Australia Issues a Draft Law to Amend Global Minimum Tax Rules

On February 16, 2026, Australia issued the Taxation (Multinational—Global and Domestic Minimum Tax)

Amendment (2026 Measures No.1) Rules 2026, to amend its Global Minimum Tax Rules.

1. Non-Consolidation

1.1 Overview of Accounting Treatment

1.2 Pillar Two – Non-Consolidated JVs

1.3 How the Pillar Two Rules Apply to JVs

2. Consolidated JVs

2.1 General Rule

2.2 Top-Up Tax

For accounting purposes, the key criterion is whether there is significant influence.

For instance, under IAS 28, it is presumed that if an investor controls 20%-50% of the voting rights of the JV that there is significant influence, but there can be cases where significant influence can apply even below this threshold (eg significant transactions between the entities or participation in board meetings etc).

Under accounting rules such entities are usually classed as ‘associates’.

Where there is significant influence, the interest in the JV is accounted for under the equity method and the results are not consolidated.

Essentially the initial investment is recorded at cost and then adjusted for the actual performance of the JV.

Note that there is still an impact on the consolidated accounts.

In the consolidated statement of profit or loss, dividend income received from the JV is replaced by bringing in one line that shows the parent’s share of the JV results immediately before the consolidated profit before tax.

If by contrast, the investor controlled the investee then the results of the investee would be consolidated on a line-by-line basis in the consolidated financial statements.

For Pillar Two purposes under the general rules, an MNE group’s share of the income of a JV that it did not control would not be brought into account as the JV is not consolidated on a line-by-line basis as is required by Article 1.2 of the OECD Model Rules.

Therefore, there is a separate rule for JVs.

Article 10 of the OECD Model Rules define a JV as an entity whose financial results are reported under the equity method in the Consolidated Financial Statements of the MNE Group provided that the UPE holds directly or indirectly at least 50% of its ownership interests.

Therefore, an associate that was accounted for under the equity method and where the UPE held less than 50% of the ownership interest would not be subject to the special JV rule.

For example, in a limited partnership, limited partners are not considered controlling if the general partner controls the investment, even if a limited partner owns a large share of the investment. For GloBE purposes, the income and tax items attributable to these would be excluded from the ETR calculation.

In addition, an excluded entity or a JV that is the UPE of an MNE group already within the Pillar Two rules are not classed as JVs for this purpose.

1. The JV and any of its subsidiaries are treated as a separate MNE group for Pillar Two purposes, and the JV is treated as the UPE, under Article 6.4.1(a) of the OECD Model Rules.

This means that for the purposes of jurisdictional blending the JV group income and covered tax is not included with other entities in the jurisdiction.

2. The JV itself does not apply the income inclusion rule or the under-taxed payments rule, under Article 6.4.1(b) of the OECD Model Rules.

The standard rules apply and the UPE or other parent entity would apply an IIR.

3. The UPE or parent entity is subject to top-up tax on its allocable share of the JV group under Article 6.4.1(c) of the OECD Model Rules.

This takes into account both direct and indirect holdings.

4. Where the allocable share is not fully accounted for under an IIR then any amount remaining is added to the total under-taxed payments rule amount, and then allocated to other constituent entities under the general rules.

If the interest in the investee is consolidated due to the investor exercising control, then the first step is that the general rules apply.

The Pillar Two rules use the consolidated financial statements and therefore the income and tax of the JV would be brought within the scope of the Pillar Two rules anyway.

Providing the UPE holds more than 30% in the JV the results are included along with other group entities for the purposes of jurisdictional blending.

If the UPE holds less than 30%, the JV is treated as a minority-owned entity and is a separate entity (or sub-group) for the ETR calculation.

Note that the imposition of top-up tax where a JV is consolidated can vary depending on the interest that the UPE holds in the JV.

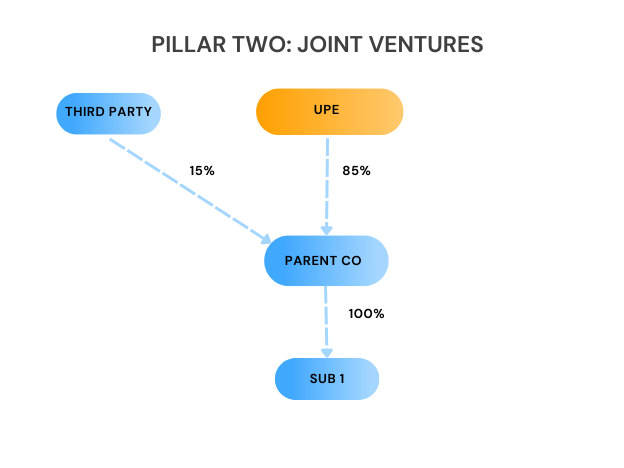

If the UPE holds more than an 80% interest in the JV, the standard rules apply and the UPE of the group would account for top-up tax under an IIR (or other parent entity if the UPE did not apply an IIR).

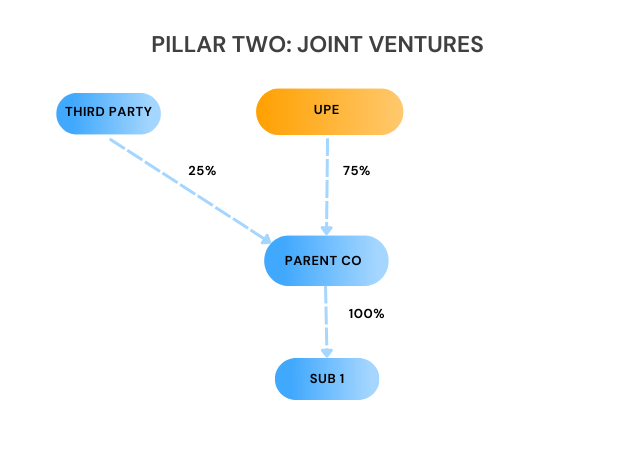

If the UPE held less than an 80% interest in the JV the treatment depends on the group structure.

If the JV is a single entity held by the JV then the UPE would just apply an IIR.

However, if there was another parent entity, that would be classed as a partially owned parent entity (POPE).

The POPE then accounts for top-up tax in respect of its subsidiaries. The following examples illustrate this:

If Sub 1 was a low-taxed entity with top-up tax calculated at 1 million euros, the UPE would apply an IIR to its allocable share (85%). Therefore, it would account for top-up tax of 850,000 euros and the remaining 150,000 euros would be uncollected.

If, however, the group structure was:

The Parent Co would be a POPE as more than 20% of its ownership interest was held by non-group entities. As such, Parent Co would account for the 1 million euros top-up tax. The UPE would then reduce any top-up tax by the 1 million euros that the POPE accounted for.

The treatment of joint ventures (JVs) under the Pillar Two rules depends on whether the interest in the JV is consolidated on a line-by-line basis in the consolidated accounts. If it is, the general rules apply. If not, special rules apply to treat the JV separately from other jurisdictional entities.

Joint Ventures (JVs) that aren’t consolidated are treated as follows:

1. The JV and any of its subsidiaries are treated as a separate MNE group for Pillar Two purposes, and the JV is treated as the UPE, under Article 6.4.1(a) of the OECD Model Rules.

This means that for the purposes of jurisdictional blending the JV group income and covered tax is not included with other entities in the jurisdiction.

2. The JV itself does not apply the income inclusion rule or the under-taxed payments rule, under Article 6.4.1(b) of the OECD Model Rules.

The standard rules apply and the UPE or other parent entity would apply an IIR.

3. The UPE or parent entity is subject to top-up tax on its allocable share of the JV group under Article 6.4.1(c) of the OECD Model Rules.

This takes into account both direct and indirect holdings.

On February 16, 2026, Australia issued the Taxation (Multinational—Global and Domestic Minimum Tax)

Amendment (2026 Measures No.1) Rules 2026, to amend its Global Minimum Tax Rules.

On February 13, 2026, Poland issued a draft law to amend its Global Minimum Tax Law for the December 2023, June 2024 and January 2025 OECD Administrative Guidance. This also includes QDMTT changes, including the introduction of a Local Financial Accounting Standard rule.

On February 12, 2026, Cabinet Resolution No. (2) of 2026, was published in the Official Gazette to provide for the detailed implementation of the IIR and QDMTT in Qatar.

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |