Qatar Issues Cabinet Resolution for Detailed IIR and QDMTT Implementation Rules

On February 12, 2026, Cabinet Resolution No. (2) of 2026, was published in the Official Gazette to provide for the detailed implementation of the IIR and QDMTT in Qatar.

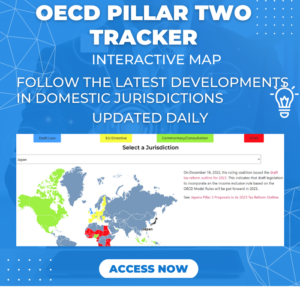

Latest articles on global Pillar 2 developments.

On February 12, 2026, Cabinet Resolution No. (2) of 2026, was published in the Official Gazette to provide for the detailed implementation of the IIR and QDMTT in Qatar.

On February 6, 2026, the Italian Revenue Agency approved the model for the GloBE tax Return. This is a consolidated form with information on the calculation of top-up tax under the IIR, UTPR and QDMTT.

On January 29, 2026, Canada’s Department of Finance released draft GMTA technical amendments introducing an elective private investment entity de-consolidation rule for Pillar Two/GMTA purposes.

On January 30, 2026, Japan’s National Tax Agency issued a law implementation circular clarifying certain aspects of its UTPR and QDMTT.

In January 2026, Canada issued the filing procedures for the GIR, GMT Return and the Double Filing Relief Notification.

On January 19, 2026, South Korea issued a Draft Law to amend the Enforcement Decree to the International Tax Adjustment Act. This provides for detailed provisions for the application of the QDMTT and will also extend the Transitional CbCR Safe Harbour by 1 year (as provided in the January 2026 OECD Side-by-Side Package).

On January 19, 2026, the Hong Kong Inland Revenue Department opened its E-filing portal for the submission of Top-Up Tax Notifications

On December 31, 2025, Israel enacted Law No. Law 5776-2025 on the Minimum Corporate Tax for Multinational Groups. The enacted law contains some significant changes from the previous draft law.

On December 29, 2025, Uruguay’s President issued Decree No. 325/025, to provide for exemptions from the QDMTT for entities covered by a tax stability agreement. Note that Law N° 20446 to enact the QDMTT was published in the Official Gazette on January 8, 2026.

On December 23, 2025, Korea enacted Law number 21215 to implement the 2026 Tax Reform. This includes a QDMTT from January 1, 2026.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Simplified ETR Safe Harbour from December 31, 2026 (December 31, 2025 in certain cases). We provide an excel overview for the key elements of the Safe Harbour calculation.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This includes a new Substance-based Tax Incentive Safe Harbour. This online tool shows how the new safe harbour operates.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package. This article looks at a number of the new elections that arise from this.

On January 5, 2026, the OECD Released Guidance on amendments to the Pillar 2 rules for the Side-by-Side Tax Package.

On December 23, 2025, Germany enacted a law to amend the Minimum Tax Act. This follows the two previous discussion drafts and now includes the January 2025 OECD Administrative Guidance and DAC9 amendments.

On December 23, 2025, Austria published the Tax Amendment Act 2025 in its Official Gazette. This includes amendments to aspects of the December 2023, June 2024 and January 2025 OECD Administrative Guidance, as well as DAC 9 implementation.

Part III of the Dutch Year-End Decree 2025 (published in the Official Gazette on December 23, 2025) amends the Minimum Tax Executive Decree 2024 for aspects of the December 2023, June 2024, and January 2025 OECD Administrative Guidance.

On December 30, 2025, IRAS issued further details on the Pillar 2 registration process. The registration portal is to be open from May 2026, however, a draft registration form and explanatory notes have been issued.

On December 26, 2025, Turkey published the Communique on the Minimum Tax Law. Whilst Turkey has enacted its Minimum Tax Law, a lot of the detailed application of the GloBE rules was left to a further Regulation. This Communique therefore provides for the detailed rules for the implementation of the GloBE rules in Turkey.

On December 19, 2025, the Danish Official Gazette published an Executive Order providing for GIR information reporting requirements and on December 17, 2025, the Danish Official Gazette published Law No. 1643 to amend the Minimum Tax Act.

On December 23, 2025, Liechtenstein’s Official Gazette included amendments to the Pillar 2 law and regulation to implement domestically the OECD provisions for the exchange of information in the GloBE Information Return (GIR) under the multilateral agreement between competent authorities on the exchange of GloBE information (GIR MCAA).

On December 18, 2025, the Irish Revenue issued Revenue eBrief No. 244/25 which provides for an extension in the Pillar 2 registration deadline to February 28, 2026 (from December 31, 2025).

On December 19, 2025, the Luxembourg Official Gazette published:

– a law to amend its Minimum Tax Law to provide for the January 2025 OECD Administrative Guidance and the EU DAC 9 GIR filing requirements: and

– a Grand Ducal Regulation which includes the format of the GIR

On December 19, 2025, SARS issued further guidance on the Pillar 2 registration process.

Order No. 158/2025 XXV issued on December 12, 2025 provides that for constituent entities whose fiscal year ended between December 31, 2024 and March 31, 2025 the filing deadline for Form 62 (the Pillar 2 Registration Form) is the last day of the 15th month following the end of that fiscal year.

On December 16, 2025, The Netherlands Parliament approved the Second Amendment to the Minimum Tax Act to implement the December 2023, June 2024 and January 2025 OECD Administrative Guidance.

On December 10, 2025, Law No. SFS 2025:1461 to amend the Global Minimum Tax Act was published in the Swedish Official Gazette. The purpose of the law is to implement the provisions of the June 2024 OECD Administrative Guidance into domestic law.

On November 25, 2025, the Finnish Tax Administration published guidance on the allocation of profits/losses and taxes between group entities to take account of the June 2024 OECD Administrative Guidance.

On November 26, 2025, Montenegro issued a Draft Law to apply a domestic minimum top-up tax (DMTT) from January 1, 2026.

On December 1, 2025, Turkey announced an extension in the filing and payment date for the QDMTT return and the opening of a test environment for the submission of the QDMTT return.

On November 26, 2025, the Swiss Federal Council issued an amendment to the Minimum Tax Ordinance to provide for the OECD GIR provisions, as well as some other small amendments.

On November 19, 2025, Hungary enacted Pillar 2 amendments from the 2025 Autumn Tax Package. This includes some amendments to the operation of the Transitional CbCR Safe Harbour.

On November 18, 2025, Slovakia issued its QDMTT Return

On November 14, 2025, Hungary issued a Draft Regulation (for consultation) to provide for the detailed application of the Pillar 2 Safe Harbours.

Italy has issued 2 regulations relating to the Administration of the Pillar 2 top-up tax. A November 7, 2025 Decree provides for more information on the rules for the submission of the GloBE tax return. Resolution no. 63 of November 10, 2025 provides for the tax codes to be used for the payment of top-up tax on the F24 payment form.

On November 3, 2025, Finland issued a draft law for consultation to amend its Minimum Tax Act for the June 2024 and January 2025 OECD Administrative Guidance.

A Communique of October 29, 2025 issued by the MRA provides further information on QDMTT Notifications.

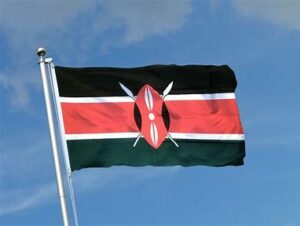

On November 3, 2025, Kenya issued the Draft Income Tax (Minimum Top Up Tax) Regulations, 2025 to provide for the detailed application of the Pillar 2 domestic minimum tax.

On October 16, 2025, Ireland published its 2025 Finance Bill. This includes amendments for the January 2025 OECD Administrative Guidance, DAC 9 implementation as well as other technical amendments.

On October 28, 2025, Government Notice No. 6763 was issued which extended some of the Pillar 2 filing and notification deadlines.

On October 29, 2025, Order HAC/1198/2025, of October 21 was published in the Official Gazette. This approves the final versions of three specific Pillar 2 forms – Form 240 (registration), Form 241 (the GIR) and Form 242 (the top-up tax return).

On October 21, 2025, Slovakia’s Parliament approved a law to amend its minimum tax act to provide for the June 2024 and January 2025 OECD Administrative Guidance, as well as EU Directive DAC 9 amendments.

On October 21, 2025, Vietnam released Decision 3563/QD-BTC 2025 on the Administrative Procedures for the Minimum Tax. This includes the final forms to be submitted for notification, registration and returns.

Guernsey has issued the Guernsey Pillar 2 Brief: Issue 1 which includes further detail on the registration process (the actual registration system is planned to be operational during the fourth quarter of 2025).

On October 14, 2025, France released the 2026 Finance Bill. This includes amendments to include the June 2024 OECD Administrative Guidance, as well as DAC 9 implementation.

On October 15, 2025, Hungary issued the draft Advance QDMTT Tax Declaration (Form 24GLBADO) as well as filing instructions and a draft XML guide.

On October 10, 2025, Belgium issued a Draft Law to amend its Minimum Tax Act. There are a number of technical amendments (which don’t effect the Minimum Tax calculation), the correction of an error in the original text as well as administrative amendments.

On October 3, 2025 Normative Instruction RFB No. 2282, of October 2, 2025 was published in the Official Gazette. This includes amendments to Brazil’s DMT Law for the OECD June 2024 OECD Administrative Guidance and other sundry amendments.

On October 5, 2025, Israel published a consultation on a draft law for a domestic minimum tax (intended to be a Qualified Domestic Minimum Top-Up Tax or ‘QDMTT’) from January 1, 2026.

On September 18, 2025, Croatia opened a consultation on a Draft Bill to amend its Minimum Tax Act. The amendments are primarily to amend the QDMTT accounting standard so that the Croatian QDMTT qualifies for the QDMTT Safe Harbour and to provide for the notification deadline for appointing a designated filing entity.

On September 26, 2025, Hong Kong updated its Pillar 2 guidance to include information on its Pillar 2 Portal, applications for Group Codes and mandatory e-filing of profit tax returns for Pillar 2 groups.

On September 29, 2025, the Federal Ministry of Finance opened a consultation on a Draft Regulation for the implementation of the Minimum Tax Act. This provides for compliance rules for the exchange of the GIR and simplified reporting.

Japan has launched its Multinational Enterprise Information Reporting Portal for filing Pillar 2 returns.

On 6 September 2025, Nigeria’s Tax Act 2025 was published in the Official Gazette. This includes a DMTT (without any of the detailed GloBE adjustments yet applying).

On September 11, 2025, the Polish Ministry of Finance issued the draft Pillar 2 notifications and top-up tax returns for consultation.

On August 29, 2025, Vietnam issued its Decree for the detailed implementation of the Pillar 2 rules from January 1, 2024.

On September 2, 2025, Act No. 316/2025 Coll was published in the Official Gazette to amend the Minimum Tax Act for various aspects of the OECD Administrative Guidance as well as filing dates, QDMTT amendments and amending the Safe Harbour rules.

On August 31, 2025, the Ministry of Economy and Finance sent the Draft Budget Law for the period 2025–2029 to Parliament. This includes a domestic minimum tax (intended to be a QDMTT).

On August 29, 2025, Ordinance No. 21 of August 28, 2025 was published in the Official Gazette. This amends various aspects of the Minimum Tax Act, including for the filing deadline for the designated filing entity nomination, transferable tax credits and the excess negative tax carry forward election.

On August 26, 2025, Australia issued a list of jurisdictions that have qualified status for the purposes of the income inclusion rule and domestic minimum tax (including the QDMTT Safe Harbour).

On August 27, 2025, the Australian Taxation Office issued a draft legislative instrument (the ‘Taxation Administration (Exemptions from Requirement to Lodge Australian IIR/UTPR tax return and Australian DMT tax return) Determination 2025’). This outlines situations when entities within the scope of the Pillar 2 GloBE rules do not need to file an Australian DMT Return or an IIR/UTPR Return.

The Finance Act 2025, enacted on August 8, 2025, introduces a new Sub-Part AF to the Income Tax Act to include a domestic minimum top-up tax (intended to be a QDMTT) from July 1, 2025.

On January 15, 2025, the OECD issued Administrative Guidance that includes a list of jurisdictions that have transitional qualified status for the purposes of the income inclusion rule and domestic minimum tax (including the QDMTT Safe Harbour). This was subsequently updated on March 31, 2025 and August 18, 2025.

On August 13, 2025, Canada issued draft legislative proposals to amend its Global Minimum Tax Act to provide for aspects of the June 2024 and January 2025 OECD Administrative Guidance.

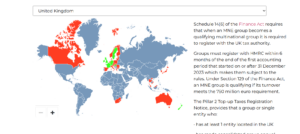

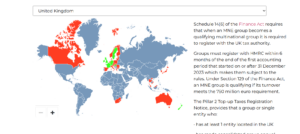

Many jurisdictions will require GloBE registration for administrative purposes, however, the law issued to date has been inconsistent. We outline the GloBE registration obligations from the domestic legislation (enacted and draft) issued to date, with citations and links to relevant laws.

South Koreas 2025 Tax Reform Proposal (announced on July 31, 2025), provides that a QDMTT will be applied from January 1, 2026.

On July 16, 2025, Kuwait updated its electronic registration portal to include Pillar 2 registration for in-scope groups.

The Pillar Two effective tax rate (ETR) calculation for investment entities is similar to the standard ETR calculation, however, there is an important twist in that the top-up tax is adjusted for minority interests. There is no adjustment for minority interests under the standard ETR calculation. In this article we look at the impact of this.

Foreign tax credits interact with the Pillar Two GloBE Rules in a number of ways. In this article we assess the key impact.

In most cases, a Qualifying Refundable Tax Credit will result in a higher Pillar Two effective tax rate than a non-qualifying tax credit. However, this is not always the case. We look at some examples in this article.

On July 9, 2025, ANAF Order 1.729/2025 was issued to nominate a single designated entity for QDMTT filing and payment purposes, if there are several constituent entities in Romania that are part of the same group.

On June 30, 2025, Japan issued its updated GloBE Information Return (GIR) to reflect the OECD GIR changes in January 2025.

The Executive Regulations were issued on June 29, 2025, in Ministerial Resolution No. 55 of 2025. The Regulations provide for the detailed rules for the application of the domestic minimum top-up tax from January 1, 2025.

Section 26 of the amendment law in the 2025 Spring Tax Package (approved on June 19, 2025), amends the registration deadline to the last day of the second month following the last day of the tax year.

On June 19, 2025, the updated version of the Global Minimum Tax (Pillar Two) Order 2024 was published.

On June 20, 2025, a draft Order was issued to nominate a single designated entity for QDMTT filing and payment purposes, if there are several constituent entities in Romania that are part of the same group.

On June 16, 2025, the Norwegian Ministry of Finance opened a consultation on a Draft Bill to amend the Norwegian Minimum Tax Act for the June 2024 and January 2025 OECD Administrative Guidance.

On June 5, 2025, Iceland issued a Draft Minimum Tax Bill for consultation. The Draft Bill includes an Income Inclusion Rule (IIR) and a domestic minimum tax from January 1, 2026.

On June 6, 2025, the Inland Revenue (Amendment) (Minimum Tax for Multinational Enterprise Groups) Ordinance 2025 was published in the Official Gazette. The Bill includes an Income Inclusion Rule (IIR) and a domestic minimum tax from January 1, 2025.

On June 3, 2025, the Danish Parliament passed Bill 2024/1 LSV 194 A to amend the Danish Minimum Tax Act for the June 2024 and January 2025 OECD Administrative Guidance.

The GloBE rules include a number of insurance specific adjustments. In this article we look at the nature of these provisions as well as the impact of the GloBE rules on insurance companies generally. Updated for OECD Administrative Guidance.

Whilst the treatment of investment property for financial accounting purposes is important when determining the GloBE treatment, of even more importance are any differences between the financial accounting treatment and the domestic tax treatment.

Top-up taxes under a QDMTT are added to covered taxes of a CFC but only for the purposes of calculating the allocation of Blended CFC Taxes. The way the rules operate is aimed at minimising unrelievable CFC taxes under Blended CFC Regimes. Read more.

The clarifications and additions to the Commentary to the Pillar Two GloBE Rules provided by the OECDs Administrative and Safe Harbours Guidance, means that there are now up to four jurisdictional effective tax rates (ETRs) that may need to be calculated to determine the impact of the GloBE Rules.

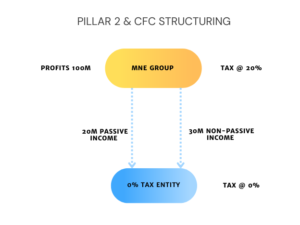

The definition of CFC taxes that are restricted in the GloBE rules is much narrower than under many domestic CFC regimes. In this article we look at this issue.

MNE groups should pay careful attention to any group financing companies in light of the Pillar Two Rules. In this analysis we look at the impact of Pillar Two for both general GloBE and QDMTT purposes.

Law 3/2025, of 29 April, was published in the Spanish Official State Gazette on April 30, 2025. This amends the Economic Agreement with the Basque Country and includes a new Article 20bis for the application of the Pillar 2 Global Minimum Tax.

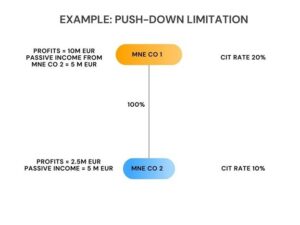

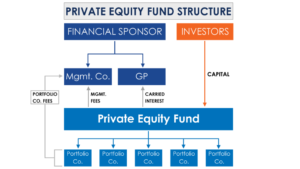

In this article we look at some of the most significant issues to consider including the determination of when and how deals can bring groups within the scope of Pillar Two, specific considerations for private equity funds, differences in GloBE and domestic tax treatment and potential restrictions on post-acquisition transfers.

The Pillar Two GloBE treatment of corporate investments will depend to a large extent on the nature of the activities, the accounting treatment and the ownership interest.

On March 31, 2025, Japan enacted Cabinet Order No. 121 of 2025 and Ministry of Finance Ordinance No. 19 of 2025 to provide further details on the application of Japan’s QDMTT from April 1, 2026.

In April 2025, the Hong Kong Government proposed a number of Committee Stage Amendments to the Inland Revenue (Amendment) (Minimum Tax for Multinational Enterprise Groups) Bill 2024. This includes amendments for the January 2025 and June 2024 OECD Administrative Guidance.

South Korea’s amendment to the Enforcement Decree No. 35348 of February 28, 2025 and the Decree of the Ministry of Economy and Finance No. 1114 of March 21, 2025 provide for further aspects of the June 2024 OECD Administrative Guidance as well as additional top-up tax forms.

Updates to our ‘OECD Administrative Guidance: Domestic Implementation Matrix’ to reflect the latest April 2025 Pillar 2 updates for the UAE and Poland.

On April 7, 2025, the Polish Ministry of Finance released details for a draft bill to amend the Minimum Tax Act. The amendments are primarily to implement the June 2024 and January 2025 OECD Administrative Guidance.

On April 16, 2025, the Ministry of Finance issued Ministerial Decision No. (88) of 2025 to provide for the application of the OECD Administrative Guidance from January 1, 2025.

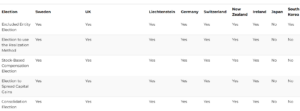

The UTPR exclusion for MNEs in their initial phase of international activity does not need to be included in a QDMTT, however, it can be included. In this article we look at the different jurisdictional approaches.

On January 15, 2025, the OECD issued Administrative Guidance that includes a list of jurisdictions that have transitional qualified status for the purposes of the income inclusion rule and domestic minimum tax (including the QDMTT Safe Harbour). This was subsequently updated on March 31, 2025.

On April 10, 2025, the Belgium Ministry of Finance issued the QDMTT Return. This is still considered as draft until published in the Official Gazette but is unlikely to now change as this follows a consultation of a previous draft of the QDMTT Return that lasted until November 8, 2024.

Om March 31, 2025, the Law to Partially Amend the Income Tax Act was published in the Official Gazette. This implements the UTPR and QDMTT from April 1, 2026.

On April 3, 2025, the Federal Ministry of Finance issued a letter on the application of Country-by-Country (CbC) reporting for transparent partnerships, including the impact on the Transitional CbCR Safe Harbour for Pillar 2 purposes.

On March 10, 2025 and March 12, 2025, Finland issued explanatory guidance on the application of the Minimum Tax Act, including provisions from the OECD June 2024 Administrative Guidance relating to the DTL recapture.

On April 2, 2025, Spain issued Regulations for the application of the Global Minimum Tax Law. This includes a number of aspects of the OECD Administrative Guidance.

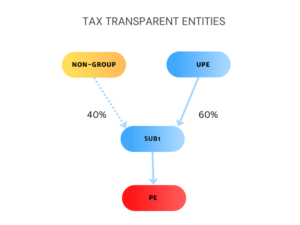

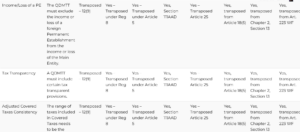

Permanent Establishments (PEs) are subject to a number of specific rules under Pillar Two in order to apply the general provisions to them. Key issues are what is a PE under Pillar Two? where is it located? and how are income and taxes allocated to it?

On March 21, 2025, the UK approved a list of jurisdictions that have qualified status for the purposes of the income inclusion rule and domestic minimum tax (including the QDMTT Safe Harbour).

On March 27, 2025, Law No. 22 of 2024 was published in Qatar’s Official Gazette. This implements the Pillar Two Income Inclusion Rule and a Domestic Minimum Top- Up Tax from January 1, 2025.

On March 27, 2025, Bulgaria’s 2025 State Budget Law (the ‘2025 Budget Law’) was published in the Official Gazette. This includes a number of changes to the Corporate Income Tax Law to amend the Global Minimum Tax provisions from January 1, 2024.

Insurance Investment Entities are subject to special treatment under the Pillar Two GloBE Rules. Read our analysis of the key provisions.

On March 6, 2025 a Decree of the Italian Ministry of Finance on Notification Requirements for Global Minimum Tax purposes was published in the Official Gazette. This provides more details on the double filing relief notification under Article 51(4) of Legislative Decree December 27, 2023, no. 209 (the Global Minimum Tax Law).

The Pillar Two Rules include specific provisions for tax transparent entities to avoid artificially low effective tax rates and significant top-up tax, particularly for tax transparent UPEs.

Centralized HR/payroll companies are frequently used by MNE groups but raise specific issues in relation to the Pillar Two GloBE Rules. In particular, the impact of using a centralized function and the nature of recharges could have an impact on the substance-based income exclusion of group entities.

Jurisdictions that apply a territorial basis do not tax foreign source income. This raises some interesting issues in the application of the Pillar 2 rules.

On February 20, 2025, Gibraltar issued the Income Tax (Allowances, Deductions, and Exemptions) (Amendment) Rules 2025 to allow in-scope MNEs to just be taxed under the Global Minimum Tax Act, and not the Income Tax Act.

In this article we look at the interaction between deferred tax on bonus depreciation and the substance-based income exclusion on investments in tangible assets.

On February 15, 2025, Law 2025-127 of February 15, 2025 (the 2025 Finance Act) was published in the French Official Gazette. This includes a number of amendments to the Pillar 2 regime from December 31, 2024.

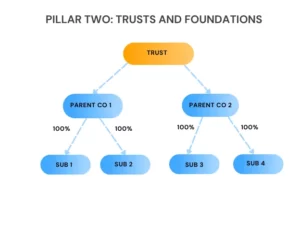

The Pillar Two rules don’t just apply to companies. They apply to ‘entities’. This means that the Pillar Two GloBE rules can apply to both trusts and foundations.

Pension funds are subject to a number of specific provisions under the Pillar Two rules. In this article we look at some of the key aspects of Pillar Two that impact on Pension Funds.

On February 12, 2025, Poland issued a list of jurisdictions that have qualified status for the purposes of the income inclusion rule and domestic minimum tax (including the QDMTT Safe Harbour).

In January 2025, the OECD provided some much-needed guidance on the operation of the Pillar 2 GloBE rules. This Orbitax article provides an analysis of the impact of the guidance on Pillar 2 compliance.

In this article we look at the implementation of the Pillar 2 Domestic Minimum Tax in the United Arab Emirates, based on Cabinet Decision 142 of 2024 issued on February 8, 2025

In this article we look at the implementation of the Pillar 2 Global Minimum Tax in Germany, including the implementation of the OECD Administrative Guidance.

On February 7, 2025, Order no. 193 of 2025 was published in the Official Gazette. This provides amendments to the income tax return (form 100) to report amounts due under the IIR/UTPR or DMTT.

On February 3, 2025, the Danish Ministry of Finance issued draft legislation (Bill 2024-4606) for consultation. This is to amend the Danish Minimum Tax Act for the June 2024 and January 2025 OECD Administrative Guidance.

On 10 October 2024, the French Government presented the draft Finance Bill for 2025 to Parliament. This includes amendments to its General Tax Code to reflect the OECD Administrative Guidance, including the December 2023 OECD amendments to the Safe Harbours.

On January 9, 2025, Liechtenstein released its GloBE Registration form (submitted via email within 6 months of the end of the fiscal year).

The Fourth Set of OECD Administrative Guidance (issued on June 17, 2024) includes guidance on the treatment of Securitization Entities.

On May 24, 2024, the Corporation Top-up Tax Act, 2024 was published in the Official Gazette. This implements a domestic minimum top-up tax intended to be a QDMTT for Pillar 2 purposes.

On November 29, 2024, the Domestic Minimum Top-Up Tax Act, 2024 was published in the Official Gazette of The Bahamas. This implements a domestic minimum top-up tax intended to be a QDMTT for Pillar 2 purposes.

On December 19, 2024, Law 917/2024 was published in the Finnish Official Gazette to amend the Minimum Tax Act to reflect numerous aspects of the OECD Administrative Guidance. This applies to financial years beginning on or after January 1, 2024.

On December 18, 2024, Cyprus published the law to implement the EU Minimum Tax Directive its its Official Gazette. This implements the IIR from December 31, 2023 and a UTPR and domestic minimum tax from December 31, 2024.

On December 31, 2024 the Indonesian Ministry of Finance issued Minister of Finance Regulation Number 136 of 2024 (the ‘Regulation’) for the imposition of a global minimum, tax which will take effect from January 1, 2025.

On December 23, 2024, Australia issued the Taxation (Multinational—Global and Domestic Minimum Tax) Rules 2024 (the ‘Rules’) to provide for the detailed application of the Pillar 2 GloBE rules in Australia.

On January 15, 2025, the OECD issued Administrative Guidance that includes a list of jurisdictions that have transitional qualified status for the purposes of the income inclusion rule and domestic minimum tax (including the QDMTT Safe Harbour).

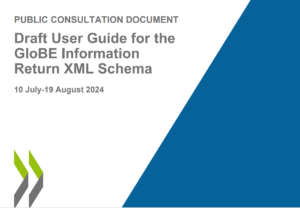

On January 15, 2025, the OECD issued an updated GloBE Information Return (GIR) and GIR XML Schema. In this article we look at the changes to the previous GIR.

On January 3, 2025 the Law on Global Minimum Corporate Income Tax was published in the Official Gazette to implement the EU Global Minimum Tax Directive.

On January 15, 2025, the OECD issued a list of jurisdictions that have transitional qualified status, further Administrative Guidance on the application of the Article 9.1 transitional rules, and an updated GloBE Information Return and GIR XML Schema, as well as the GIR MCAA.

On December 31, 2024, Law No. 20612, was published to amend the International Tax Adjustment Act for the 2025 Tax Reform provisions. This includes some amendments to the Global Minimum Tax provisions.

On December 31, 2024, Ministerial Decree of December 27, 2024 was published in the Official Gazette. This implements Article 4.1-4.3 of the February 2023 OECD Administrative Guidance and some aspects of the June 2024 OECD Administrative Guidance on deferred taxation.

The Ministerial Decree of December 27, 2024 published in the Official Gazette on December 31, 2024 provides for a number of miscellaneous, but important aspects of the OECD Administrative Guidance that were not included in the original Minimum Tax Law.

The Dutch Minimum Tax Executive Decree 2024 was published in the Government Gazette on December 23, 2024 to implement various aspects of the OECD Administrative Guidance.

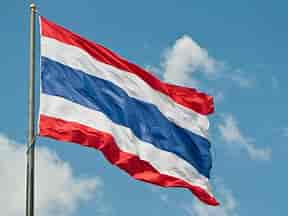

On December 26, 2024, The Emergency Decree on Top-Up Tax B.E. 2567, was published in the Government Gazette to implement the Pillar 2 GloBE rules from January 1, 2025.

On December 27, 2024, the Inland Revenue (Amendment) (Minimum Tax for Multinational Enterprise Groups) Bill 2024 was published in the Official Gazette. The Bill includes an Income Inclusion Rule (IIR) and a domestic minimum tax from January 1, 2025.

On December 31, 2024, Oman issued Royal Decree No. 70/2024 to implement the Pillar 2 Income Inclusion Rule and a Domestic Minimum Tax from January 1, 2025..

On December 20, 2024, Curacao’s Pillar 2 Global Minimum Tax Ordinance was approved by Parliament and it was subsequently published on December 27, 2024.

On December 30, 2024, Singapore published the Multinational Enterprise (Minimum Tax) Regulations 2024 which provide for the detailed rules for the application of the multinational top-up tax and domestic top-up tax.

On December 30, 2024, Brazil’s President enacted Law No. 15,079, of December 27, 2024 that repeats (with minor amendments) Provisional Measure No. 1,262, of October 3, 2024, to introduce a Domestic Minimum Tax (DMT) from January 1, 2025.

On December 30, 2024, Kuwait published Decree-Law 157 of 2024 for the introduction of a Domestic Minimum Top-Up Tax (DMTT) for in-scope MNE groups from January 1, 2025.

On December 21, 2024, Spain published Law 7/2024 in its Official Gazette to transpose the EU Minimum Tax Directive into domestic law.

On December 24, 2024, South Africa published the Global Minimum Tax Act in its Official Gazette. This applies an IIR and QDMTT from January 1, 2024.

On December 23, 2024, Australia issued the Taxation (Multinational—Global and Domestic Minimum Tax) Rules 2024 to provide for the detailed application of the Pillar 2 GloBE rules in Australia.

On December 19, 2024, Luxembourg’s Parliament approved a law to amend its Global Minimum Tax Law to implement aspects of the OECD Administrative Guidance.

The Isle of Man has issued a domestic top up tax cessation form for entities that are located in the Isle of Man that are intending to enter liquidation, dissolution or any other form of winding up, or otherwise cease to be located in the Isle of Man for DTUT purposes

On December 13, 2024, the Tax Laws (Amendment) Act, 2024 was published in the Official Gazette. It comes into force on December 27, 2024 and includes a domestic minimum top-up tax.

On December 17, 2024, the Dutch Parliament approved a draft law to amend the GMT Law. This includes a number of amendments to implement further aspects of the February 2023 and July 2023 OECD Administrative Guidance and some aspects of the December 2023 OECD Administrative Guidance.

On December 17, 2024, the Chamber of Deputies approved Bill 3817/24 that repeats Provisional Measure No. 1,262/2024 and implements the DMT. It will be sent to the Senate.

In December 2024, the Malaysian Inland Revenue Board (MIRB) issued guidance on the interpretation and administration of the Pillar Two global minimum tax applicable from January 1, 2025.

On 12 December 2024, the Cyprus House of Representatives voted to approve local legislation to implement Pillar 2. The Law will come into effect once it is published in the official Government Gazette.

On December 15, 2024, Bahrain issued Decision no. (172) of 2024 to provide for the Executive Regulations for the DMTT law. This provides the detailed rules for the operation of the DMTT.

On December 10, 2024, the Australian GloBE legislation received Royal Assent.

On December 10, 2024, Gibraltar issued the Global Minimum Tax Bill 2024 to transpose the OECD Model Rules (and accompanying guidance) into domestic law.

On December 5, 2024, Decree No. 2024-1126 was published in the French Official Gazette. This provides additional details on the reporting requirements for Pillar 2 purposes.

On December 6, 2024 Germany’s Ministry of Finance issued a Second Discussion Draft to implement aspects of the Fourth Set of OECD Administrative Guidance.

In December 2024, updated instructions were provided and the form is now available via the Tax Authority e-services website.

On December 9, 2024, the Kuwaiti Ministry of Finance issued a draft law that includes a 15% domestic minimum top-up tax (DMTT) as part of its overhaul of the Business Profits Tax Regime.

On November 26, 2024, the Guernsey issued the Income Tax (Approved International Agreements) (Implementation) (OECD Pillar Two GloBE Model Rules) Regulations, 2024 to transpose the OECD Model Rules into domestic Regulations.

On September 18, 2024, the Bulgarian Ministry of Finance published for public consultation draft legislation to amend the Bulgarian minimum taxation rules. This was submitted to Parliament on December 2, 2024.

. On November 12, 2024, the President enacted the Finance Act 2024. In the Act, a number of amendments are implemented to the Global Minimum Tax provisions.

On November 28, the Slovakian Parliament approved the draft GMT amendment law.

On November 15, the Hungarian Tax Authority issued draft forms for the registration notification under Article 44(1) of the Minimum Tax Act, and the appointment of a domestic filing entity under Article 3(47).

On November 27, 2024, the Multinational Enterprise (Minimum Tax) Act 2024 was published in the Singapore Official Gazette. This implements the Pillar 2 GloBE rules in Singapore for fiscal years beginning on or after January 1, 2025.

The Hungarian Autumn Tax Package has been passed by Parliament and was sent to the President for signature on November 27, 2024. This includes amendments to the GMT law, most notably registration and the QDMTT return/payment obligation.

On November 26, 2024, the bills to implement the Pillar 2 GMT in Australia has been passed by the Senate. They now await Royal Assent for enactment.

On November 22, 2024, the Annual Tax Act was passed by the Upper House of Parliament. This includes two technical changes relating to the Global Minimum Tax

On November 21, 2024, the Isle of Man Parliament passed the Global Minimum Tax (Pillar Two) Order 2024

On November 20, 2024, the Swiss Federal Council issued the amended Minimum Tax Ordinance to provide for the IIR from January 1, 2025.

On October 18, 2024, the Cypriot draft law to implement the EU Minimum Tax Directive was tabled in Parliament. The full version has recently been released.

On November 19, 2024, the Law implementing the Global Minimum Tax was published in the Polish Official Gazette. See our updated GloBE Country Guide.

On November 12, 2024, the Vietnamese Ministry of Finance issued a Draft Decree for the Implementation of the GloBE Rules. This is subject to a consultation until December 6, 2024 and it includes provisions for the detailed operation of the GloBE rules in Vietnam.

The September 17, 2024 draft law to amend the Minimum Tax Act was amended on October 3, 2024. Read our updated GloBE Guide.

On November 7, 2024, the UK issued Finance Bill 2024-2025 which includes a number of amendments to provide for the December 2023 and June 2024 OECD Administrative Guidance. Read our updated GloBE Guide.

On October 30, 2024 the Global Minimum Tax Bill and the Global Minimum Tax Administration Bill were sent to the National Assembly. Read our updated Country Guide.

On November 7, 2024, the Finance Bill 2024-2025 was introduced to Parliament. This includes provisions to enact the UTPR (and associated rules such as the Transitional UTPR Safe Harbour and Initial Phase of International Activity Exemption), and other Pillar 2 amendments.

On October 31, 2024 additional amendments were made to the 2024 draft amendment law to incorporate aspects of the OECD June 2024 Administrative Guidance.

On October 29, 2024, Hungary issued its Autumn Tax Package proposal. This included minor changes to the Pillar Two law. Most notably it expanded on the registration requirements.

We keep track of the domestic implementation of the Subject-to-Tax Rule (STTR) internationally including links to relevant effected double tax treaties.

On October 30, 2024, the Hong Kong government released the outcome statement following the previous consultation into the introduction of the GloBE rules.

The UK 2024 Budget on October 30, 2024 confirmed a number of proposed amendments to the application of the Pillar Two GloBE rules including a provision for a foreign QDMTT to qualify for the QDMTT Safe Harbour if it is reasonable to conclude that it is likely to fall within the OECD guidance. Read our updated UK GloBE Guide for more information.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in the Isle of Man for accounting periods beginning on or after January 1, 2025. Updated for the draft legislation issued by the Income Tax Division on October 24, 2024.

On October 24, 2024, the Isle of Man (‘IOM’) income tax division published the draft legislation to implement the IIR and QDMTT in the IOM. The draft legislation will be considered by the Parliament in November 2024.

On October 28, 2024, the EU Commission adopted a proposal to amend the Directive on administrative cooperation in the field of taxation (DAC 9) to reflect the OECD Model Rules so that MNEs would only have to file one GIR, at central level, for the entire group.

On October 15, 2024, Italy issued Decree 11, of October 2024 on the calculation of the Substance-based Income Exclusion (SBIE) under Pillar 2. This includes all of the OECD Administrative Guidance on the SBIE.

On October 22, 2024, Jersey enacted the Multinational Taxation (Global Anti-Base Erosion – IIR Tax) (Jersey) Law 202 (the ‘IIR law’) and the Multinational Corporate Income Tax (Jersey) Law 202 (the ‘MCIT law’), to provide for the IIR and MCIT from January 1, 2025. Read our updated GloBE Country Guide.

On October 17, 2024, Germany released its Group Parent notification form for German minimum tax groups. Section 3 of the German GMT law provides that the Group Parent of the German minimum tax group is required to register with the Federal Tax Authority within 2 months of the end of the relevant fiscal period (ie February 28, 2025 for the 2024 fiscal year).

On October 22, 2024, Jersey enacted the Multinational Corporate Income Tax (Jersey) Law 202 and the Multinational Taxation (Global Anti-Base Erosion – IIR Tax) (Jersey) Law 202 to provide for the IIR and MCIT from January 1, 2025.

On September 19, 2024, the Lithuanian government launched a public consultation on a draft law to fully implement the OECD’s Pillar Two Model Rules. Read our updated GloBE Country Guide.

On 10 October 2024, the French Government presented the draft Finance Bill for 2025 to Parliament. This includes amendments to its General Tax Code to reflect the OECD Administrative Guidance. Read our updated GloBE Country Guide.

On October 18, 2024, Belgium issued a draft 7-page QDMTT Return for consultation. The consultation lasts until November 8, 2024.

On October 10, 2024, Ireland published its 2024 Finance Bill. In the Bill, a number of amendments are made to the Global Minimum Tax provisions. Our Ireland GloBE Country Guide has been updated for relevant changes.

On October 18, 2024, the Portuguese Parliament approved a law to introduce the EU Minimum Tax Directive into domestic legislation, whilst on October 16, 2024 and October 18, 2024 (respectively), the Bahamas and Cyprus tabled legislation in Parliament to implement Pillar Two.

On October 10, 2024, Ireland published its 2024 Finance Bill. In the Bill, a number of amendments are made to the Global Minimum Tax provisions.

On October 4, 2024, Singapore issued a Consultation document on the GloBE Safe Harbours (Transitional Country-by-Country Reporting (“CbCR”) Safe Harbour, QDMTT Safe Harbour and the Simplified Calculations Safe Harbour), as well as other aspects of the OECD Administrative Guidance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Brazil for accounting periods beginning on or after January 1, 2025. Updated for Provisional Measure No. 1,262, and Normative Instruction No. 2,228 of October 3, 2024.

Yesterday, Brazil issued Provisional Measure No. 1,262, of October 3, 2024 and a supporting Regulation to introduce a Domestic Minimum Tax (intended to be a QDMTT) from January 1, 2025. It now needs to be ratified by Congress.

Our Lithuania GloBE Guide has been updated for the Order on Information Notices in relation to Pillar Two.

On September 18, 2024, the Bulgarian Ministry of Finance published draft legislation for public consultation to amend the Bulgarian minimum taxation rules, including the introduction of the Transitional UTPR Safe Harbour.

On September 24, 2024, the Puerto Rico Treasury Department launched a public consultation on the implementation of the GloBE rules, including a QDMTT.

On September 11, 2024, the government of Slovakia approved a draft bill on amendments to the law to reflect various aspects of the OECD Administrative Guidance. See our updated GloBE Guide.

On September 17, 2024, a draft law to amend the Minimum Tax Act was published. This includes a number of amendments to implement the OECD Administrative Guidance. Read our updated GloBE Country Guide.

On September 19, 2024, the OECD held the signing ceremony for the Multilateral Convention to Facilitate the Implementation of the Pillar Two Subject to Tax Rule. 9 jurisdictions have signed with a further 10 stating an intention to sign.

On April 3, 2024, Regulations for the implementation of the GloBE law were issued which implement a number of aspects of the First, Second and Third Set of OECD Administrative Guidance. The Regulations were amended in August 2024.

On September 12, 2024, the UK issued further draft guidance on the Multinational Top-up Tax and Domestic Top-up Tax. The issued draft guidance now runs to over 300 pages.

On September 9, 2024, Singapore introduced its Multinational Enterprise (Minimum Tax) Bill, 2024 into Parliament. Read our updated analysis.

On August 28, 2024, the Czech Republic issued amendments to draft law no. 595/24 (originally issued in April 2024) to amend Act No. 416/2023 implementing the EU Minimum Tax Directive in the Czech Republic.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Bahrain for accounting periods beginning on or after January 1, 2025. Updated for Decree-Law No. (11) of 2024 issued on September 1, 2024.

On September 4, 2024, the Swiss Federal Council announced that the Income Inclusion Rule (IIR) will apply from January 1, 2025.

The substance-based income exclusion favours capital intensive and certain low profit margin companies. These companies stand to benefit the most.

On August 20, 2024, the German Ministry of Finance issued a Discussion Draft of a Draft Law to implement most aspects of the Third Set of OECD Administrative Guidance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in The Bahamas for accounting periods beginning on or after January 1, 2025. Updated for the draft legislation issued by The Bahamas Government on August 12, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Jersey for accounting periods beginning on or after January 1, 2025. Updated for the draft legislation issued on August 14, 2024.

Updated Pillar 2 GloBE guide for Austria following OECD Administrative Guidance, including currency provisions and extending the Transitional CbCR Safe Harbour to cases where an MNE is not required to prepare CbC

On August 12, 2024, the Finnish government issued draft legislation to amend the Minimum Tax Act to reflect numerous aspects of the OECD Administrative Guidance. The draft law is subject to a consultation until September 6, 2024, and once enacted will apply from January 1, 2024.

On August 8, 2024, the Bermuda Ministry of Finance issued a consultation on the administrative provisions for the new corporate income tax that is to apply from 2025

The “Law on the Amendment of Tax Laws and Certain Laws” was published in the Turkish Official Gazette on August 2, 2024. Articles 37 – 50 of the Law include provisions to implement the GloBE rules in domestic law from January 1, 2024. This includes the IIR, UTPR and a domestic minimum top-up tax.

On July 25, 2024, the Ministry of Economy and Finance issued the 2024 Tax Law Amendment Bill. This includes a number of amendments to the South Korean global minimum tax law to reflect aspects of the OECD Administrative Guidance.

On July 29, 2024, the UK government issued draft legislation for the implementation of the Pillar Two anti-avoidance rules targeting Hybrid Arbitrage Arrangements.

On July 29, 2024, the Israeli Ministry of Finance announced it will implement a QDMTT from January 1, 2026. The IIR and UTPR will not be introduced at that point and further consideration will be given to their implementation after a review of the effectiveness of the QDMTT.

On June 11, 2024, Law No. 684 was published in the Danish Official Gazette. This implements additional aspects of the OECD Administrative Guidance.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Turkey for accounting periods beginning on or after January 1, 2024. Updated for the draft legislation submitted to the Turkish Parliament on July 16, 2024.

Updates to our QDMTT Legislative Tracker to include domestic QDMTT legislation released up to July 19, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Portugal for accounting periods beginning on or after January 1, 2024. Updated for the draft law issued on July 10, 2024.

On July 10, 2024, the OECD released the draft XML schema for the GloBE Information Return (GIR). This provides a method of structuring the data reporting for the GIR.

Many jurisdictions will require GloBE registration for administrative purposes, however, the law issued to date has been inconsistent. We outline the GloBE registration obligations from the domestic legislation (enacted and draft) issued to date, with citations and links to relevant laws.

On July 3, 2024, the Italian Ministry of Economy & Finance issued a Decree which contains the procedures for the implementation of the Qualified Domestic Minimum Top-up Tax (QDMTT).

In the 2024 Budget address, the Gibraltar government confirmed that draft legislation for the introduction of a QDMTT is expected in September 2024.

On July 4, 2024, the Australian Government introduced legislation to implement the Pillar 2 GloBE rules into Parliament. This includes a domestic minimum tax, IIR and UTPR.

On July 2, 2024, the Belgian Tax Authority extended the notification deadline to September 16, 2024 (from July 13, 2024) for groups that are not subject to advance payments in 2024 for the QDMTT or the IIR.

On June 5, 2024, the German Federal Ministry of Finance published the government draft for an Annual Tax Act 2024. Article 32 includes an amendment to the minimum tax act to implement a provision from the July 2023 OECD Administrative Guidance.

Our OECD Administrative Guidance Tracker has been updated for the latest amendments in the June 2024 Administrative Guidance.

On June 20, 2024, the Global Minimum Tax Act (included in the Budget Implementation Act 2024, No. 1) received royal assent. This includes provisions to implement an IIR and a QDMTT from December 31, 2023:

Our QDMTT Legislative Tracker has been updated for the amendments to the design of QDMTTs, as provided in the June 2024 OECD Administrative Guidance.

Updates to the GloBE Country Guides for Latvia and Lithuania following the publication of their laws to implement Art 50 of the EU Minimum Tax Directive in the Official Gazette.

The Fourth Set of OECD Administrative Guidance (issued on June 17, 2024) includes guidance on the treatment of Securitization Entities.

Section 5 of the Fourth Set of OECD Administrative Guidance (published on June 17, 2024) provides clarifications on the allocation of both profits and taxes of Flow-through Entities (including both hybrid entities and reverse hybrid entities). Most of these changes are to ensure the consistent matching of income and taxes in the same entity.

On June 17, 2024, the OECD provided more information on the Transitional Qualification Mechanism for determining the qualified status of IIRs and Domestic Minimum Taxes

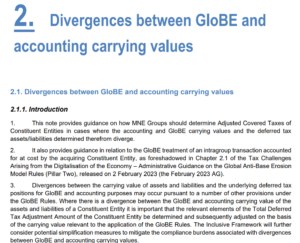

Section 2 of the Fourth Set of OECD Administrative Guidance (issued on June 17, 2024) provides details of the use of GloBE carrying values and the impact that these will have on the GloBE ETR calculation.

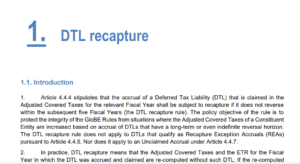

Section 1 of the Fourth Set of OECD Administrative Guidance (issued on June 17, 2024) provides further details on the deferred tax liability recapture rule. Read our detailed analysis.

On June 17, 2024 the Fourth set of OECD Administrative Guidance was issued. This includes guidance related to the recapture rule applicable to deferred tax liabilities, cross-border allocation of current and deferred taxes, flow-through entities and securitisation vehicles.

On June 14, 2024, the Official Gazette of the Spanish Parliament published the draft law to implement the EU Minimum Tax Directive. The draft law includes minor changes from the version published in December 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Singapore for accounting periods beginning on or after January 1, 2025.

On June 5, 2024, the Luxembourg Government adopted the draft law amending the law of 22 December 2023 on the minimum effective taxation for multinational enterprise groups and large domestic groups. The draft law provides for a number of amendments in the December 2023 OECD Administrative Guidance.

On June 6, 2024 the Latvian Parliament adopted in its final reading the “Law on ensuring the global minimum tax level of large groups of companies”, which implements the EU Global Minimum Tax Directive, with an Article 50 postponement.

On June 4, 2024, the Spanish Council of Ministers approved the second Draft Law to transpose the EU Global Minimum Tax Directive into domestic law. It will now be sent to the Spanish Parliament.

On May 17, 2024, the Germany Finance Ministry issued a draft Global Minimum Tax Return to specialist publishers, software providers and associations for feedback. This includes draft explanatory guidance.

On May 24, 2024, the Canadian government issued detailed explanatory notes on the application of the Global Minimum Tax.

On May 29, 2024, the Royal Decree of 15 May 2024 was published in the Belgian Official Gazette. This sets July 13, 2024 at the latest, as the deadline for the first GloBE Notification Form.

On May 23, 2024, the EU Commission issued a reasoned opinion to Spain, Cyprus, Latvia, Lithuania, Poland and Portugal as result of them not yet enacting domestic Pillar Two legislation.

On May 21, 2024, the Italian Ministry of Economy and Finance issued a Decree providing further details on the application of the Transitional Safe Harbours.

On May 21, 2024, the Belgian Tax Authority issued further details on the notification requirements for in-scope MNE groups. This includes significant information on the group structure.

Analysis of the Pillar Two GloBE rules in the Czech republic, updated for the April 26, 2024, draft law to reflect various aspects of the OECD Administrative Guidance (particularly the December 2023 amendments).

On May 22, 2024, Jersey announced it will be implementing an Income Inclusion Rule (IIR) and a new standalone multinational corporate income tax for accounting periods beginning on or after January 1, 2025.

On April 30, 2024, a Draft Law to amend the Danish Minimum Taxation Act was submitted to the Danish Parliament. This implements additional aspects of the OECD Administrative Guidance.

On May 20, 2024, the Isle of Man Government issued a press release stating it intends to introduce a Qualified Domestic Minimum Top-Up Tax (QDMTT) with effect from January 1, 2025.

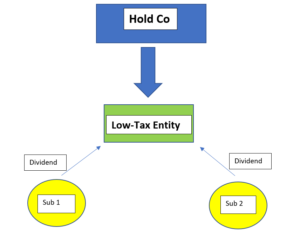

The specific treatment of dividends and other distributions under the Pillar Two GloBE Rules raises some interesting issues and opportunities in blending such payments between otherwise low-taxed entities and holding companies to reduce any potential top-up tax liability.

On May 13, 2024, the Finance Bill, 2024 was sent to the Kenyan Parliament. It includes provisions to introduce a 15% domestic minimum top-up tax from January 1, 2025.

The Transitional CbCR Safe Harbour is a short-term measure that will allow an MNE to avoid undertaking detailed GloBE calculations for a jurisdiction if certain requirements are met. Data will need to be extracted from the CbC Report, financial statements and ERP and EPM systems. Group structure information will also be required.

On May 2, 2024, the Estonian Official Gazette enacted the ‘Act supplementing the Tax Information Exchange Act, the Tax Administration Act and the Income Tax Act’ to implement Article 50 of the EU Minimum Tax Directive.

Analysis of the implementation of the Pillar Two GloBE rules for Canada, updated for the Budget Implementation Bill, 2024, No. 1, issued on April 30, 2024.

Whether multinationals adopt a centralized or decentralized approach to Pillar Two will be one of the key factors in correctly establishing the systems and architecture to collect, manage, analyse and store source data for the Pillar Two effective tax rate and top-up tax calculation.

On April 25, 2024, the Polish Ministry of Finance issued a draft law to implement the EU Minimum Tax Directive into domestic law. Read our review of the draft law.

The tax data mapping assessment is the cornerstone for MNEs looking to implement an effective approach to manage Pillar Two. All systems changes flow from this.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Barbados for accounting periods beginning on or after January 1, 2024. Updated for the draft legislation being considered by the Barbadian Parliament.

The Pillar Two rules include specific rules for Joint Ventures (JVs) that would otherwise not be within the scope of Pillar Two due to not being consolidated in the financial accounts of the MNE group. However, of more interest is how the amount of top-tax tax (and by implication the amount not collected) varies depending on the JV group structure. Read more in this article.

On March 22, 2024, the Decree of the Ministry of Economy and Finance No. 1048, to amend the Enforcement Regulations of the International Tax Adjustment Act entered into force.

On March 22, 2024, the Enforcement Regulations to the International Tax Adjustment Act were amended. This includes attachments for the GIR (in English and Korean), the GloBE Tax Return and the Notification Form for a Foreign CE to File the GIR.

Whilst the OECD Model Rules require the application of the IIR to Low-Taxed Constituent Entities outside the jurisdiction, the Commentary permits the application of the IIR domestically (a ‘DIIR’). Both New Zealand and the EU apply a DIIR.

Analysis of the Pillar Two GloBE rules in Greece – updated for Law 5100/2024 of April 5, 2024 implementing the EU Minimum tax Directive.

On April 5, 2024, Law 5100/2024 was published in the Official Gazette. This implements the EU Minimum Tax Directive in Greece from December 31, 2023 (with the UTPR applying from December 31, 2024).

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Liechtenstein from 2024. Updated for the GloBE Regulation of March 28, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in New Zealand. Updated for the enacted legislation on March 28, 2024.

On March 28, 2024, the Decree on the minimum taxation of large groups of undertakings (the ‘GloBE Regulation’) was published in the Official Gazette.

On March 28, 2024, the GloBE Regulations were published in the Liechtenstein Official Gazette and New Zealand’s Pillar Two Law received Royal Assent.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Australia for accounting periods beginning on or after January 1, 2024. Updated for the draft legislation issued by the Australian Treasury on March 21, 2024.

On March 19, 2024, the Swedish Ministry of Finance issued a proposal (including Draft Legislation and Explanatory Notes) to amend its Pillar Two law to include relevant provisions of the OECD Administrative Guidance.

On March 21, 2024, the Australian Treasury issued draft GloBE legislation for consultation. The consultation is open until April 16, 2024.

On March 13, 2024, the Lithuanian Parliament updated the draft law to implement the EU Minimum Tax Directive.

On March 11, 2024, the Finance and Expenditure Committee of the New Zealand Parliament made a number of amendments to the Taxation (Annual Rates for 2023–24, Multinational Tax, and Remedial Matters) Bill (which includes proposed legislation to transpose the OECD GloBE Rules).

On March 15, 2024, the UAE launched a public consultation on the implementation of the GloBE rules in the UAE. The consultation is open until April 10, 2024.

On March 14, 2024, the UK Government confirmed it is to apply an anti-avoidance rule for the purposes of the Transitional CbcR Safe Harbour from March 14, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Belgium for accounting periods beginning on or after December 31, 2023. Updated for the Draft Law to amend the ‘Act on the introduction of a minimum tax for multinational enterprise groups and large domestic groups’ of March 6, 2024.

On March 6, 2024, the Belgian Government submitted a draft law to Parliament which includes provisions to amend the GloBE Law to implement aspects of the OECD Administrative Guidance.

On March 7, 2024, the Australian Taxation Office provided an update on the implementation of Pillar Two.

Analysis of the implementation of the Pillar Two Global Minimum Tax rules in the UK on or after 31 December 2023. Updated for the 2024 Finance Act.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Thailand for accounting periods beginning on or after January 1, 2025. Updated for the Draft Law issued on March 1, 2024.

On March 1, 2024, the Thai Revenue Department published an 18-page consultation paper on the implementation of Pillar Two. This includes draft legislation which includes, an IIR, UTPR and a domestic minimum tax.

In this article, we look at the status of Pillar Two implementation in the EU, as at March 1, 2024, for jurisdictions that have not yet enacted domestic law to implement the EU Minimum Tax Directive.

On February 22, 2024, the UK enacted the 2024 Finance Act to domestically implement amendments provided in the OECD Administrative Guidance.

On February 22, 2024, the Ministry of National Economy and Finance issued a draft law to implement the EU Global Minimum Tax Directive. In this article we review the draft law.

On February 21, 2024, the National Treasury and the South African Revenue Service issued the Draft Global Minimum Tax Bill and the Draft Global Minimum Tax Administration Bill.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Malta for accounting periods beginning on or after 31 December, 2023. Updated for Legal Notice 32 of 2024 of February 20, 2024.

On February 20, 2024, the Maltese Government issued Legal Notice 32 of 2024 which enacts the EU Minimum Tax Directive with the Article 50 postponement.

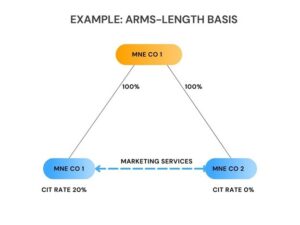

On February 19, 2024, the OECD published its final report on Pillar One Amount B, aimed at providing a simplified and streamlined approach to the application of the arm’s length principle to baseline marketing and distribution activities.

In this article we look at the impact of Pillar Two on tax stabilization agreements, and the benefits of renegotiating agreements.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Estonia. Updated for the Draft Law of February 8, 2024.

On February 8, 2024, the Government approved the ‘Act supplementing the Tax Information Exchange Act, the Tax Organisation Act and the Income Tax Act’ which includes provisions to implement Article 50 of the EU Minimum Tax Directive.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Lithuania. Updated for the Draft Law of October 27, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Latvia. Updated for the Draft Law of January 30, 2024

On January 30, 2024, a draft law to implement the EU Minimum Tax Directive (and delay the application of the GloBE rules until 2030) was approved by the Latvian Cabinet of Ministers.

We have tracked the draft and enacted domestic laws issued to date to the OECD Model Rules. This will be constantly updated as new or amended legislation is issued.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Austria for accounting periods beginning on or after 31 December, 2023. Updated for the Minimum Taxation Reform Act published in Austrian Federal Law Gazette No. 187/2023 on December 30, 2023.

On January 25, 2024, the EU Commission announced infringement decisions against EU member states that have not enacted domestic law to implement Pillar 2.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Spain for accounting periods beginning on or after 31 December, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Slovakia for accounting periods beginning on or after 31 December, 2023. Updated for Act No. 507/2023 of December 23, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in the Czech Republic for accounting periods beginning on or after 31 December, 2023. Updated for Law 416/2023 published in the Official Gazette on December 29, 2023.

Tax incentives for R&D are a common way for a jurisdiction to attract foreign direct investment (FDI).

In this article we look at the financial accounting, domestic tax and Pillar Two treatment of some of the key incentives offered including a deduction, capitalized treatment, a super deduction, tax credits and patent boxes or other similar arrangements.

The Polish Ministry of Finance has stated that Poland will begin the legislative process to implement Pillar 2 in the first quarter of 2024, with the rules to be effective from January 1, 2025.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Croatia for accounting periods beginning on or after 31 December, 2023. Updated for Law No 155/23, of December 22, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Slovenia for accounting periods beginning on or after 31 December, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Norway for accounting periods beginning on or after 1 January 2024. Updated for Law 2024-01-12-1 of January 12, 2024.

On January 12, 2024, the Norwegian Council of State ratified the Norwegian Parliament’s enactment of the Supplementary Tax Act in Legislative Decision 37 (2023-2024) Act No. 1

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Vietnam for accounting periods beginning on or after January 1, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Ireland from 2024. Updated for the Finance (No. 2) Act 2023 of December 18, 2023.

Yesterday, a Bill to implement the EU Minimum Tax Directive was considered by the Greek Council of Ministers. This includes an IIR and QDMTT from December 31, 2023 and a UTPR from December 31, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Romania for accounting periods beginning on or after 31 December, 2023. Updated for Law No. 431/2023 of December 29, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in the Netherlands from December 31, 2023. Updated for the Minimum Tax Act of December 27, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Finland for accounting periods beginning on or after 31 December, 2023. Updated for the ‘Law on the Minimum Taxation for Corporations’ of December 28, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in France for accounting periods beginning on or after 31 December, 2023. Updated for the French Finance Act published on December 30, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Bulgaria for accounting periods beginning on or after 31 December, 2023. Updated for the Law Amending the Corporate Income Tax Act on December 22, 2023.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Switzerland from January 1, 2024. Updated for the Ordinance on the Minimum Taxation of Large Groups of December 22, 2024.

The Minimum Tax Act (to implement the EU Minimum Tax Directive) was published in the Official Gazette of Liechtenstein, No. 2023/484

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Italy for accounting periods beginning on or after 31 December, 2023. Updated for Legislative Decree No. 209 of December 27, 2023.

On December 29, 2023 and December 30, 2023, Romania and the Czech Republic, and Austria (respectively) gazetted their Pillar 2 Laws.

On December 31, 2023, Law 19928 was issued to amend the International Tax Adjustment Act to take account of a number of OECD amendments issued in the Administrative Guidance.

Bulgaria, Croatia and Slovenia gazetted Pillar 2 laws on December 22, 2023, whilst Slovakia gazetted its Pillar 2 law on December 23, 2023,

On December 28, 2023, Italy, Belgium and Finland gazetted laws to implement the EU Minimum Tax Directive.

Germany, Luxembourg and the Netherlands have all enacted Pillar Two Laws over the last few days.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Luxembourg for accounting periods beginning on or after 31 December, 2023. Updated for the draft law n°8292 approved by Parliament on December 20, 2023.

Today, the UK and EU have issued guidance on the application of the GloBE Rules whilst Switzerland is to introduce a QDMTT from December 31, 2023 and has delayed its IIR/UTPR.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Sweden from January 1, 2024. Updated for Law No. SFS 2023:875 of December 16, 2023.

On December 19, 2023, Gibraltar announced it is bringing forward its QDMTT to apply from December 31, 2023. This was previously intended to apply from December 31, 2024.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Malaysia for accounting periods beginning on or after January 1, 2025. Updated for the law approved by Parliament on December 13, 2023.

The December 2023 OECD Administrative Guidance provides additional information on the application of the Blended CFC rules.

The December 2023 OECD Administrative Guidance provides additional information on Year End Mismatches and identifying Consolidated Revenue.

The December 2023 OECD Administrative Guidance provides additional information on the application of the Transitional CbCR Safe Harbour in a number of areas.

The December 2023 OECD Administrative Guidance provides further information on the NMCE Simplified Calculations (for the Simplified Calculations Safe Harbour).

The December 2023 Administrative Guidance provides more guidance on whether purchase accounting adjustments also need to be removed from Qualified Financial Statements for the purposes of the Transitional CbC Safe Harbour.

Today, the OECD issued their Third Set of Administrative Guidance on the Pillar Two GloBE Rules.

The Austrian GloBE Country Guide has been updated for the Minimum Tax Law approved by Austria’s National Council on December 14, 2023.

Draft laws to implement the Pillar Two Globe rules have been passed by Parliaments in Austria, Bulgaria, Germany and Malaysia this week. Denmark has enacted its Minimum Tax Act.

Today, the EU Commission published the Commission Notice to Elect to delay application of the IIR and UTPR under Article 50 of the Pillar Two Directive.

On November 30, 2023, the Belgian House of Representatives adopted draft law 55K3678/2023 to implement the EU Minimum Tax Directive.

Slovakia draft law was submitted to the National Council on December 4, 2023. It applies the derogation under Article 50(1) of the EU Minimum Tax Directive to postpone the application of the IIR/UTPR.

Act LXXXIV of 2023 on ‘Additional taxes ensuring a global minimum tax level and amending certain tax laws in connection with this’ was published in issue 171/2023 of the Hungarian Gazette.

On December 1, 2023, the Czech Parliament approved the Draft Top-up Tax Act to give effect to the GloBE rules.

There were limited amendments to the draft law during the parliamentary process (including the inclusion of the QDMTT and Transitional UTPR Safe Harbour, and other key aspects of the July 2023 Administrative Guidance, such as the rules for transferable tax credits).

On November 29, 2023, the Vietnamese Parliament passed a Resolution to implement the Pillar Two Global Minimum Tax in Vietnam with effect from January 1, 2024.

On November 24, 2023, a draft law to implement the Pillar Two GloBE rules into domestic law was introduced into the Norwegian Parliament.

Yesterday, the Austrian Government sent the updated Minimum Taxation Reform Bill to Parliament. The Bill implements the EU Minimum Taxation Directive into domestic law.

Members can access our unofficial English translations of domestic Pillar Two laws (both enacted and draft).

On November 21, 2023, the draft law to implement the EU Minimum Tax Directive was approved by the Hungarian Parliament. It was sent to the Hungarian President today for signature.

Analysis of the implementation of the Pillar Two GloBE rules in Luxembourg, updated for amendments to the draft law on November 13, 2023.

On November 13, 2023, draft law No. 55K3678 to implement the EU Minimum Tax Directive was sent to the Belgian Parliament.

On November 13, 2023, the Luxembourg Government issued amendments to update its draft law implementing the EU Minimum Tax Directive (Law 8292 issued on August 4, 2023).

On November 15, 2023, Bermuda issued draft corporate income tax legislation as part of a third consultation on enacting a new 15% corporate income tax from January 1, 2025.

An article by article analysis that sources all of the articles of the South Korean Pillar Two legislation (the original Law, Amended Law and Amended Enforcement Decree) back to the OECD Model Rules.

Analysis of the implementation of the EU Global Minimum Tax Directive in Germany, taking account of the changes made in the recent draft law, approved by the Bundestag on November 10, 2023.

Our South Korea GloBE Country Guide chapter has been updated for the recent amendment to the Enforcement Decree of the International Tax Adjustment Act which provides additional detail for the operation of the GloBE rules.

On November 10, 2023, the Bundestag (lower house) approved the German draft law to implement the EU Minimum Tax Directive.

The Amended Enforcement Decree implements most aspects of the February and July 2023 OECD Administrative Guidance. Read our analysis.

On November 9, 2023, South Korea issued the Preliminary Legislative Notice of Partial Amendment to the Enforcement Decree of the International Tax Mediation Act.

Bermuda and Barbados announced on November 3 and 7, 2023 (respectively) their intention to implement the Pillar 2 GloBE rules (albeit with different approaches).

The Transitional CbCR Safe Harbour is included in the OECD Safe Harbour and Penalty Relief Guidance and where it applies it deems the jurisdictional top-up tax to be zero. Read our detailed analysis.

Today, the Finance (No. 2) Bill, 2023 (the ‘draft law’) had its first reading before the Malaysian Parliament. This inserts a new Part XI into the Income Tax Act, 1967 to implement the GloBE rules.

Qatar’s General Tax Authority closed its three-day regional workshop on the Pillar Two global minimum tax.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Japan from April 1, 2024, as updated by the detailed implementation guidance issued by the Ministry of Finance on October 20, 2023,

On October 27, 2023, Lithuania’s Ministry of Finance issued a draft law to implement the EU Global Minimum Tax Directive (along with a Draft Law on the Amendment of Article 589 of the Code of Administrative Offenses).

On October 27, 2023, it was suggested by an EU official that Estonia, Latvia, Lithuania, Malta, and Slovakia are to delay the implementation of the IIR and UTPR under the Pillar Two rules.

Updated analysis of the treatment of intra-group asset transfers under the GloBE rules, including the step-up denial and examples of the impact of claiming a deferred tax asset under the OECD Administrative Guidance.

It was reported on October 23, 2023, that Kuwait is considering a comprehensive overhaul of its tax laws from January 1, 2025 to apply a 15 percent corporate tax on the profits of all legal persons, including major international companies.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Hungary from 2024.

On October 19, 2023, the Irish Ministry of Finance released the Finance (No. 2) Bill 2023 (‘draft law’). to implement the Pillar Two GloBE rules/EU Minimum Tax Directive.

On October 17, 2023, the Hungarian Ministry of Finance issued a draft law to implement the Pillar Two GloBE rules/EU Minimum Tax Directive.

On 13 October 2023, the Dutch State-Secretary of Finance issued a Bill to amend the Dutch Draft Minimum Tax Bill.

In the 2024 Budget Speech today, the Malaysian Prime Minister confirmed that the Pillar Two GloBE rules are to apply from 2025.

On October 11, 2023, the OECD published the Multilateral Convention to Implement Amount A of Pillar One (MLC).

On October 4, 2023, the Romanian Ministry of Finance issued a draft law to implement the Pillar Two GloBE rules/EU Minimum Tax Directive.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Cyprus for accounting periods beginning on or after 31 December, 2023.

On October 3, 2023, the Austrian Federal Ministry of Finance issued the ‘Federal law enacting the Federal Act to Ensure a Global Minimum Taxation for Groups of Companies’ to implement the Pillar Two GloBE rules/EU Minimum Tax Directive.

On October 3, 2023, the Cyprus Ministry of Finance issued a draft law to implement the Pillar Two GloBE rules/EU Minimum Tax Directive. It is open for consultation until October 31, 2023.

On September 29, 2023, the National Tax Agency published the “Partial Revision of the Basic Circular on Corporate Tax” which provides some administrative guidance on various aspects of Japan’s GloBE law.

The text of the Pillar 2 STTR Multilateral Instrument has been released by the OECD and the STTR MLI is now open for signature from October 2, 2023.

Article 4 of the French 2024 Finance Bill (published on September 27, 2023) includes provisions to implement the EU Global Minimum Tax Directive.

Both the EU Minimum Tax Directive and the OECD Model Rules leave the determination of GloBE penalties to domestic jurisdictions. See our Global Roadmap.

On September 26, 2023, the Bulgarian Ministry of Finance issued a draft law for the implementation of the EU Global Minimum Tax Directive. Read our detailed review.

Differences in Accounting Standards have a significant impact on the Pillar Two effective tax rate (ETR) and top-up tax calculation. Read this detailed report.

On September 19, 2023, Turkey gazetted the Pillar 2 amendments to IAS 12, as previously announced by the IASB.

On September 11, 2023, the Italian Ministry of Finance issued a draft law for the implementation of the EU Global Minimum Tax Directive. Read our detailed review.

The requirements for a participation exemption under domestic law may not match the exemption requirements in the Pillar Two Rules. Read our analysis.

Analysis of the domestic implementation of the Pillar Two Global Minimum Tax rules in Germany from 2024. Updated for the August 16, 2023 Draft Law.