Australia Issues a Draft Law to Amend Global Minimum Tax Rules

On February 16, 2026, Australia issued the Taxation (Multinational—Global and Domestic Minimum Tax)

Amendment (2026 Measures No.1) Rules 2026, to amend its Global Minimum Tax Rules.

Intragroup financing arrangements are subject to special rules under Article 3.2.7 of the OECD Model Rules.

This is a common area of tax planning for MNE’s and without specific provisions, they could adjust the effective tax rate (ETR) of jurisdictions by structuring financing operations.

For instance, they could reduce Pillar Two GloBE income in jurisdictions that were just below the minimum rate (therefore increasing the ETR and potentially resulting in the jurisdictional ETR being over 15%) whilst increasing Pillar Two GloBE income in jurisdictions that had significant ETR capacity (ie where the jurisdictional ETR is significantly above 15% anyway).

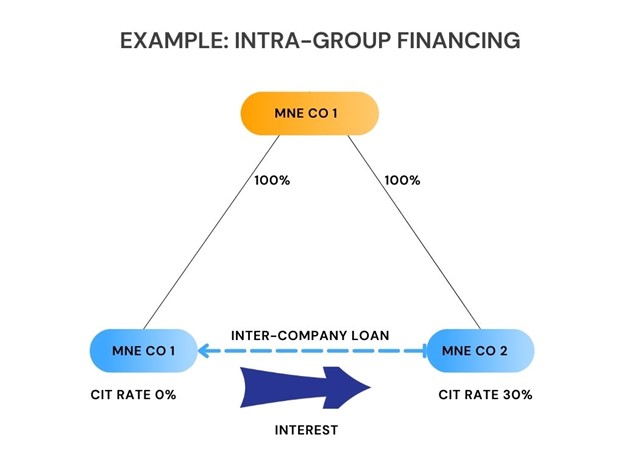

A typical arrangement that would be targeted by this is a hybrid financing arrangement such as:

MNE Co 1 is resident in a low-tax jurisdiction. It borrows money from MNE Co 2 by way of a debt instrument 2. MNE Co 2 is a member of the same MNE group and is resident in a high tax jurisdiction.

The debt instrument is treated as equity for tax purposes and debt for financial accounting purposes in both jurisdictions.

As such, interest payments by MNE Co 1 would reduce Pillar Two GloBE income (and therefore increase the Pillar Two GloBE ETR) without any reduction in the domestic tax liability (as dividends are generally not tax-deductible).

By contrast, the interest receipt would increase Pillar Two GloBE income in MNE Co 2 (reducing its Pillar Two GloBE ETR) without a corresponding increase in its domestic taxable income.

Therefore, as an anti-avoidance measure, the Pillar Two GloBE income or loss of a low-taxed entity does not include any expenses of an intra-group financing arrangement that can be expected to increase the expenses of a low-taxed entity without a corresponding increase in the taxable income of a high taxed entity.

A low-taxed entity is generally an entity in a jurisdiction where the Pillar Two GloBE ETR is less than 15%.

There is no increase in the taxable income of a high-taxed entity if the income qualifies for an exclusion or deduction ie just because the high-taxed entity is allocated the income for local tax purposes does not mean this requirement is met, if it qualified for deduction or credits that offset it.

This could be the case if, for example, it has brought forward interest expenses sufficient to offset interest received from the low-taxed entity.

Whether there is an intragroup financing arrangement in place is an objective test and is based on whether there is an arrangement between two or more members of an MNE group which results in a high taxed entity directly or indirectly providing credit or making an investment in a low taxed entity.

In addition, again using an objective test, the arrangement must be reasonably expected to reduce the Pillar Two GloBE income of a low taxed entity without increasing the taxable income of a high taxed entity over the duration of the agreement.

Profits from international shipping (eg profits derived from the transport of cargo or passengers by ships) as well as certain ancillary income are generally exempt for Pillar Two GloBE income purposes under Article 3.3 of the OECD Model Rules.

As this would have been included in the profits in the financial accounts, an adjustment to the Pillar Two GloBE income is required.

On February 16, 2026, Australia issued the Taxation (Multinational—Global and Domestic Minimum Tax)

Amendment (2026 Measures No.1) Rules 2026, to amend its Global Minimum Tax Rules.

On February 13, 2026, Poland issued a draft law to amend its Global Minimum Tax Law for the December 2023, June 2024 and January 2025 OECD Administrative Guidance. This also includes QDMTT changes, including the introduction of a Local Financial Accounting Standard rule.

On February 12, 2026, Cabinet Resolution No. (2) of 2026, was published in the Official Gazette to provide for the detailed implementation of the IIR and QDMTT in Qatar.

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |