A blended CFC regime arises when the tax charge under the CFC regime is based on a blend of income or of multiple CFCs. They therefore don’t blend CFC income on a jurisdictional basis but tend to apply globally to all foreign income. The lack of jurisdictional blending is one of the reasons why these blended CFC rules such as GILTI won’t qualify as qualified domestic minimum taxes.

As GILTI is treated as a CFC regime, US parent companies that are subject to tax under GILTI on foreign low tax entities will allocate the tax levied under the GILTI regime to the foreign low taxed entities for GloBE purposes.

For fiscal years that begin on or before 31 December 2025 but not ending after 30 June 2027, the Administrative Guidance includes a simplified formula to allocate CFC taxes in blended CFC regimes such as GILTI.

The formula allocates CFC tax under a Blended CFC Tax Regime to entities located in jurisdictions in which the GloBE Jurisdictional ETR is below the rate for the Blended CFC Tax Regime.

The effect of this is that entities with lower covered taxes and larger CFC income will be allocated more of the CFC tax, as shown in the example below.

The Blended CFC allocation formula is:

(Blended CFC Allocation Key/Total of all Blended CFC Allocation Keys) * CFC Tax under the Blended CFC Regime

The Blended CFC Allocation Key is:

Attributable Income of the Entity * (CFC Rate – GloBE jurisdictional ETR)

Attributable Income of the entity is the owner’s proportionate share of the income of the CFC.

The GloBE jurisdictional ETR is the GloBE ETR before taking the CFC tax into account. If the GloBE ETR is higher than the CFC rate the allocation key is nil. Any tax under a QDMTT is taken into account in the GloBE ETR providing the Blended CFC tax regime permits a foreign tax credit for it.

Clarifications in the December 2023 Administrative Guidance

If the MNE applies the Simplified ETR Test under the Transitional CbCR Safe Harbour, the Simplified ETR is used instead of the GloBE Jurisdictional ETR when determining the Blended CFC Allocation Key for Entities in that Jurisdiction.

If an MNE Group elects the de minimis test or the routine profits test under the Transitional CbCR Safe Harbour, the MNE Group calculates the jurisdiction’s Simplified ETR using the guidance in the Transitional CbCR Safe Harbour document (i.e., dividing the Tested Jurisdiction’s Simplified Covered Taxes by its Profit (Loss) before Income Tax as reported on the MNE Group’s Qualified CbC Report).

For a jurisdiction for which the MNE Group has elected the QDMTT Safe Harbour, the GloBE Jurisdictional ETR is calculated based on the taxes and income used to determine the ETR for the jurisdiction under the jurisdiction’s QDMTT, except that any creditable QDMTT payable in the jurisdiction for the Fiscal Year shall be added to the taxes in the numerator of the ETR computation.

Where a Constituent Entity is subject to a Blended CFC Tax Regime on the income of non-GloBE Entities (i.e. Entities that are not Constituent Entities, Joint Ventures or JV Subsidiaries) in which it has a direct or indirect Ownership Interest, tax imposed under the Blended CFC Tax Regime must be allocated to the non-GloBE Entities to avoid it being included in the adjusted covered tax of in-scope entities.

Each non-GloBE Entity must compute a Blended CFC Allocation Key using the GloBE Jurisdictional ETR for the blending group in the same jurisdiction that has the largest aggregate amount of Attributable Income of Entity and shall include its Blended CFC Allocation Key in the Sum of All Blended CFC Allocation Keys.

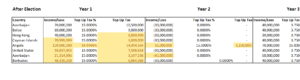

An in-scope MNE group has a parent company located in jurisdiction A that wholly owns three subsidiaries operating in three different jurisdictions.

Parentco is taxed on the income of Sub1, Sub2 and Sub3 under a blended CFC regime. The CFC tax rate is 10% (this is the foreign effective tax rate that will generate sufficient foreign tax credits to prevent the imposition of a CFC charge under the Blended CFC Tax Regime).

Subco1 in jurisdiction X has taxable income of 1 million euros. The GloBE ETR is 8%.

Subco2 in jurisdiction Y has taxable income of 5 million euros.The GloBE ETR is 15%.

Subco3 in jurisdiction Z has taxable income of 10 million euros. The GloBE ETR is 5%.

The CFC Tax of 1.5 million euros.

Step 1 – Calculate the Blended CFC Allocation Key

SubCo1: (10%-8%)* 1 million = 20,000 euros

SubCo2: (10%-15%)* 5 million = No Allocation

SubCo3: (10%-5%)* 10 million = 500,000 euros

Step 2 – Allocate Blended CFC Tax

SubCo1: 20,000/520,000 * 1.5 million = 57,692 euros

SubCo2: No Allocation

SubCo3: 500,000/520,000 * 1.5 million = 1,442,308 euros

As noted above, SubCo 3 has the lowest GloBE ETR and the highest taxable income and as such is allocated most of the CFC tax. This would therefore push its GloBE ETR up, reducing any potential top-up tax.

Where tax under the Blended CFC Tax regime arises to entities that aren’t constituent entities under the GloBE Rules, they are still included in the allocation formula but is ignored for calculating covered taxes for GloBE purposes.

If the non-Constituent Entity is located in a jurisdiction in which the MNE Group does not compute a GloBE ETR, the GloBE Jurisdictional ETR for the CFC allocation formula is based on the total income and taxes in the financial accounts for all non-Constituent Entities in the jurisdiction.

Assume in the example above, there were 2 subsidiaries in jurisdiction X, Subco1NonCE (250K) and Subsco1CE (income 750K). Subco1NonCE is not a constituent entity for the GloBE Rules. This would change the calculation to:

Step 1 – Calculate the Blended CFC Allocation Key

Subco1NonCE: (10%-8%)* 250,000 = 50,000 euros

Subsco1CE: (10%-8%)* 750,000 = 15,000 euros

SubCo2: (10%-15%)* 5 million = No Allocation

SubCo3: (10%-5%)* 10 million = 500,000 euros

Step 2 – Allocate Blended CFC Tax

Subco1NonCE: 20,000/520,000 * 1.5 million = No Allocation as not a constituent entity

Subsco1CE: 15,000/520,000 * 1.5 million = 43,269 euros

SubCo2: No Allocation

SubCo3: 500,000/520,000 * 1.5 million = 1,442,308 euros

Total 1,485,577

This leaves 14,423 euros of the blended CFC tax that was attributable to Subco1NonCE unallocated.