For a detailed analysis of the deferred tax liability recapture rules, see Pillar Two: Deferred Tax Liability Recapture Rule.

On the creation of the deferred tax liability the accounting entry would have been:

Dr Deferred Tax – P&L

Cr Deferred Tax – Balance Sheet

This would therefore increase the tax charge in the year of creation, lowering any potential top-up tax liability.

As the deferred tax liability unwinds, the accounting entry would be:

Dr Deferred Tax – Balance Sheet

Cr Deferred Tax – P&L

This would reduce any tax charge in the P&L.

If deferred tax is recaptured under Article 4.4.4 of the OECD Model Rules, the P&L credit is effectively transferred to the year the deferred tax liability was created, reducing the tax charge and potentially increasing top-up tax payable for that year.

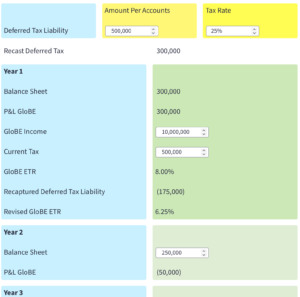

The interactive tool below is designed to illustrate how the deferred tax recapture rule operates. It is based on the OECD Model Rules and the published Commentary

Add in details of the deferred tax liability at creation and the tax rate used. The tool recasts the deferred tax liability if this is above the 15% global minimum rate.

Then add the amount utilised in years 2-5. The tool calculates any recaptured deferred tax and recalculates the Pillar Two GloBE ETR for year 1.

For more detailed Pillar Two modelling tools, including multiple years, more companies and the impact of elections, see our Pillar Two Tax Engine.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |