Japan Issues Guidance on its UTPR and QDMTT Application

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

Additional top-up tax is added to the initial top-up tax under Article 5.2.3 of the OECD Model Rules.

Additional top-up tax can occur in two main ways.

A prior-year adjustment can arise under Article 5.4.1 of the OECD Model Rules where:

• A constituent entity makes an election to carry back a capital gain on local tangible assets

• A deferred tax liability is not released within five fiscal years

• There is a prior year increase in covered taxes (for example, as a result of a review of prior year tax returns)

• A current tax expense that is claimed as adjusted covered tax is not paid within four years

• An election is made for deemed distribution tax.

In these cases, the ETR and top-up tax calculation for the previous year needs to be recalculated. Any additional top-up tax is then levied in the year of the recalculation.

If there is no net Pillar Two GloBE income for the jurisdiction for the recalculation year, the net Pillar Two GloBE income is increased by:

Additional top-up tax/15%

The other occasion that additional top-up tax could arise is under Article 4.1.5 of the OECD Model Rules, where a domestic tax loss is greater than the Pillar Two GloBE loss. The Pillar Two GloBE loss derives from the financial accounts of the constituent entity (with GloBE adjustments), and therefore a difference in the tax treatment locally could give rise to a different domestic tax loss.

This could occur for instance if for domestic tax purposes certain income is exempt, but is not for calculating Pillar Two GloBE income or if there was an enhanced tax deduction for expenses.

In this case, there would be a deferred tax asset created which would reduce adjusted covered taxes for Pillar Two GloBE purposes in the year of creation, whilst increasing adjusted covered taxes when it is released. For more information on deferred tax, see Deferred Tax.

Therefore in the year of creation there would be a negative tax expense (ie the creation of the deferred tax asset would be to Dr the balance sheet for the deferred tax asset and Cr the P&L for the deferred tax expense which is effectively negative income).

The Pillar Two GloBE rules retain the deferred tax asset treatment but provide that any amount of the deferred tax asset created that exceeds 15% of net Pillar Two GloBE income is treated as additional top-up tax.

Note that this only applies where the domestic tax loss exceeds the Pillar Two loss and this results from a permanent difference. If it arose from a timing difference, the deferred tax provision would take account of this.

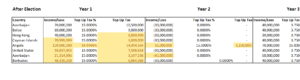

Company A has a domestic tax loss of 1,000,000 euros and a Pillar Two GloBE loss of 750,000 euros due to income not being taxed for domestic tax purposes. The loss is available for carry-forward for tax purposes.

The domestic tax rate is 15%.

The deferred tax asset for domestic tax purposes is 150,000 euros. This exceeds 15% of the net Pillar Two GloBE loss (112,500 euros). Therefore, additional top-up tax of 37,500 euros is calculated. This does not change the general deferred tax approach.

So adjusted covered taxes in year 1 would still be a negative 150,000 euros. If the loss is fully offset in year 2, the deferred tax asset would unwind and adjusted covered taxes would be increased by 150,000 euros.

Note, that this adjustment is calculated on a jurisdictional basis, however, the top-up tax is allocated to the constituent entity that generated the difference.

As an alternative to incurring additional top-up tax when a domestic tax loss exceeds the GloBE loss, Article 2.7 of the OECD Administrative Guidance provides that an MNE can elect for the Excess Negative Tax Expense administrative procedure.

Where this applies the Excess Negative Tax Expense is removed from Adjusted Covered Taxes for the Fiscal Year and an Excess Negative Tax Expense Carry-forward is established equivalent to the additional top-up tax that would be due

Then in future years when the MNE Group has positive GloBE Income for the jurisdiction the MNE Group reduces (but not below zero) the aggregate Adjusted Covered Taxes by the remaining balance of the Excess Negative Tax Expense Carry-forward.

As such in the example above the Excess Negative Tax Expense Carry-forward would be 37,500 euros as this is the difference between the adjusted covered tax (-150,000) and the expected covered tax (-112,500).

If, in the following year it had taxable/GloBE income of 1 million euros the full tax loss offsets the income for domestic tax purposes. For GloBE purposes, the deferred tax asset of 150,000 euros that was recorded in Year 1 will be released to the P&L due to usage of the loss carry-forward. This would usually increase covered taxes by 150,000 euros (ie Dr P&L, Cr Balance sheet deferred tax).

However, if the Excess Negative Tax Expense administrative procedure was elected in Year 1, the Adjusted Covered Taxes for jurisdiction X are reduced by the Excess Negative Tax Expense carry-forward of 112,500 in Year 2. As a result, Adjusted Covered Taxes for Year 2 are 37,500 euros.

The Excess Negative Tax Expense administrative procedure also applies in one other circumstance – where there is a negative GloBE ETR. The key difference is that in this case it is mandatory, as opposed to being at the option of the MNE.

In this case, as above, the Negative Tax Expense is excluded from Adjusted Covered Taxes in the year and an Excess Negative Tax Expense Carry-forward is created. The Excess Negative Tax Expense Carry-forward is then offset as above in all subsequent jurisdictional ETR calculations.

The difference from the above is that there is not a GloBE loss, there is positive GloBE income but adjusted covered taxes are negative (eg due to the creation of a large deferred tax asset resulting from beneficial domestic tax treatment). The GloBE ETR would therefore be negative.

An in-scope MNE group has GloBE income of 2 million euros in Country Y. For domestic tax purposes, there is a loss of 1 million euros. A deferred tax asset at 15% of the loss is created (Dr Balance sheet, Cr P&L tax expense) and adjusted covered taxes are -150,000 euros, which results in a negative GloBE ETR.

The MNE Group must apply the Excess Negative Tax Expense administrative procedure. Therefore the negative tax expense is excluded and the GloBE ETR is 0%. Top-up tax is 300,000 euros. An Excess Negative Tax Expense Carry-forward of 150,000 euros is created.

In Year 2, the MNE Group earns GloBE Income/taxable income of 1 million euros. The brought forward tax loss offsets its taxable income resulting in no tax payable.

When the brought forward loss is used this would release the deferred tax asset and 150,000 euros would usually increase the deferred tax/adjusted covered tax charge.

However, because the Negative Tax Expense administrative procedure was used, the Excess Negative Tax Expense Carry-forward is applied in Year 2 and Adjusted Covered Taxes for Year 2 are 0. Therefore, the ETR Country Y is 0% and Top-up Tax is 150,000 euros.

Additional tax is added to the initial top-up tax calculated by applying the low-tax percentage to the GloBE income. It is the penultimate step in the top-up tax calculation, with any qualified domestic minimum top-up tax being deducted after this.

Additional tax can arise in two situations. Firstly where there is a requirement to calculate the effective tax rate of a previous year, and secondly where a domestic tax loss is greater than a GloBE Loss (under Article 4.1.5 of the OECD Model Rules).

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

On December 31, 2025, Israel enacted Law No. Law 5776-2025 on the Minimum Corporate Tax for Multinational Groups. The enacted law contains some significant changes from the previous draft law.

On December 29, 2025, Uruguay’s President issued Decree No. 325/025, to provide for exemptions from the QDMTT for entities covered by a tax stability agreement. Note that Law N° 20446 to enact the QDMTT was published in the Official Gazette on January 8, 2026.

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Simplified ETR Safe Harbour from December 31, 2026 (December 31, 2025 in certain cases). We provide an excel overview and a sample calculator for the key elements of the Safe Harbour calculation.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Substance-based Tax Incentive Safe Harbour. This online tool shows how the new safe harbour operates.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |