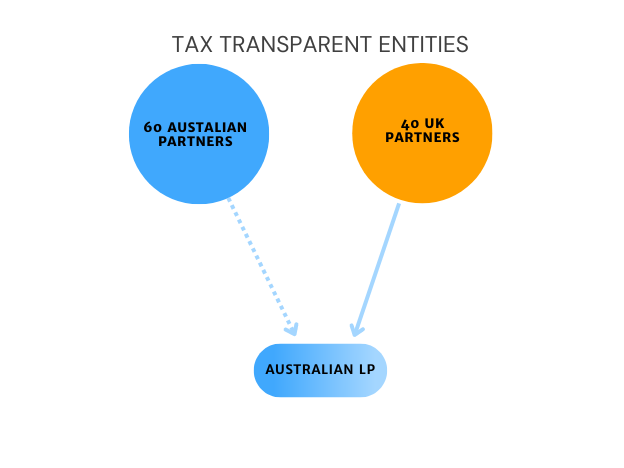

Assume the Australian LP has GloBE income of 100 million. 60 million is attributable to the Australian partners and 40 million to the UK partners.

If the Australian partners are all individuals that hold less than 5% of the profits/assets of the UPE and are tax resident in Australia, the 60 million attributable to them is deducted from the UPEs GloBE income under Article 7.1.1(b) of the Model Rules.

If the UK partners are taxed at a rate of 15% or above (as would be expected) the 40 million attributable to them would also be deducted from the UPEs GloBE income under Article 7.1.1(a) of the Model Rules.

Determining GloBE status when a Flow-through Entity is held directly by another Flow-through Entity

The GloBE rules determine whether a Flow-through Entity is classified as a Tax Transparent Entity or a Reverse Hybrid Entity based on whether the Flow-through Entity is treated as fiscally transparent in the “jurisdiction in which the owner is located”.

The question then arises if there is a chain of ownership through other flow-through entities in different jurisdictions, which entity is treated as the owner for determining the GloBE status of the entity?

The

June 2024 OECD Administrative Guidance confirms that the status of a Flow-through Entity as a Tax Transparent Entity or Reverse Hybrid Entity should generally be determined by reference to the tax law of the Constituent Entity-owner closest to the Entity in the ownership chain that is not itself a Flow-through Entity (other than a Flow-through UPE).

Application of Article 3.5.3

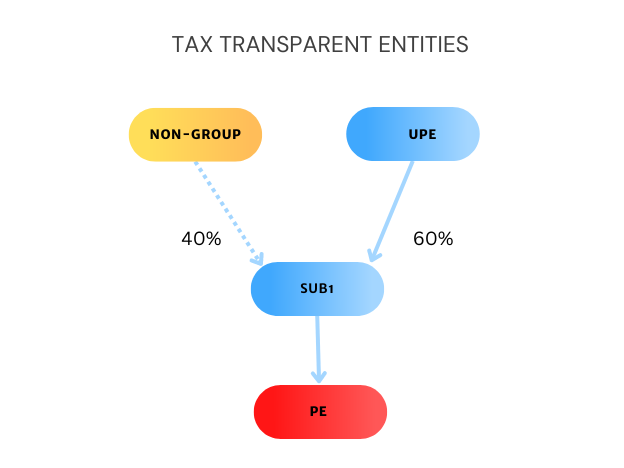

Article 3.5.3 of the GloBE rules reduces the FANIL of a Flow-through Entity by the amount allocable to its owners that are not Group Entities and that hold their Ownership Interest in the Flow-through Entity directly or through a Tax Transparent Structure. The OECD guidance addresses two issues that arise from this.

Partially owned Flow-through Entity

Article 3.5.4 states that Article 3.5.3 does not apply:

(a) where the UPE of the MNE Group is a Flow-through Entity; and

(b) where a Flow-through UPE owns the Flow-through Entity directly or indirectly through a Tax Transparent Structure

If this provision wasn’t included Article 3.5.3 could have resulted in the FANIL of a Flow-through UPE being reduced to zero because the owners of the Flow-through UPE are all non-Group Entities.

The question arises as to whether Article 3.5.4 disapplies Article 3.5.3 fully when there is a non-group owner or whether it applies to the extent of the Ownership Interests owned by the UPE?

The

June 2024 OECD Administrative Guidance confirms that Article 3.5.4(b) applies when the Ownership Interests in the Flow-through Entity are owned by the UPE directly or indirectly through a Tax Transparent Structure and applies to the extent of the Ownership Interests owned by the UPE.

Minority Owners with Indirect Ownership

The other issue relating to Article 3.5.3 considered by the

June 2024 OECD Administrative Guidance is whether the reference to Tax Transparent Structure in Article 3.5.3 only refers to Ownership Interests of Constituent Entities of the MNE Group or whether it also covers the Ownership Interests owned by the minority investors.

If reference to Tax Transparent Structure included the treatment of the Entities through which the minority owners own their Ownership Interests in the tested Entity under the laws of the minority owners’ jurisdiction(s), then the flow-through entity’s FANIL would only be reduced to the extent that the tax laws of the minority owners’ jurisdiction(s) treated the indirect holding entity as a fiscally transparent entity. This would therefore require a determination of the tax treatment in the jurisdiction of a third party.

The OECD confirms that this is not the case and Article 3.5.3 requires the FANIL to be reduced when the minority owners’ Ownership Interests in the tested Entity are held directly or are indirectly owned through a Constituent Entity-owner which is a Flow-through Entity and is closer in the ownership chain to the tested Entity than the Reference Entity (i.e. is between the tested Entity and the Reference Entity).

Taxes allocated to a flow through entity

Article 3.5.1(b) provides that the FANIL of a Tax Transparent Entity that is not the UPE is allocated to its Constituent Entity-owners in accordance with their Ownership Interests (subject to any allocation to a PE or a reduction for non-group owners).

In order to match jurisdictional income with related taxes, Article 4.3.2(b) provides that any Covered Taxes accrued by the Tax Transparent Entity with respect to this income should also be allocated to the Constituent Entity-owner.

However, Article 4.3.2(b) refers only to Covered Taxes that are accrued in the Tax Transparent Entity’s financial accounts that are used to compute its FANIL. It does not expressly apply to any Covered Taxes that are reallocated from another Constituent Entity to the Tax Transparent Entity under another provision in Article 4.3, for example the CFC pushdown.

The

June 2024 OECD Administrative Guidance confirms hat taxes allocated to a Tax Transparent Entity under Article 4.3.2 should be allocated under Article 4.3.2(b) in the same way as Covered Taxes accrued by the Tax Transparent Entity. As such the tax will follow the allocation of the income.

This means that Covered Taxes should first be allocated to the Tax Transparent Entity under the relevant sub-paragraph of Article 4.3.2 (eg under a CFC or Hybrid pushdown). Article 4.3.2(b) then allocates both Covered Taxes accrued by the Tax Transparent Entity and any Covered Taxes that are allocated to it, to the constituent-entity owner.

Hybrid Entities

Article 4.3.2(d) of the OECD Model Rules allocates Covered Taxes that are included in the financial accounts of a Constituent Entity-owner of a Hybrid Entity to the Hybrid Entity. This is again based on the matching principle that taxes should be included in the same jurisdictional ETR computation as the profits to which they relate.

A Hybrid Entity is defined in Article 10.2.5 as a separate taxable person for income tax purposes in the jurisdiction where it is located but fiscally transparent in the jurisdiction where its ‘owner’ is located.

Does ‘owner’ include indirect owners?

In order to prevent double taxation and ensure the consistent application of the matching principle the latest OECD guidance confirms that “owner” refers to both the direct and indirect Constituent Entity-owners of the entity.

Therefore, covered taxes reflected in the financial accounts of the direct and indirect Constituent Entity-owners that relates to the income of the Hybrid Entity and are imposed because the Entity is fiscally transparent under the tax law applicable to the direct and indirect Constituent Entity-owners will be allocated to the Hybrid Entity (subject to the passive income limitation).

Entities located in jurisdictions without a Corporate Income Tax

Under Article 10.2.5 of the OECD Model Rules, an Entity can only be considered a Hybrid Entity if it is treated as a separate taxable person for income tax purposes in the jurisdiction where it is located. As such, the Hybrid Entity definition in Article 10.2.5 does not apply when a Constituent Entity is located in a jurisdiction without a CIT because the Entity will not be treated as a separate taxable person in that jurisdiction.

This would lead to a breakdown in the matching principle because the tax of the Constituent Entity[1]owner will not be included in the same jurisdictional ETR computation as the profit to which it relates. There is also no clear policy justification for only allocating taxes to a Constituent Entity when it is located in a jurisdiction with a CIT. Article 4.3.2(d) only applies when the Constituent Entity is a Hybrid Entity or a Reverse Hybrid Entity.

The

June 2024 OECD Administrative Guidance confirms that the Hybrid Entity definition will also apply to an Entity that is not treated as fiscally transparent under Article 10.2.4 and is located in a jurisdiction under Article 10.3.1(b).

Matching of taxes and income where an owner is subject to tax with respect to a Reverse Hybrid Entity’s income

As noted above, this OECD guidance confirms that the tax law of the Reference Entity’s jurisdiction determines whether a Flow-through Entity is treated as a Tax Transparent Entity or a Reverse Hybrid Entity.

However, this rule may not always match the Flow-through Entity’s profit and the MNE Group’s tax on that profit in the same jurisdictional ETR computation if the Entity is owned through a chain of Entities.

This is because the jurisdictions where the owners are located could take different views on the transparency of an Entity, with some treating an entity as fiscally transparent and some as opaque.

In order to ensure the tax is matched with the income the

June 2024 OECD Administrative Guidance extends the hybrid pushdown to reverse hybrid entities. As such Covered Taxes paid by a direct or indirect Constituent Entity-owner with respect to the profits of a Reverse Hybrid Entity are allocated to the Reverse Hybrid Entity under Article 4.3.2(d). This also means that the passive income limitation in Article 4.3.3 will also apply.

This will also have a QDMTT impact as the OECD Guidance also confirms that the relevant Commentary on the determination of a QDMTT will also be amended.

The existing guidance requires a domestic minimum tax to exclude the Covered Tax expense of:

-a Constituent Entity-owner under a CFC Tax Regime that is allocable to a domestic Constituent Entity under Article 4.3.2(c) of the GloBE Rules;

-a Main Entity that is allocable under Article 4.3.2(a) to a Permanent Establishment located in the jurisdiction;

-a Constituent Entity-owner on income of a Hybrid Entity that is allocable under Article 4.3.2(d) to a Hybrid Entity that is either located in the jurisdiction or is included in the scope of the QDMTT because the QDMTT applies to stateless Flow-through Entities created in the QDMTT jurisdiction;

-Constituent Entity-owner (e.g. net basis taxes), other than a withholding tax imposed by the QDMTT jurisdiction, that is allocable to a distributing Constituent Entity located in the jurisdiction under Article 4.3.2 (e).