally eliminate them anyway. For more information on jurisdictional blending, see ETR calculation and top-up tax.

There are two exceptions to this:

1. a transfer of an asset between group entities in the same jurisdiction that gives rise to a loss that is included in the Pillar Two GloBE income or loss. In this case the arms-length basis needs to be applied otherwise an MNE could artificially manufacture losses.

2. Transactions between a minority-owned constituent entity or investment entity and other constituent entities aren’t subject to the standard jurisdictional blending and their ETR is calculated on a standalone basis. As such the transactions wouldn’t be eliminated in the jurisdictional blending calculation. Therefore, an arms-length requirement applies to these transactions. For more information, see minority-owned entities.

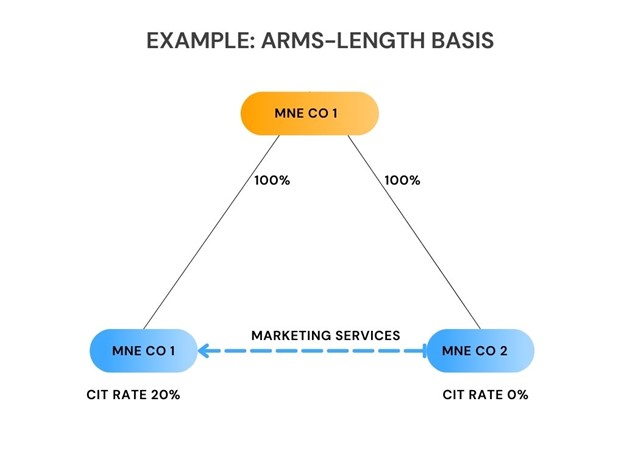

MNECo1 is located in Country A, which has a corporate income tax rate of 20%.

MNECo2 is located in Country B, which has a 0% rate of corporate income tax.

MNECo1 and MNECo2 are both wholly owned by UPE, and this is an MNE group within the scope of Pillar Two.

MNECo2 provided group marketing services to MNECo1. The financial accounts of both MNECo1 and MNECo2 reflect expenses and income of 5,000,000 euros.

However, for tax purposes, MNECo1 deducts 7,500,000 euros.

In this case, 2,500,000 euros is effectively not subject to tax in Country A and is not subject to top-up tax in Country B.

As such, to apply the arms-length requirement MNECo1 is required to add back 2,500,000 euros of its expense for the Pillar Two GloBE income calculation, and MNECo2 is required to reflect additional income of 2,500,000 euros in its Pillar Two GloBE income calculation.

Adjustments can also apply when there is a unilateral transfer pricing adjustment.

For instance, if in the above example MNECo1 had deducted an expense of 3,000,000 euros for tax purposes as a result of a unilateral transfer pricing adjustment, this would increase taxable income subject to corporate income tax by 2,000,000 euros in MNECo1, but that 2,000,000 of income is also subject to top-up tax in MNECo2.

Therefore, MNECo1 is required to reduce its expense in the calculation of Pillar Two GloBE income by 2,000,000 euros and MNECo2 is required to reduce its Pillar Two GloBE income by 2,000,000 euros.

Note that if the result of an adjustment to the arms-length basis would result in double taxation or non-taxation, then no adjustment is made.

For instance, if in the example above MNEco2 reflected income of 4,000,000 euros for tax purposes and the corporate income tax rate was 10%, no adjustment would be required.

Although the deduction in MNECo1 is 5,000,000 euros, this is included in Pillar Two GloBE income and is subject to top-up tax in MNECo2. Therefore, no adjustment is permitted.

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

On December 31, 2025, Israel enacted Law No. Law 5776-2025 on the Minimum Corporate Tax for Multinational Groups. The enacted law contains some significant changes from the previous draft law.

On December 29, 2025, Uruguay’s President issued Decree No. 325/025, to provide for exemptions from the QDMTT for entities covered by a tax stability agreement. Note that Law N° 20446 to enact the QDMTT was published in the Official Gazette on January 8, 2026.

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |