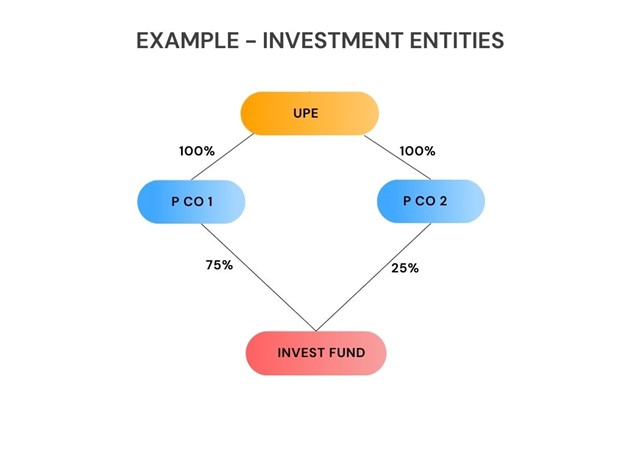

Canada’s January 2026 Draft Amendments to the Global Minimum Tax Act: the Elective Private Investment Entity De-Consolidation Regime

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.